Exchange Rate Outlook and Forecasts for Pound sterling (GBP) vs US dollar (USD), Euro (EUR) and Aus Dollar (AUD)

- Written by: Gary Howes

-

Pound Sterling Live presents a compilation of forecasts and on the British pound at the start of a new week.

We consider the outlook for the sterling against the US dollar, Euro and Aus dollar in the near term.

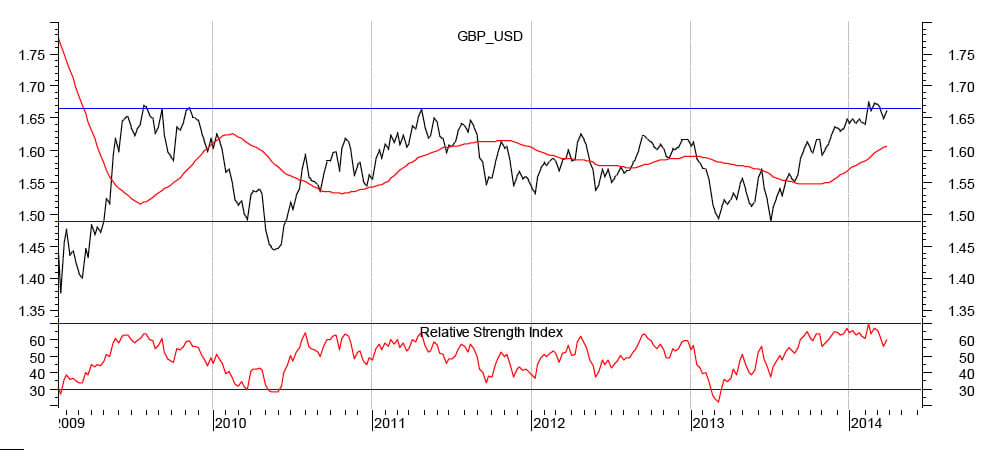

Pound dollar exchange rate outlook

Bill McNamara at Charles Stanley comments on the GBP-USD:

"After failing at 1.675 or so (which it tested on three occasions) the UK currency subsequently dropped back to 1.6488, and the fact that it then bounced from that level strongly suggests that a new range has been established up near the recent highs. In fact, the broader technical picture is indicating that we should expect to see another challenge to the top before too long."

UBS are neutral on the pound dollar for now:

"Important support at 1.6470 was tested earlier last week and prompted a bounce which has a strong resistance at 1.6684. A break above this will be positive, opening 1.6823."

Note all quotes are reflective of the inter-bank market. Your bank or payment institution is free to levy a rate at their discretion. However, FCA-registered independent providers guarantee to undercut your bank's offer, thus delivering up to 5% more FX. Please learn more here.

Euro pound exchange rate outlook

Bill McNamara at Charles Stanley comments on the GBP-EUR:

"The small double-bottom that formed a around 1.19 has acted as a floor for sterling and this has lately provided it with the impetus to start tracking higher again. Last week’s 1.2% gain marked a clear reversal off the lows and it is going to be interesting to see whether the previous uptrend now starts to represent resistance. The January peak, at 1.223, is still the resistance point to watch and it is entirely possible that we could see that tested in the near term."

Concerning the euro pound, UBS say:

"The recent sharp sell-off brings our focus on the support at 0.8250, which was tested on Friday. A close below this will be negative as it would see the MACD cross below its zero line. Resistance is at 0.8305."

Karen Jones at Commerzbank says:

"EUR/GBP has sold off to the 61.8% retracement at .8250 and is seeing a small rebound off here. We note the 13 counts on the 60 and 240 minute chart and the TD supports at .8260/45 and suspect that we will see near term consolidation/ a small rebound. Rallies are indicated to remain capped by .8305 for an immediate downside bias to remain.

"Current Position: Long .8263. Recommended trade: stop .8240. Partially exit longs.8290 and look to exit the remainder.8305. Resell here."

Pound Australian dollar outlook

Looking at the Aus Dollar, the team at TD Securities note:

"GBP-AUD remains at risk of a deep slide. Losses have slowed through the end of the week but trend momentum is bearishly aligned across the longer-term studies and monthly price action (bearish key month reversal is all but certain) suggests a major turning point in this cross.

"We look for limited gains (1.81/1.83 at most) from here and, with the GBP sliding below the neckline of the bearish H&S reversal that formed up through the early part of this year, a drop to 1.7150 (measured move target) beckons."