New Zealand Dollar Strength Ahead, RBNZ Won't Cut Until 2024 Says Westpac

- Written by: Gary Howes

Image © Adobe Images

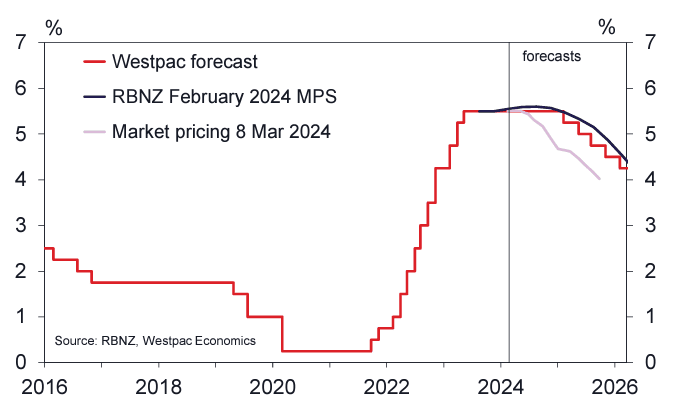

The market is overestimating the quantum of rate cuts to come from the Reserve Bank of New Zealand (RBNZ) in 2024, a mispricing that can assist the New Zealand Dollar over the coming months.

This is according to new research from Westpac, one of New Zealand's 'big four' banks, and follows the RBNZ's decision late in February to keep interest rates unchanged.

That decision was actually something of a surprise to markets, as one major New Zealand lender said the RBNZ could actually raise interest rates again owing to signs that inflation might struggle to fall to the 2.0% target on current trends.

Darren Gibbs, Senior Economist for New Zealand at Westpac, says the RBNZ's communication and forecasts are consistent with an interest rate cut coming in 2025, which is at odds with currency market expectations.

"In reaction to the RBNZ’s projections and commentary, markets have all but priced out any chance of a rate hike at upcoming meetings and have returned to pricing about 50bps of rate cuts by the end of this year," he explains.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

Westpac forecasts that the RBNZ's OCR will remain at 5.5% for the balance of this year.

"Absent some very favourable downside surprises to inflation or a sharp deterioration in the global economic outlook, we continue to think that a rate cut is unlikely to be seriously on the table until early next year," says Gibbs.

Foreign exchange markets are highly sensitive to interest rate expectations. Currencies fall when markets raise expectations for rate cuts and strengthen when the opposite happens. In this regard, any decline in current market expectations for RBNZ rate cuts could boost the NZ Dollar.

Above: RBNZ rate cuts are a distant prospect, says Westpac.

Elsewhere in the currency sphere, Westpac expects the U.S. Dollar to "break materially lower" in the coming months, but unlike the NZ Dollar, the Pound will only make marginal gains against the Greenback.

This has implications for Pound exchange rates as it implies a broader underperformance by the UK currency on the crosses.

This bearish stance on Pound Sterling underpins expectations for a retreat in the Pound to New Zealand Dollar exchange rate (GBP/NZD) over the coming months.

"Admittedly, Sterling’s spot price is above our expectation for the end of March quarter 2024, and so there is arguably some upside risk for GBP/USD. Yet uncertainty is rife for the UK," says Elliot Clarke, Senior Economist at Westpac.

He says the Bank of England is unsure about when inflation will sustainably return to target, with price pressures expected to re–accelerate in the second half of 2024 and wage growth still a threat.

He adds that GDP is signalling recession and the "economic and political headwinds the UK faces are long-lasting".

Westpac's currency forecasts show the NZD/GBP exchange rate strengthening to 2.0% by mid-year, a point target it holds until 2025.

This implies GBP/NZD will return to the big 2.0 figure sustainably.

New Zealand Dollar strength is seen against the U.S. Dollar, reflecting Westpac's thesis that the U.S. Dollar is set to break lower. Point forecasts are 0.63 for mid-year, 0.64 for the end of the third quarter and 0.64 for year-end.

For the New Zealand Dollar to Euro exchange rate, the respective forecast point targets are 0.57, 0.57 and 0.56.