Gold Price Forecast: Risk of Near-term Breakdown

- Written by: Gary Howes

Image © Adobe Stock

Gold prices are subdued around $1946 an ounce on Thursday, however the market could experience increased volatility over coming hours and days as the U.S. Federal Reserve delivers a major policy update.

Volatility ramped up once more on gold yesterday as the bulls moved decisively to prevent a near term breakdown.

The resulting rebound of over +$50 from session lows formed a decisive positive candle (a bullish engulfing/bullish outside day).

Leaving a low at $1902 reflects the growing importance of the support effectively in the band $1900/$1910. Technically this was also important as the market again bounced of the support of the 11 week uptrend.

However, the bulls are not yet in control though.

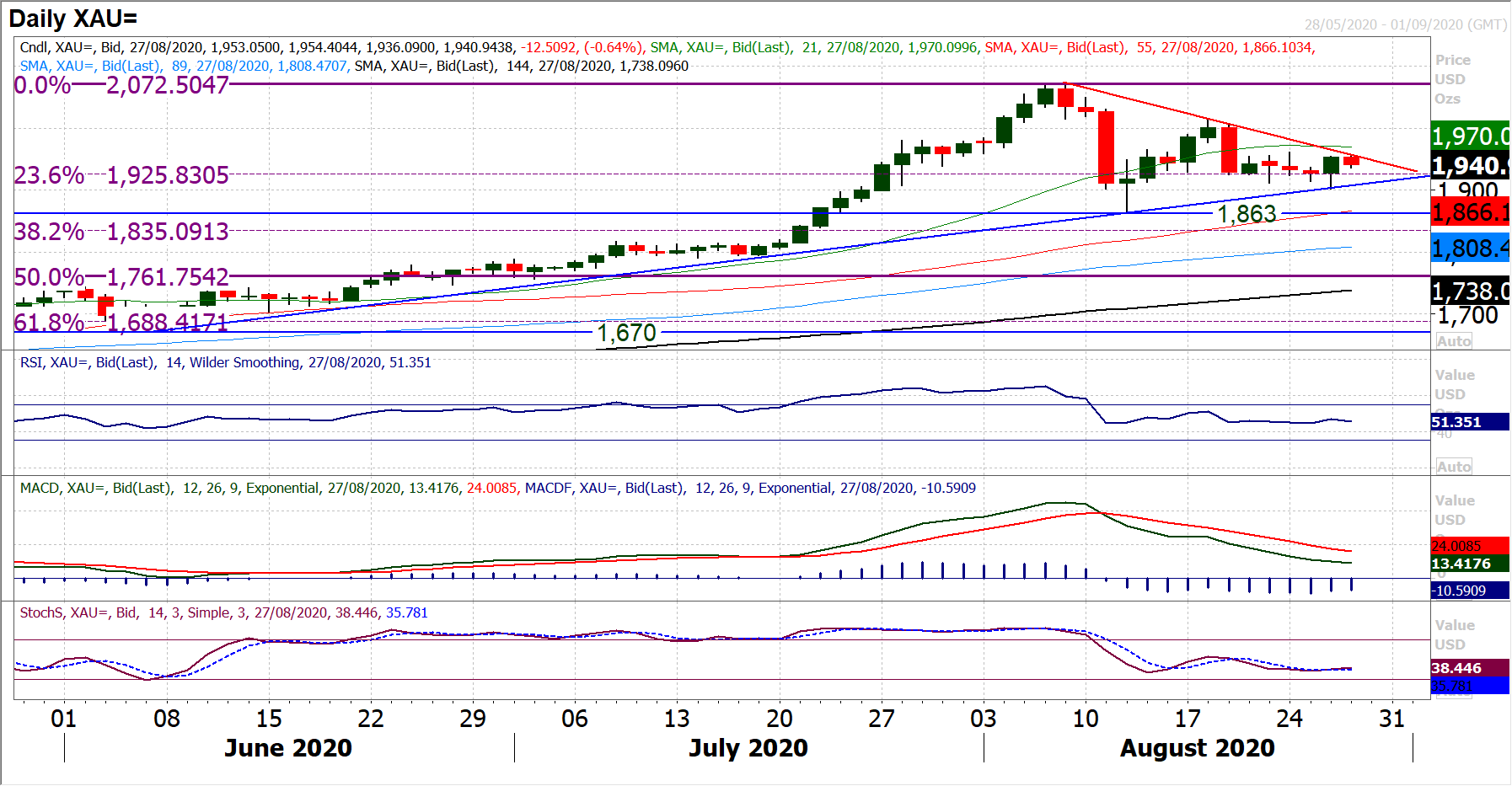

Failing at the resistance of a now three week downtrend this morning leaves a symmetrical triangle consolidation pattern formation and the market is still lacking decisive trend moving into Fed chair Powell’s speech today, perhaps understandably.

We anticipate elevated volatility to continue in the wake of the speech and there is still the risk of a near term breakdown.

We would continue to view the 23.6% Fibonacci (of $1451/$2072) retracement as a near term gauge of sentiment (at $1926) and a decisive closing breach increases the corrective potential near term.

The 11 week uptrend sits at $1907 today. Our strategy remains to buy gold into supported near term weakness, and once through Powell’s speech we should know more as to whether there is room for another leg lower.

A close above $1955 would break the mini downtrend, and be a near term breakout (on the hourly chart this is shown well). The important resistance then becomes $2015.

There have been some significant swings in bond and forex markets in the past 24 hours as traders prepare themselves for what could be a ground-breaking speech from the chairman of the Federal Reserve, Jerome Powell today.

However, given the importance of the speech, we see a calm and cautious look to forex majors, whilst equities are also flat.

Markets have been anticipating a dovish shift from chair Powell, and it was interesting to see the dollar weakening once more into the close yesterday, whilst the huge rally on Wall Street continued. However, will these dovish expectations be met?

Powell speaks via a webcast in the Jackson Hole Economic Symposium and the key issue is how he is set to address the FOMC’s forward guidance.

Minutes of the last Fed meeting seemed to play down negative rates or yield curve control right now, but forward guidance is certainly an important part of the toolbox. Will the Fed adopt an “Average Inflation Targeting” measure, and if so, then how formal will this be?

At this stage the Fed may do little more than allow an overshoot of inflation above the 2% target, allowing, a range of possibly +1.5% to +2.5%. Inflation has been consistently below 2% for much of the past decade, only being above 2% briefly on a couple of occasions.

The most recent was in 2018 when the FOMC was hiking rates, with inflation pulling quickly lower. Allowing an overshoot of the 2% target without tightening rates could help to improve inflation expectations.

It would also set in place the expectation that the Fed is going to remain ultra-loose on monetary policy for several years to come. This would be negative for yields and the dollar too. If Powell also leaves the door open to yield curve control, then the market will see this as dovish.

However, this clearly leaves the risk for Powell not being as dovish as expected and a near term dollar rally.

We would see this as simply a counter-trend move though as the path of dollar weakness through the rest of 2020 seems to be set.