Pound-Australian Dollar: Further Declines Possible from Here Says Equals Money

- Written by: Gary Howes

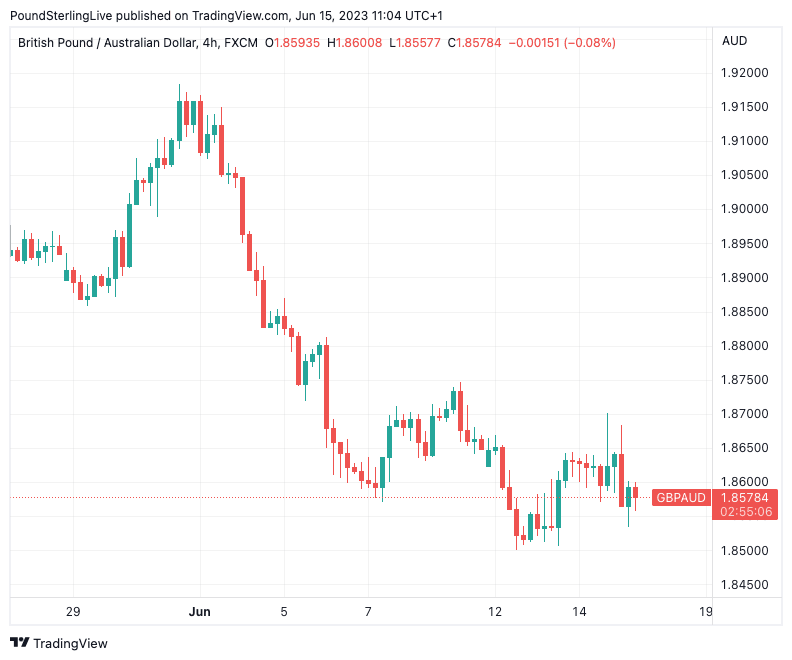

- GBPAUD extends June decline

- As Aussie jobs data smash expectations

- Boost RBA rate hike bets

- News from China also proving supportive

- As authorities there cut lending rates

- Market reaction to Fed skip also supporting

Image © Adobe Images

The Pound to Australian Dollar exchange rate (GBPAUD) retreated a third of a per cent following the release of data confirming Australia's jobs market continues to tighten, and further losses are possible says one foreign exchange services provider.

The Australian Dollar was broadly higher after Statistics Australia said 75.9K jobs were added in the month of May, easily surpassing the consensus expectation for the addition of 15K jobs and marking a strong recovery from the -4K reported in April.

The unemployment rate slid to 3.6% from 3.7% and analysts are of the view the Reserve Bank of Australia must raise interest rates further to ensure inflationary pressures don't run away from the 2.0% target.

For the Australian Dollar, these dynamics are supportive, according to analysis from Equals Money.

"GBPAUD continues to show signs that further declines on the pair could be on the card," says Thanim Islam, Head of FX Analysis at Equals Money.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

Economists at UBS say they still expect the RBA to hike rates by another 25bps, to 4.35% with the most likely timing remaining in August, after second-quarter CPI inflation figures are released.

"However, the risk to our view of an earlier hike at the next meeting in July is now materially higher," says George Tharenou, Economist at UBS.

The GBPAUD exchange rate peaked at the end of May and has declined through the course of June, thanks in large part to the RBA's unexpected interest rate hike earlier in the month.

Above: GBP to AUD at four-hour intervals, showing the June retreat from multi-month highs.

The hike and subsequent guidance that more might be needed, has aided Australian bond yields, which act like a magnet for foreign investor funds, creating flows that in turn boost the Aussie.

The rerating higher of RBA rate hike expectations can keep Australian yields supported, which would in turn support the domestic currency and could signal a retest of the highs in GBPAUD are looking increasingly remote at this juncture.

But there were further supportive Australian Dollar developments underscoring the currency.

Most notably, Chinese authorities pushed through fresh measures to boost the economy, bolstering the outlook for Australia's main trading partner.

"Following another round of worrisome economic data, Chinese authorities slashed the 1-year medium lending facility rate. The move was expected after the cut in the repo rate earlier this week, and hence not a surprise," says Marios Hadjikyriacos, Senior Investment Analyst at XM.com.

The People’s Bank of China lowered the rate on 237 billion Chinese yuan ($33 billion) of one-year medium-term lending facility (MLF) loans to some financial institutions by 10 basis points.

The move comes as authorities struggle to reignite the economy following its Covid lockdown slump. It is this lacklustre rebound in activity that has been a key factor in Australian Dollar underperformance up until June.

Also underscoring the Australian Dollar is the ongoing improvement in investor appetite, a fundamental source of support for the cyclical and risk-sensitive AUD.

Markets rallied following the Federal Reserve's decision to keep interest rates unchanged midweek in a sign that the rise in U.S. lending rates - a key determinant of global economic activity - is nearing an end.

Economist Steven Blitz at TS Lombard says the trend is clear: the Fed is done.

"My call is still recession, and the next move is a cut, but only after the unemployment rate reaches 4.5%," he says.

This is viewed as supportive of future global economic activity by investors, which is in turn supportive of the commodity-exporting Australian economy.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes