Pound Sterling: PMIs Indicate UK Economic Output Jumped in April, But No Lift-off for GBP

- Written by: Gary Howes

Image © Adobe Stock

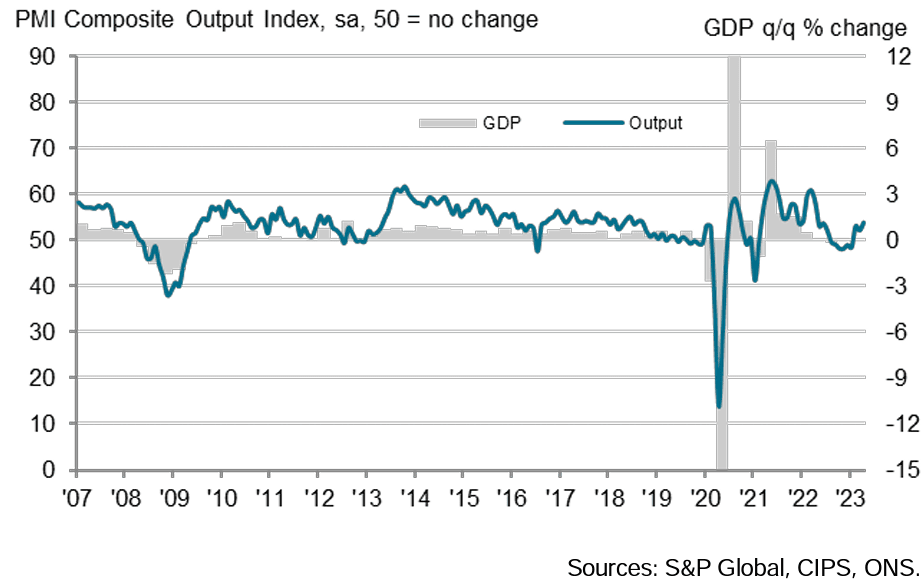

The UK economy witnessed the fastest rise in private sector output for one year in April, according to the S&P Global PMI survey.

The data will offer some support to Pound Sterling which was at risk of ceding significant ground to the Euro and Dollar on a disappointing outcome.

S&P Global said the UK composite PMI read at 53.9 in April which represents a pick-up in pace on March's 52.2 and exceeded expectations for a reading of 52.6. "A further robust rise in new order intakes added to signs of an improving economic landscape," said S&P Global.

We meanwhile report today that the Euro rose after Eurozone PMIs reported a sharp rise in activity in April, meaning the Pound would have been exposed to some downside if the UK's reading disappointed.

But the Pound steadied after UK services PMI rose handsomely to 54.9 from 52.9 in March, exceeding expectations for a near-steady print of 53.

The inflation pipeline is also cooling as the report found the slowest increase in input costs at private sector companies for just over two years, due to lower fuel and energy prices as well as improving supply conditions.

The Bank of England will however sit up and take note of the finding "survey respondents nonetheless widely noted another month of strong wage inflation. This led to a steep increase in output charges during April."

The Bank of England is fully priced to raise interest rates again in May. But further hikes would be likely if ongoing wage pressures are seen to be propping up domestic core inflation.

UK manufacturing meanwhile remains in contractionary territory with a PMI of 46.6 disappointing against an expectation for 48.5. But manufacturing woes are not limited to the UK as the Eurozone also reported a similar performance with Germany posting a concerning 44.

The figures come on the same day GfK reported a sharp improvement in UK consumer confidence in April, raising expectations the UK economy would avoid the recession the Bank of England, IMF and countless institutional analysts have long been warning of.

"Data out this week has continued to reaffirm our view that fears of a technical recession in the UK this year are overblown," says Matthew Ryan, Head of Market Strategy at Ebury.

The Pound is, nevertheless, a laggard ahead of the weekend: following the figures GBP/EUR was quoted at 1.1317, down 0.20% on the day. GBP/USD was at 1.24, down a third of a per cent.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The Pound rallied sharply after the PMIs of previous months beat expectations, suggesting the currency is now potentially losing its responsiveness to positive data surprises.

This should worry those holding out for a stronger exchange rate in the near term as it suggests the UK 'better-than-expected' theme has potentially run its course.

"This may be as good as it gets," says Kamal Sharma, FX Strategist at Bank of America. "The best of UK data surprises may be behind us and there is little encouragement that international investors are returning to UK asset markets - a necessary condition for medium-term optimism."