New Zealand Dollar and Pound Approaching a Bout of Volatility as Compressed Range Looks to Break

Image © Pavel Ignatov, Adobe Stock

- GBP/NZD in a sideways range but risks of a breakout ever-present

- Political risks are likely to be the major drivers in the week ahead

- NZ Dollar eyes business confidence data this week

The Pound-to-New Zealand Dollar exchange rate is trading at 1.9263 on the interbank market at the time of writing, placing it in a position many who have been watching this particular pair will be familiar with.

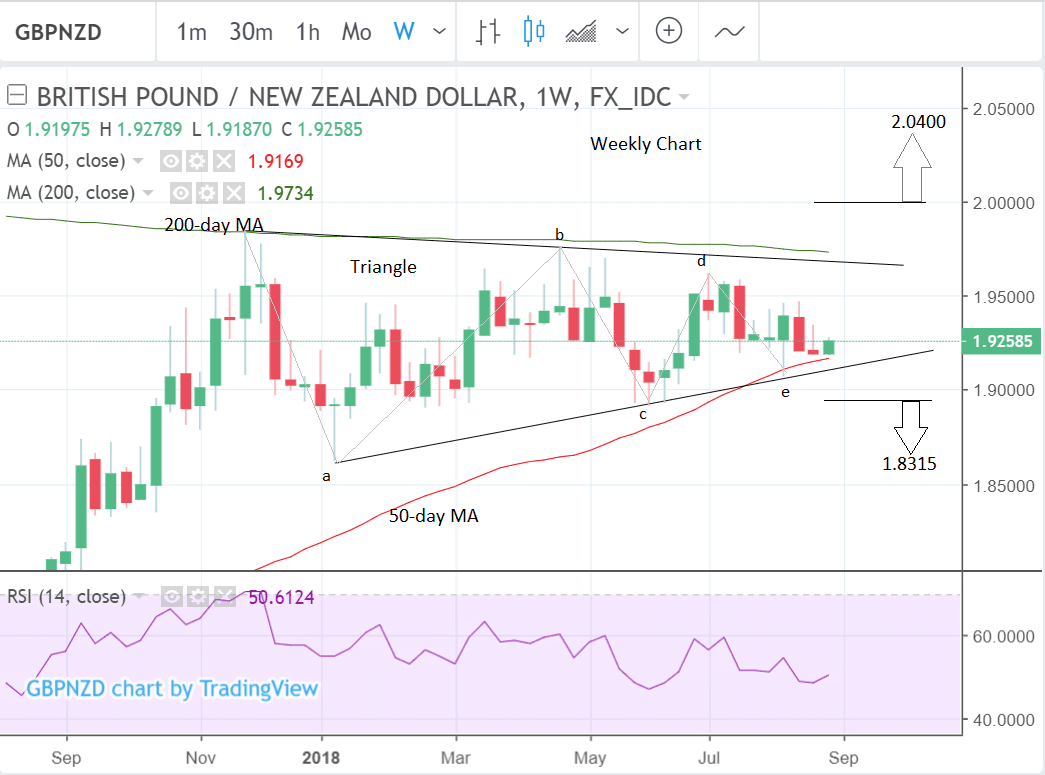

From a technical perspective the exchange rate is trading in a range, resembling a triangle pattern and although it has been directionless for several months now, a volatile period is promised fairly soon.

The pair has now completed the minimum five waves to qualify as a triangle and this suggests a breakout is probably close at hand.

The pair could breakout in either direction now, but the upper and lower boundaries of the triangle are 'reinforced' with the 200 and 50 week moving averages (MAs) respectively, which are formidable obstacles.

Major moving averages tend to repel price action because they attract short-term technical traders who often fade any approach.

The trend prior to the formation of the triangle was bullish, which suggests a marginal bias toward an upside breakout and continuation higher. However, the fact the component waves of the triangle are steepest on the way down also suggests there is scope for a downside breakout.

A breakout higher would be confirmed by a move above 2.00 and could take the market all the way to an upside target of 2.04. Whereas a break below 1.89 would probably signal a downward move toward 1.82 is in prospect.

Triangle breakout targets are generated by extrapolating the height of the triangle at its widest part, by a ratio of 0.618 from the breakout point.

0.618 is known as the 'golden ratio', a mathematical constant found to govern proportionality in natural phenomena and also in financial market price movements.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

The New Zealand Dollar: What to Watch

The two main releases for the New Zealand Dollar this week are building consents and business confidence.

Building consents in July are out on Wednesday at 23.45 B.S.T - they showed a -7.6% fall in June.

There is an old saying amongst investors that "housing leads the economy" so it is sometimes seen as a 'canary in the coal mine'. If it shows an unexpectedly big decline the Kiwi could weaken on fears for the economy.

ANZ bank's Business Confidence barometer in August is out at 2.00 on Thursday morning. It showed a negative -44.9 result in the previous month of July.

The New Zealand Dollar is also sensitive to trade war tensions so any escalation in the dispute between the US and China would be expected to weigh on the Kiwi.

China data could also impact on the Kiwi if it misses expectations markedly.

The week ahead sees the release of Chinese manufacturing and non-manufacturing PMIs for August, out on Friday at 2.00.

PMI is short for 'Purchasing Manager Indices', which are survey-based gauges of activity for different sectors. A result of above 50 is seen as representative of expansion and below of contraction, in that sector.

Manufacturing is forecast to show a slight slowdown to 51.0 from 51.2 in July, and non-manufacturing to 53.8 from 54.0.

PMI's are respected as a fairly reliable forward indicator for broader economic growth.

Unexpectedly negative Chinese data could weigh on the Kiwi as it would indicate a probable slowdown in the Chinese economy which could reduce demand for new Zealand exports.

China is New Zealand's largest trading partner so a fall in demand would result in aggregate fall in Kiwi Dollar buying too, thus weakening the currency as a result.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here