Why the Euro / Dollar Rate Could Still be on the March Higher Towards 1.20

For over a year now the euro to dollar exchange rate has remained caught in a broad sideways move; a trend that has rarely exceeded 1.15 on the upside and 1.05 to the bottom.

- EUR/USD @ 1.1361 on Tuesday with declines towards 1.13 probable over short term

- Longer term, technicals hint at move towards 1.20 if resistance at 1.15 range top is broken

- Citi warn the euro is getting too expensive at these levels

The euro has softened further against the US dollar as the strong performance witnessed over the past two weeks continues to be unwound.

We would expect an extension of this weekness to continue over the short-term, key here though will be the extent of that weakness.

"EUR/USD should decline towards 1.1300 on the back of the rebound in US ISM Non-manufacturing today, yet this support level should hold," say ING in a note ahead of the key economic driver of the day ahead.

The focus therefore rests with support at 1.13; if it does hold and the euro gathers itself then we could well see the ground work established for a push higher,

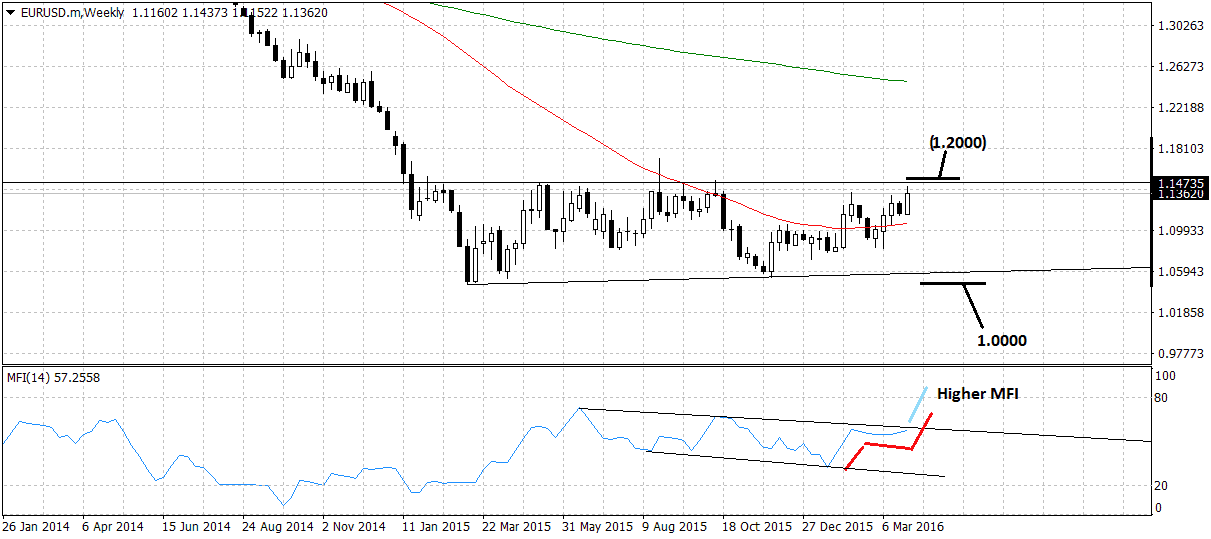

Technical evidence is building to suggest that a longer-term bullish reversal of trend in EUR/USD may be nigh as the pair reached the range highs at roughly 1.1500 last week.

It would take only a break above the 1.1500 range top to indicate a long-term change of trend from bear to bull.

The market’s structure is showing the short-term trend is probably already bullish after the break above the 1.1376 highs reversed the succession of peaks and troughs from down to up.

Friday’s better-than-expected Non-Farm Payrolls (NFP) result gave the advantage back to the dollar, however, and the pair rolled over from its 1.1437 highs.

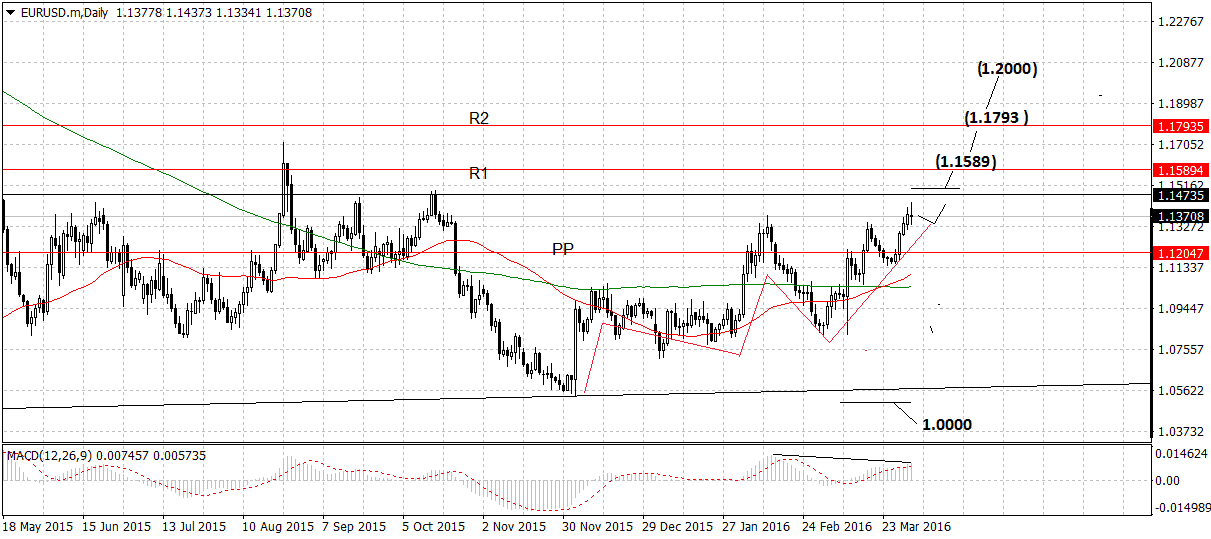

Whilst the MACD momentum indicator in the bottom pane is showing underlying weakness very short-term, the pair has weathered the dollar-positive NFP data surprisingly well, showing bulls are still in control and likely to eventually drive the rate higher.

A breakout above the 1.1500 level would likely unleash a potential surge to 1.2000 eventually, as shown on the weekly chart.

Previously we suggested the confirmation for a breakout would come from a break above 1.1550, however, that may be overly high, and we have revised it to 1.1510 instead to allow for a trade up to the next interim target at 1.5089.

The shorter-term daily chart shows the same breakout move evolving to 1.2000, but with a succession of pit-stops at resistance caps along the way.

In the absence of such a breakout above the range highs, however, our base case remains that the longer-term trend is still down and will probably resume, with a break below the 2014 lows at 1.0462 confirming a bearish breakdown to the next target at parity (1.0000).

Citi: Euro May be Getting too Expensive

Not convinced that now is the time for the euro to breach its long-held range and aim for levels towards 1.20 are analysts at the world's largest foreign exchange dealer, Citibank.

"The medium to longer term fundamentals on EUR and some other G10 FX remain bearish and current longs are likely to re-asses their overall trade should EURUSD (for instance) trade past the 1.1450 level," say CitiFX in a brief to clients.

However, it is the dollar's inability to fall much further that is of main concern to Citi.

"Fundamentals are likely to re-assert their impact on FX and with US rates (and by implication USD) already pricing in a very dovish Fed outcome for this year (only slightly more than a 50% chance of one 25bp hike this year), USD bears are going to find it difficult to even reach last year’s lows let alone slide beyond that," say Citi.

The USD Index hit a low of 91.08 in 2015, some 3.5 big figures below current levels.

Volatility Possible in Week Ahead, as Both Central Banks Release Their March Meeting Minutes

The week will be dominated to certain degree by the release of the Federal Reserves (Fed) March 15-16 meeting minutes on Wednesday April 6, and European Central Bank’s (ECB) March meeting minutes on Thursday April 7.

As far as the Fed minutes go analysts will concentrate on whether there is a more optimistic bias to the minutes than was reflected in Janet Yellen’s recent more cautious comments at the Economic Club of New York.

If the minutes show signs the Fed is closer to raising interest rates this will further boost the dollar after Friday’s strong NFP result.

“We expect the minutes to sound somewhat more hawkish than Yellen's recent remarks, potentially catching the rates market off guard, if for no other reason than more hawkish views will be represented.” Say the FX team and BofA.

In relation to the ECB minutes analysts will be scrutinising them in order to answer the big question as to whether the ECB is likely to increase stimulus.

“Next week's focus is likely to centre around the March ECB minutes. We expect the accounts to not only offer further detail into the decisions taken last month, but also to provide an insight into what path the ECB may follow should they have to act again.”

Given the euro is currently appreciating as a result of expectations that the ECB will follow Draghi’s exhortation not to cut rates any lower, the contents of the minutes will be expected to reveal a bias to maintaining current stimulus levels rather than expecting more.