The New Zealand Dollar's Strength is at Risk

The NZ Dollar is beginning to look overbought and therefore vulnerable to a sell-off, say FX brokerage LMAX Exchange.

“There is risk for a topside failure in the sessions ahead,” the broker warns in a recent note to clients.

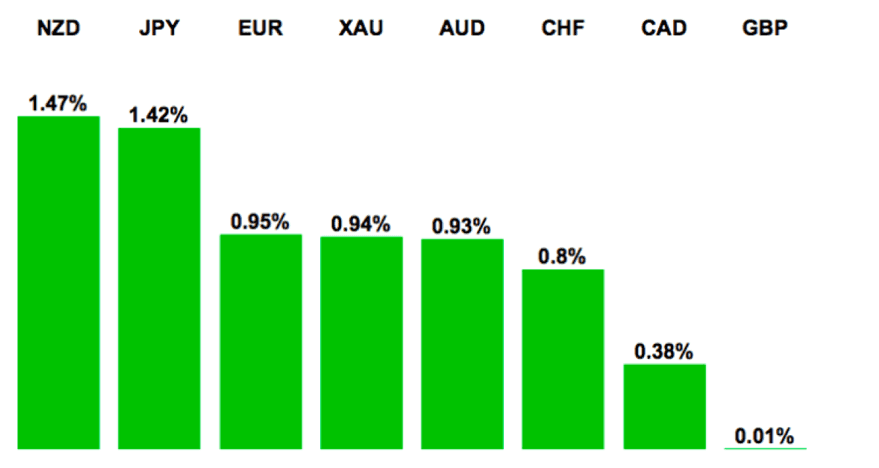

The NZD has been impressive of late; it was the best performing currency in the G10 for the five days leading into the weekend:

A sustained run of good data coming out of the New Zealand economy and a central bank that is unwilling to cut interest rates further for the time being are all proving supportive for the currency

The New Zealand Dollar did however turn lower on the final day of trade of the week in sympathy with a global decline in risk sentiment.

Stock markets and commodity prices were softer ahead of the weekend with many commentators placing the blame on the geo-political implications of news that North Korea has conducted a successful fifth nuclear test.

While the news is concerning we would expect the longevity of the market impact to be short-lived for now.

NZD remains in a strong up-trend as a result of inflows from international investors seeking a higher return on their money, as New Zealand has relatively high interest rates and the highest in the G10.

The recent rise in Dairy prices has also helped the currency as it is NZ’s largest individual export.

The price chart of NZD/USD looks bullish, as price action forms one long green bullish candlestick after another, in a steeply rising sequence.

However, according to LMAX Exchange it may now have got ahead of itself, and be ripe for a fall.

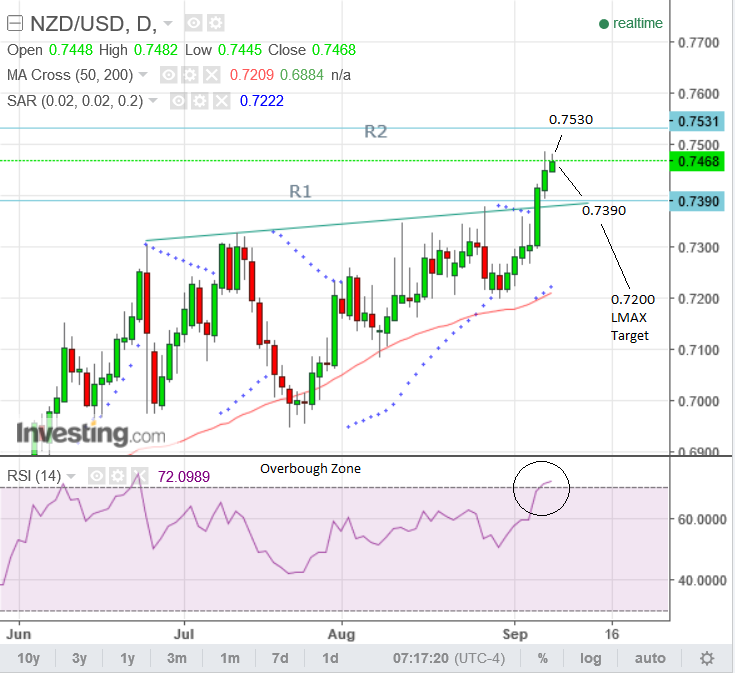

If we look at a price chart of the pair we can see that the Relative Strength Indicator (RSI) in the lower panel, which is a fairly good way to measure overbought states, has moved into the overbought region, over 70, and is therefore corroborating their view:

The correct way to interpret the RSI is when it moves into overbought it merely signals that traders should refrain from opening any new orders in the direction of the up-trend.

It does not necessarily mean that those already holding long positions – that is positions which profit from the asset going up – should close them; the signal for liquidating longs comes when the RSI moves back down below the overbought line, and therefore under 70.

Since this has not happened yet there is still a possibility the pair will continue higher in line with the dominant trend, taking it up the next major resistance level at 0.7530.

If there is a breakdown then LMAX Exchange expect, “a break back below 0.7200 would be required to take the immediate pressure off the topside.”

Our charts are indicating tough support from the R1 monthly pivot at 1.7390, however, which is a more realistic target, given the strong upside impetus and the likelihood that any pull-back will probably be short-lived before the exchange rate starts to rise again.

LMAX Exchange also mention extreme positioning as a reason to expect a pull-back in the kiwi:

“Though it's possible a good deal of this Kiwi flow comes from macro players starved for any type of yield they can get their hands on, it's unlikely this rally will be able to sustain itself, particularly with the daily sentiment index now showing bulls at a whopping 91%, a strong contrarian indicator warning of imminent reversal.”

Nevertheless, the Commitment of Traders (COT) report out on last Friday did not show an extreme positioning from non-commercial speculators in NZD, so the COT is not reading overbought even if the daily sentiment index is.

Looking ahead, the NZD will likely be tested by the release of Q2 GDP figures due for release on Thursday.

Data is expected to show that the economy grew at a pace of around 1.3% q/q.

That was probably driven by strong rises in output in the agricultural and construction sectors.

Save