Pound-to-New Zealand Dollar Rate Forecast for the Week Ahead

© Naru Edom, Adobe Stock

GBP/NZD has taken a breather and fallen of late but the exchange remains in a longer-term trend higher which should ultimately restart.

The Pound-to-New Zealand Dollar exchange rate has been rising in a long-term uptrend ever since the start of 2017 and although it has pulled back since the November highs, the uptrend remains intact and will probably continue rising.

If the trend higher does not restart in the week ahead, it should still do so over coming weeks we believe.

Nevertheless, it has pulled back substantially and we our technical studies suggset we would ideally require a break above the 1.9500 level to confirm a continuation higher.

Such a move would probably eventually rise up to a target at 1.9840 at the level of the November highs.

Conversely, a break below the 1.8620 lows would probably confirm a change of short-term trend and see a greater likelihood of more downside emerging.

Data and Events to Watch for the New Zealand Dollar

The main releases for the New Zealand Dollar in the coming week are retail sales and the fixing of dairy prices at the global dairy trade auction.

Retail Sales is significant as it is an indicator of growth and consumption since most economic growth comes from consumers buying things, thus a rise in sales indicates greater growth which results in a stronger currency.

Fourth quarter retail sales are expected to show a rise of 1.4% compared to Q3 and 4.1% compared to a year ago (ie Q4 2016) when the data is released on Thursday at 21.45 GMT.

Generally, growth has been surprisingly strong in New Zealand so a greater-than-expected result will feed into that upwards growth theme and probably result in a rise in the Kiwi.

The Global Dairy Trade auction is scheduled to be held at 14.30 on Tuesday and will provide the latest prices for dairy goods, including dried whole milk, which is New Zealand's largest export.

After a string of declines, prices rose strongly (by 5.9%) in the auction two weeks ago and if there is another strong rise at the auction on Tuesday it could lift the Kiwi since it will increase aggregate demand for the currency from New Zeland's trade neighbours such as China.

Data and Events to Watch for the Pound

The Brexit related news will likely be the key driver of any big Sterling moves from a domestic perspective we believe.

"Faced with widespread criticism that the government’s plans for the next phase of Brexit talks are, at best, unclear, PM May and several ministers are set to deliver a series of speeches seeking to clarify the government’s position, demonstrate that the Cabinet is unified and provide some impetus to allow PM May to move forward with transitional phase talks with Brussels," says Victoria Clarke, an economist with Investec.

Clarke says we can expect a more substantial speech from May and other key Brexit ministers, probably following the planned gathering of the Cabinet at Chequers.

"For Sterling and UK focused investors more broadly, that speech will be key in shaping sentiment amidst rapidly waning optimism that the UK will be able to reach a transitional arrangement deal over the coming weeks or even months," says Clarke.

© freshidea, Adobe Stock

Data-wise, in the week ahead December and January Unemployment data is the most significant release for the Pound.

Average earnings (ex-bonuses) for the three months to January are released on Wednesday, February 21, at 9.30 GMT and are forecast to show a 2.4% rise compared to the same 3-month period a year ago; earnings including bonuses are forecast to show a 2.5% rise.

A higher-than-expected result would put upside pressure on the Pound as it would signal to markets that the Bank of England is likely to raise interest rates by 0.25% in May, and perhaps even once more before 2018 is out.

Higher wages mean higher inflation as increased consumer demand bids prices in the economy higher, which in turn leads the Bank of England to raise interest rates.

Higher interest rates tend to restrict spending growth as the cost of borrowing goes up but another side effect is a higher Sterling because higher rates tend to attract greater inflows of foreign capital as overseas investors are drawn by the promise of higher returns.

The unemployment rate in December is released at the same time and expected to remain unchanged at 4.3%.

If it drops it will be positive for the Pound as lower unemployment generally leads to higher wages as fewer job-hunters means there is less competition.

"One headwind for U.K. economic growth is that real disposable income growth weakened over the course of 2017," say analysts at Wells Fargo.

"That may be poised to change as the downward trend in the unemployment rate may eventually result in a pickup in disposable income," they continue, adding:

"That is the reason the financial market in the United Kingdom will be paying particularly close attention to the release of the latest unemployment figures on Wednesday of this coming week."

The second estimate of GDP in the last quarter of 2017 is out on Thursday at 9.30 and is forecast to slide to 1.5% compared to a year ago, from the first estimate's 1.7%.

On a quarterly basis, it is forecast to rise 0.5% from 0.4% previously.

If it falls markedly it would be negative for Sterling as lower growth generally lessens the likelihood the Bank of England will raise interest rates. It also lessens inflows from outside investors who tend to choose to put their money in fast-growing economies.

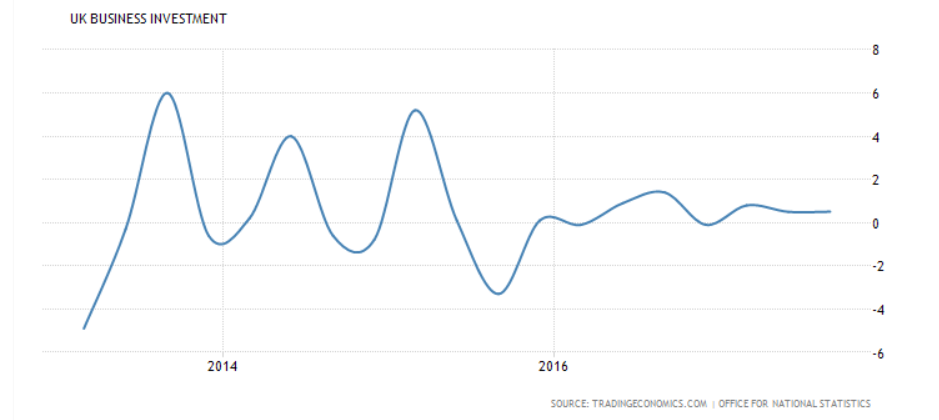

Business investment is a key gauge of confidence and growth in the economy.

Is is also extremely sensitive to Brexit politics as shown by the chart below, which shows a market slowdown post-referendum, as companies put big projects on ice until after clarification on the UK's new relationship with Europe.

The level of business investment in Q4 2017 will also be revealed in data out at the same time as GDP and is estimated to show continued growth of 0.5% quarter-on-quarter.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.