Gold Price Forecast: Strategy Centred on $1660/$1764 Range

- Written by: Richard Perry, Hantec Markets

Image © Adobe Stock

The gold price is quoted 0.90% lower at $1714 on Monday, with analyst and technical forecaster Richard Perry saying the range trade remains firmly in control of the precious metal.

For the past couple of weeks we have been increasingly neutral on gold.

A bounce of three positive daily candlesticks in a row last week could have threatened this, but once more, the resistance band around the range highs has proved to be too much for the bulls.

Failing again at $1744, the market is now falling over once more and moving into retreat.

A negative candle on Thursday and a bull failure move on Friday, have come before gold faltering this morning.

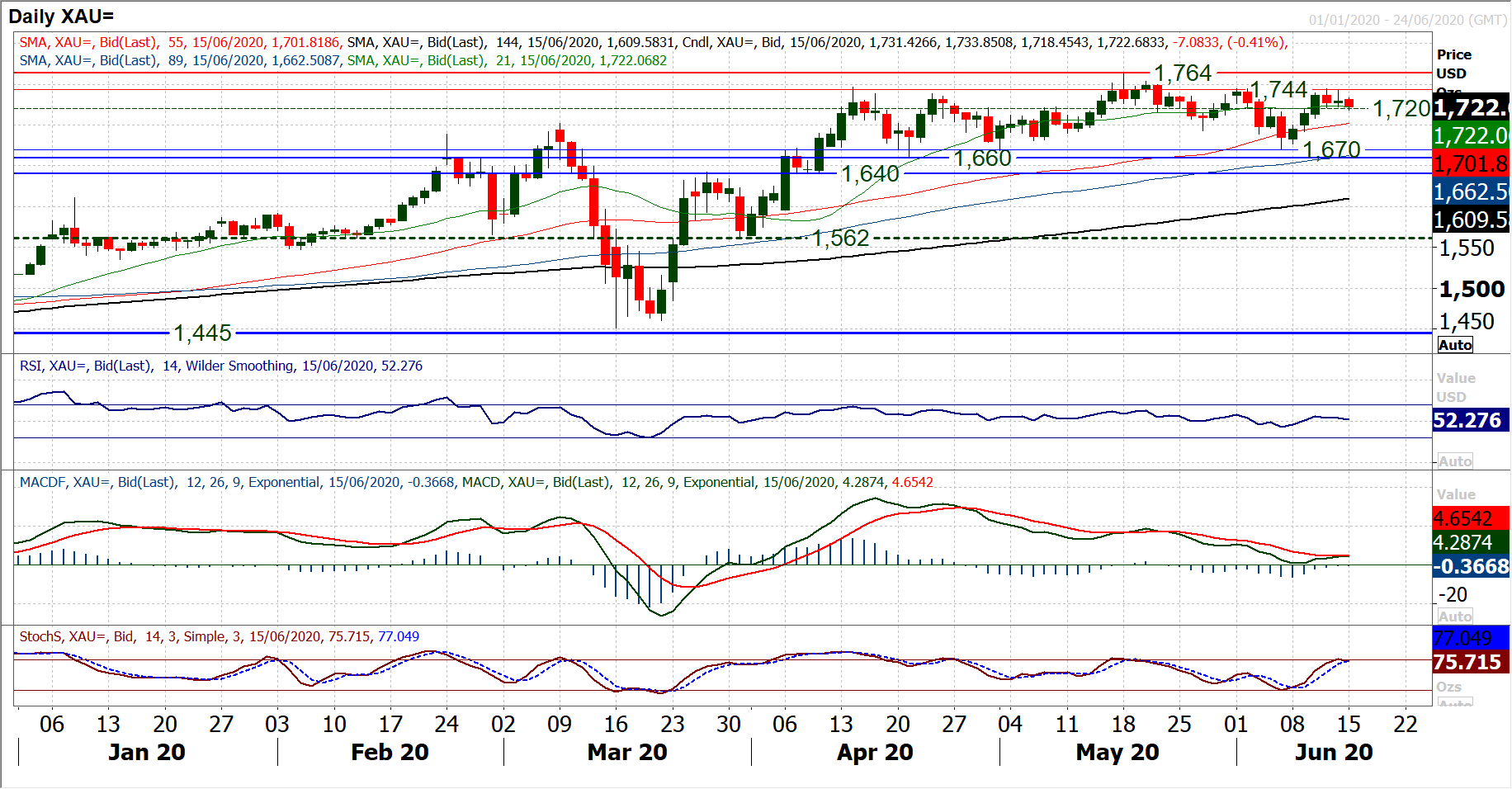

Momentum indicators continue to reflect rallies turning into bull failures. Daily RSI is again showing a near term bounce failing at a lower level, this time in the mid-50s.

Stochastics are crossing lower this morning, whilst MACD lines continue on their broad trajectory back towards neutral.

Playing gold within a medium term trading range of $1660/$1764 continues to be the strategy.

The hourly chart shows that the pivot band $1720/$1725 within the range is coming under pressure this morning and a decisive breach would imply another break back towards $1700 area.

Given the Average True Range is currently around $26 and early momentum has turned negative, this downside move is a growing possibility today.

Initial resistance is $1733 this morning.

Gold and Equity Markets Struggle

Risk appetite has turned sour in recent sessions and the news from China over the weekend now threatens to really crank up the momentum of flow back into safe haven asset plays.

The risk recovery took a turn last week as second wave infection rates in some US states started to increase again.

Over the weekend, China has reported the re-emergence of COVID-19 infections and the threat of renewed lockdown.

For now, this is only localised to Beijing and measures are rapidly being deployed to control the situation, but if this develops into something much bigger again, the world will take a collective gasp.

Second wave infections have always been a distinct likelihood, but can they be quickly contained without the need for renewed lockdown measures?

Today we see equities falling sharply in early moves, whilst Treasury yields are falling, all meaning the safe haven currencies (Japanese yen, Swiss franc and US dollar) are performing well.

Big question marks now hang over the capacity for demand recovery and this is hitting the oil price again today.

It is interesting to see gold is (perhaps counterintuitively) falling, but this is something to certainly keep an eye on today.

Adding to risk aversion today, we see that China data for May has all come out softer than expected, with misses on fixed asset investment, retail sales and industrial production, even if they did all improve on April’s numbers.

Given news of a potential second wave, it could make the Chinese authorities more nervous about easing restrictions and a slower recovery could ensue.

That would play negatively into market confidence too and this could be a real test for sentiment in the coming sessions.