GBP/NZD Forecast: Further Near-term Weakness

- Written by: Gary Howes

Image © Adobe Images

The Pound to New Zealand Dollar exchange rate can come under further pressure in the near term as global markets become more confident the Federal Reserve can cut interest rates in 2024.

The New Zealand Dollar - which tends to rise in buoyant market conditions - rose sharply last week after markets brought forward the expected start date for the first U.S. Federal Reserve interest rate cut. At the same time, the Pound was sold as markets bet that earlier Fed rate cuts meant an earlier Bank of England cut.

"The global risk rally has progressed into a new week," says Katheleen Brooks, an analyst at XTB. "Global equities rose overnight and yields edged lower as markets remained focused on the softer-than-expected US jobs data for April released last Friday," says Mark Haefele, Global Wealth Management Chief Investment Officer at UBS.

A sanguine-sounding Fed Chair Jerome Powell said last Wednesday that the recent rise in inflation was not cause for panic, while Friday's U.S. jobs report was softer than expected, suggesting that the labour market was finally softening, which tends to bring inflation down.

If the Fed cuts interest rates, assets like commodities and stocks can rally in anticipation of global economic expansion, which is supportive of the New Zealand Dollar setup.

These developments translate into a softer Pound to New Zealand Dollar exchange rate near-term outlook, particularly if this week's Bank of England update boosts the odds of a June interest rate cut.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

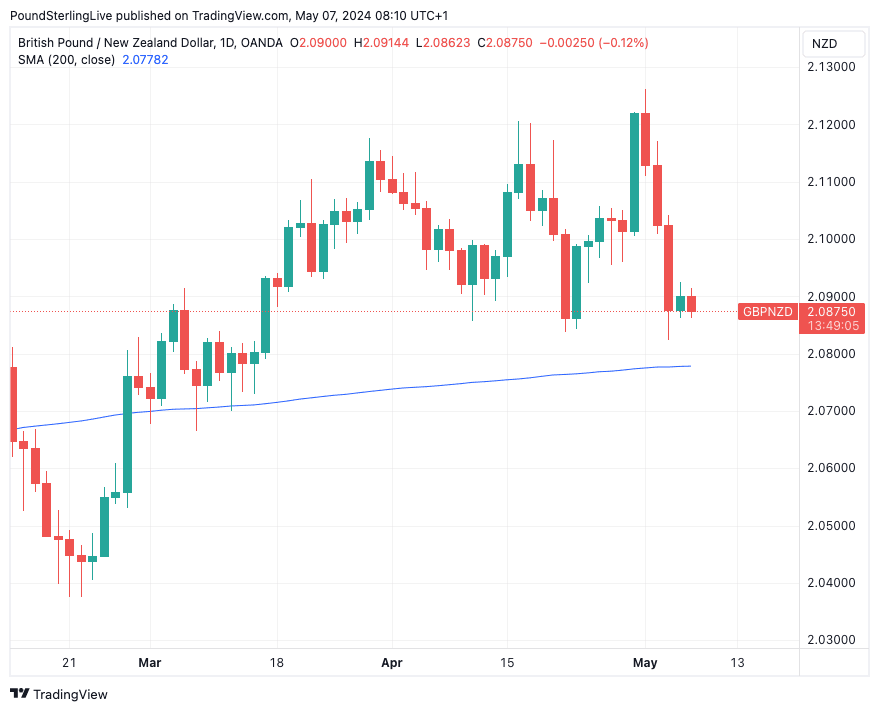

We note that GBP/NZD remains above the 200-day moving average, and our Week Ahead Forecast rules state that it is, therefore, still technically in an uptrend.

When it breaks below the 200 DMA (currently at 2.0778 vs. 2.0876 now), will the market flip from uptrend into downtrend. This level serves as this week's first target and we could see the exchange rate bounce off this level, as is often the case when large technical levels are encountered.

To be sure, momentum is shifting, and we are on alert for further losses in the coming days as the exchange rate slipped below the 50-day moving average last week, which serves as a first warning that a weaker setup is emerging.

Above: GBP/NZD at daily intervals. Track GBP/NZD with your own custom rate alerts. Set Up Here

"The pound is susceptible to BOE risks into the May 9 meeting," says a note from the foreign exchange strategy team at Barclays. "The MPC is gradually pivoting more dovish, as evidenced by Ramsden's recent speech but also more measured statements by Governor Bailey at the IMF meetings."

A clearly 'dovish' outcome for the Pound would involve the Bank pointing to a June rate cut, as this would involve a significant amount of repricing in financial markets. Such pointers could come in the form of more than one vote on the MPC for an immediate rate cut. The statement could also signal such intentions, as would a downgrade in the Bank's inflation forecasts.

When we consider an upside scenario for Sterling, we imagine it would involve the Bank being at pains to signal that nothing much has changed and that while it is pleased with progress on inflation, it remains guarded.

This could solidify expectations for an August rate cut. Here we would imagine the Pound recovers, with the scale of any recovery depending on how deep this current immediate-term selloff extends.

Any outcome that the market considers 'hawkish' could allow Pound-New Zealand Dollar a shot at retesting the 50-day moving average at 2.0959.