The Pound-to-Dollar Rate Forecast for the Week Ahead: Further Sideways Action Forecast

Image © Adobe Images

- GBP/USD remains stuck in a range

- Unless it can break out further sideways action likely

- Brexit shenanigans to drive Pound, G20 key for USD

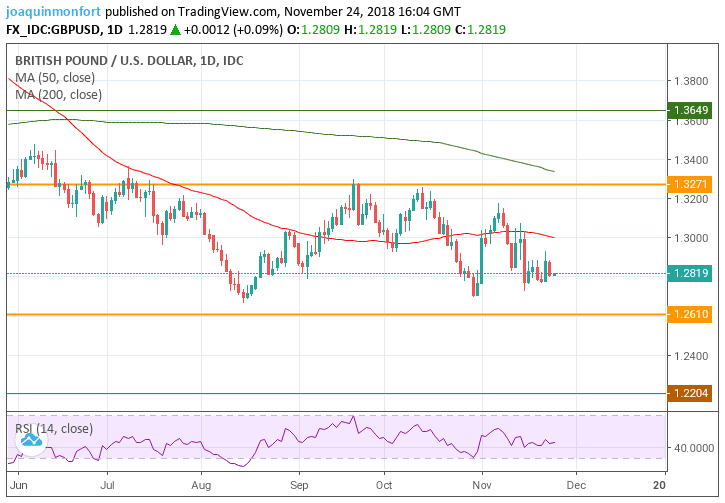

The Pound-to-Dollar exchange rate is set to open the new week at 1.2822 ensuring it remains set in a sideways range between roughly 1.2650 and 1.3300.

Last week it moved in an even narrower range within that range, closing at 1.2818 only a tenth of a cent below the close of the week before (1.2828). In the week ahead it will probably continue in the same vein.

It is only if the pair can successfully break out of the larger range that we could make a conviction call of any value.

A break above the range highs, for example, confirmed by a move above 1.3350, would probably lead to a continuation up to a target at 1.3650.

In the case of a downside break, confirmed by a move below 1.2600, we might expect a follow-through down to a target at 1.2210.

These targets are established by the orthodox technical method of taking the height of the range and extrapolating it by 61.8% above or below the range in the event of a break.

GBP/USD went sideways in the previous week because both currencies strengthened and thus essentially ‘cancelled each other out’.

The Pound rose on increased expectations that UK and EU were close to agreeing a deal. This came despite substantial opposition in Parliament making it unlikely the deal will pass. Nevertheless, Sterling rose a little on rumours negotiators were close to shaking hands.

The U.S. Dollar also rose after hopes the U.S. and China might renegotiate a deal at the G20 mitigating the fallout from their trade war took a blow, leading to safe-haven gains for USD.

Chinese officials strongly criticised the U.S. for acting in their self-interest at the recent Asia-Pacific Economic Cooperation Summit and hoped the same could not be said for the up and coming G20 summit which begins on Thursday, November 29, and ends on Saturday December 1.

If pushed to give a forecast we would still be marginally bearish, and a break below the 15 November lows at 1.2722 would confirm a follow-through down to a target just above the range floor at 1.2660.

Those with international payment requirements should note at the present time high-street banks are charging a rate in the 1.2560-1.2470 region, independent specialists are providing rates in the 1.27-1.2730 region. Those looking to make payments are advised to speak to independent specialists to both secure a competitive rate the delivers substantially more currency while also looking at how to protect against a potentially adverse move in Sterling over coming weeks.

The US Dollar: What to Watch

One major driver of the Dollar in the week a head is likely to be news filtering out from the G20 summit in Buenos Aires which starts on Thursday the 29th and ends on Saturday the 1st. Of crucial importance will be whether China and the US can improve trade relations.

A major concern for the markets are whether the US goes ahead with increased trade tariffs set to automatically kick in on January the 1st 2019 when duties on $250bn US imports from China will rise from 10% to 25%.

From an FX perspective the likely repercussions of higher tariffs or a worsening trade relationship is a rise in the Dollar because it benefits from safe-haven flows during times of geopolitical woe.

The release of the minutes of the US Federal Reserve’s (Fed) last monetary policy meeting on Thursday, November 29, at 20.00 has a risk of impacting on the Dollar.

Recent commentary from several members of the Fed’s Open Markets Committee (FOMC) has indicated they are less likely to increase interest rates as much as had previously been expected, seeing risks to the outlook which we're not there earlier in the year.

One of these is the recent steep sell-off in the US stock market and another is the sharply declining housing market.

If the minutes from the last meeting provide more clarity on the outlook for interest rates and backup the assertion they may remain low, the Dollar could suffer on Thursday. On the contrary, if the minutes present a more optimistic view, and suggest the Fed will go ahead with increasing interest rates the Dollar could rally.

Higher interest rates, or the expectation thereof, are usually supportive of a currency because they attract and retain greater inflows of foreign capital, drawn by the promise of higher returns.

Third quarter GDP data on Wednesday (14.30) could also impact on US currency even though it's is only the second estimate.The data is expected to show growth rising by an annualised 3.5% in Q3, will be lower than the first estimate of 4.2%. GDP growth is positively correlated to the dollar therefore a better estimate would support the currency and vice versa for a worse one.

New home sales are also out on Wednesday (16.00) and expected to show rebound of 4.5% in October after declining -5.5% in the previous month. Clearly whether or not they do may have a bearing on the actions of the Federal Reserve and therefore the Dollar.

The other standout release for the Dollar in the coming week is Personal Consumption Expenditure (PCE), which is the favoured gauge of the Fed when determining inflationary pressures in the economy.

The headline PCE index is forecast to show a slight rise to 2.1% from 2.0% in the previous month whilst core PCE is forecast to fall to 1.9% from 2.0% previously.

The Pound: What to Watch

Brexit politics remain the main driver of the Pound but these appear to have moved on from a rather simplistic ‘deal’ or 'no deal’ duality to encompass risks of what might come beyond the signing of the Brexit deal by EU leaders Sunda.

European leaders Sunday endorsed the Withdrawal Agreement and Political Declaration on the future EU-UK relations.

The agreement comes after Spanish Prime Minister Pedro Sanchez revealed he would no longer vote against the Brexit deal, saying the UK and EU had agreed to demands for guarantees over the status of Gibraltar in future negotiations.

Even if a deal with Brussels is agreed it still needs to be voted through Parliament and based on current thinking that seems highly unlikely.

If it fails to get approved there is a risk of a general election or leadership challenge on Prime Minister Theresa May. Whether that could be held before the March Brexit deadline and what the result would be are all unknowns.

Given these headwinds Sterling is likely to remain under ‘the cosh’, yet there is also the likelihood that the endgame will almost certainly not result in a clear cut detachment of the UK from the EU.

In my view it is highly unlikely that anyone will dare allow any tampering with the Irish border even by subtle means because of fear it will jeopardise the hard-won Good Friday agreement.

Put simply, no politician will want to increase national security risks. As such the Pound will probably rally, eventually, on a ‘soft’ form of Brexit.

Consumers drive the lion's share of economic growth in the UK so probably the most important data release in the week ahead is Gfk Consumer Confidence for November, which is forecast to show a -11 print from -10 previously, and thus signal an increase in pessimism, when it is released on Friday at 1.01 GMT.

A deeper-than-expected decline might weaken the Pound.

Mark Carney, the governor of the Bank of England is also scheduled to give a speech on Monday at 19.30 GMT and this could also spark volatility for the Pound.

Recent data has been weaker-than-expected and market participants will be keen to know whether this has had an impact on Caney's views about monetary policy.

Other data releases in the week ahead include the CBI distributive trades survey, out on Tuesday at 10.00 and BOE lending data, including mortgage approvals and consumer credit, out at 10.30 on Thursday, November 29.