New Zealand Dollar Under Pressure As Soft Job, Wage Data Bolsters Case For RBNZ Rate Cut

- Written by: Sam Coventry

Image © Adobe Stock

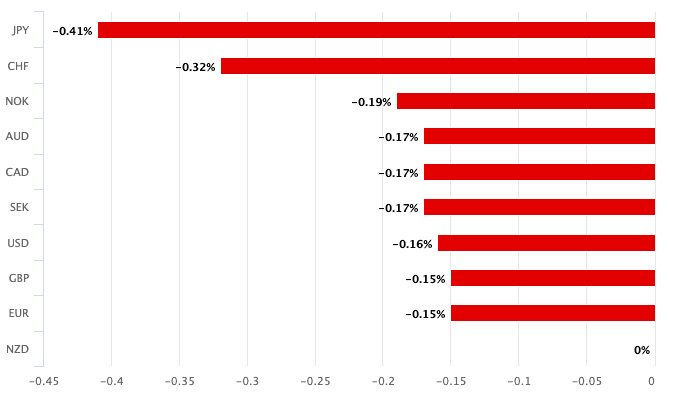

The New Zealand Dollar was October's biggest loser, and the new month doesn't appear to have started off in a strong fashion after the country's labour market statistics disappointed.

The Kiwi was down against all its G10 peers on November 01 after Statistics New Zealand reported a negative employment change for the third quarter, while wage pressures came in below expectations.

New Zealand's unemployment rose 8K in the third quarter, said StatsNZ, representing a 0.2% decline on the second quarter, which was worse than the 0.4% growth the market was expecting.

The unemployment rate rose from 3.6% to 3.9% and the participation rate fell to 72% from 72.50% in the second quarter.

"Q3 labour market figures confirm an easing in tight labour market conditions, with hiring falling and the unemployment rate at its highest in 2 years," says Mark Smith, Senior Economist at Auckland Savings Bank.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

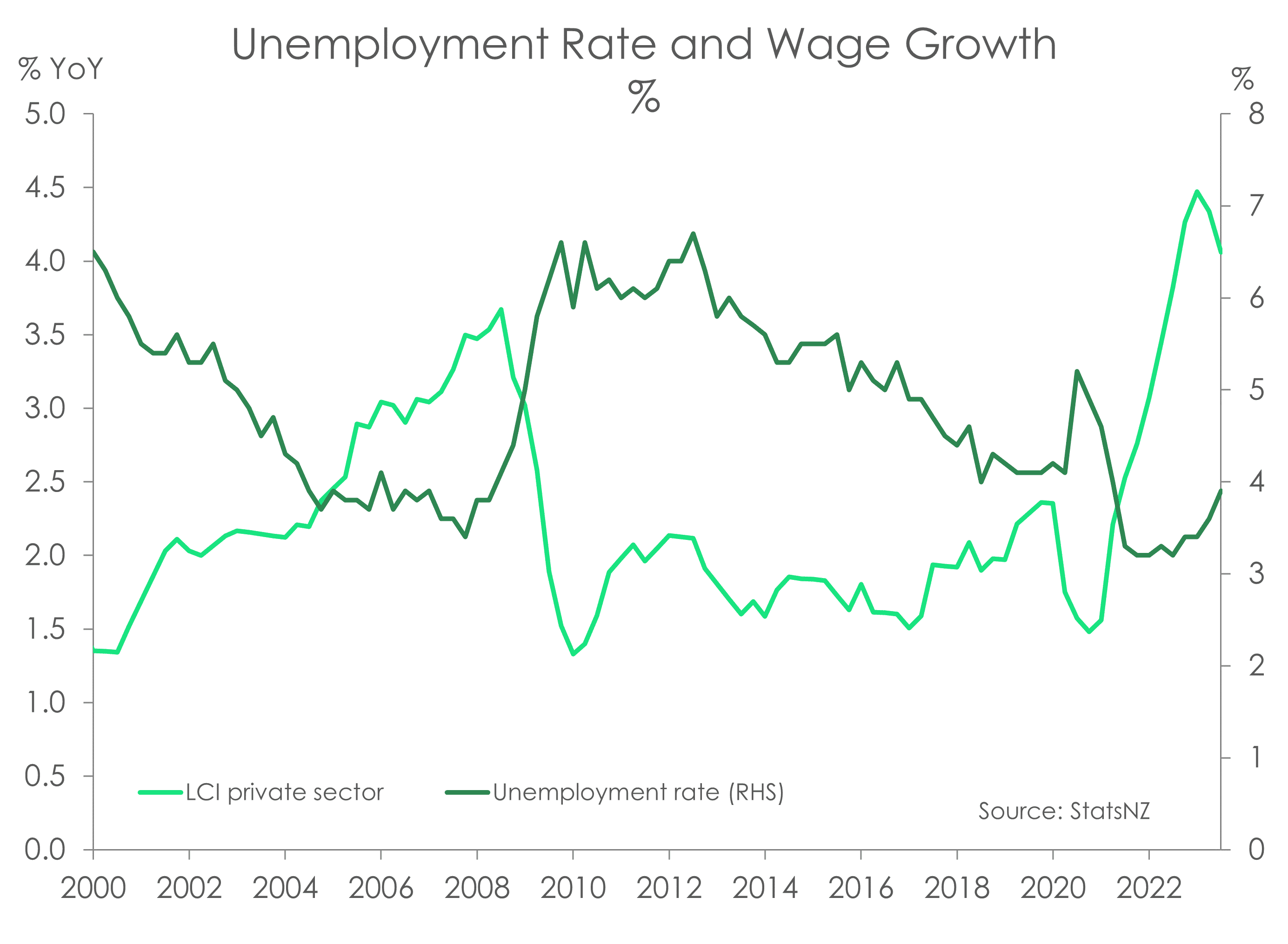

Wage pressures eased as the labour market deteriorated, with the labour cost index sliding to 4.1% year-on-year in the third quarter from 4.3%, whereas the market was braced for 4.2%.

"Labour cost growth looks to have peaked in the private sector," says Smith.

These figures lower the odds of further rate hikes at the Reserve Bank of New Zealand (RBNZ), where market analysts had seen the potential for a hike in December or February.

Reflecting this, the New Zealand Dollar is down against all G10 peers at the time of writing:

Above: NZD performance on November 01. Set up a daily rate alert email to track your exchange rate OR set an alert for when your ideal exchange rate is triggered ➡ find out more.

The Pound to New Zealand Dollar exchange rate is quoted at 2.0879, the Euro to New Zealand Dollar rate is at 1.8165, and the New Zealand Dollar to U.S. Dollar rate is at 0.5820.

"Financial markets reacted swiftly to the data, with the 2yr swap rate down around 6bp and the NZD/USD off around 40bp. That’s fair given it obviously raises the hurdle and/or might delay the timing for a hike," says Sharon Zollner, Chief Economist at ANZ.

Economists at ANZ say they continue to expect the RBNZ’s next move will be to hike 25bp, with February pencilled in for the timing.

However, their confidence in another hike has diminished following the labour market data, a loss in confidence that is reflected in a foreign exchange market that is selling NZD.

"The slowdown in employment growth and the fall in the labour force participation rate are clear indicators that the labour market is softening," says Sharon Zollner, Chief Economist at ANZ.

Image courtesy of Kiwi Bank.

Economists at Kiwi Bank say the RBNZ will take comfort in the softening of wages, as weaker wage inflation will help drive an easing in domestic inflation.

"The RBNZ-engineered recession, which is upon us, is likely to see a continued lift in the unemployment rate in the coming quarters. The demand for labour will likely weaken further into next year as the economy records further contractions, or at best, no growth," says Mary Jo Vergara, Senior Economist at Kiwi Bank.

Unlike ANZ, Kiwi Bank says the next move at the RBNZ will be a rate cut "early next year."

If the market comes on board with this view, the NZ Dollar can remain under pressure.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes