New Zealand Budget has Just Raised the Odds of Further RBNZ Rate Hikes: ASB

- Written by: Sam Coventry

Image © Adobe Stock

New Zealand's budget announcement has not only unveiled significant fiscal measures but also carries implications for the Reserve Bank of New Zealand (RBNZ) and the country's interest rates.

Senior economist Nick Tuffley from Auckland Savings Bank (ASB) suggests that the budget's fiscal stance may usher the RBNZ's upcoming decisions on interest rates in a more 'hawkish' direction.

The budget's fiscal measures, including the 2% of GDP fiscal impulse expected over the 2023/24 period prompts Tuffley to suggest the RBNZ is highly likely to follow through with at least a 25 basis point hike in May, with the possibility of a 50 basis point hike due to the budget's impact.

The worry for the RBNZ is that the less contractionary fiscal stance outlined in the budget may be less effective in cooling demand and inflationary pressures, given the current environment of strong demand for government services and the persistently high-cost environment.

While the government's intention is to shift towards a longer-term focus, Tuffley notes that government policy actions and settings will also impact shorter-term economic activity, inflation, and monetary policy settings.

This creates a complex landscape for the RBNZ to navigate as it seeks to balance inflation containment with economic growth.

With the upcoming October 14 General Election and the RBNZ identifying fiscal policy as a potential upside risk to the monetary policy outlook, it was crucial for the budget to address concerns about government policies contributing to New Zealand's economic overheating.

However, Tuffley suggests that the RBNZ may not be entirely pleased with the budget's fiscal stance.

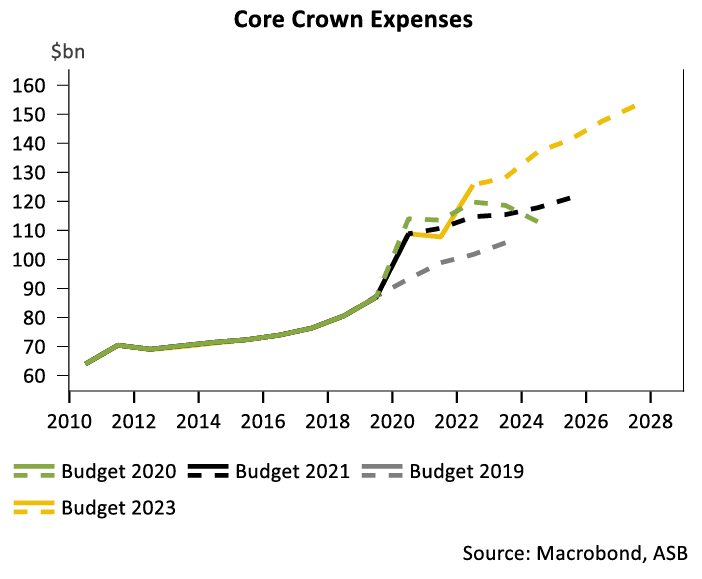

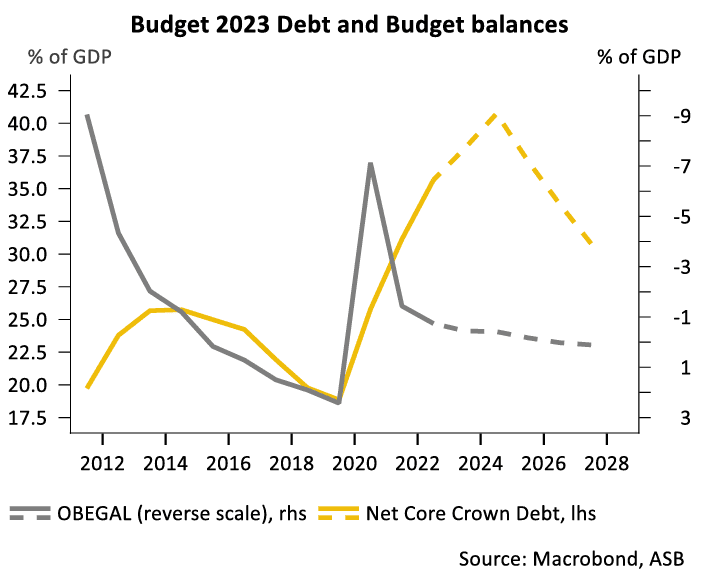

According to the budget's fiscal impulse, the fiscal stance is expected to have a considerably less contractionary impact on aggregate demand over the next few years than previously signalled.

The contractionary impulse of 1.4% in 2022/23 shifts to a positive impulse of 1.7% in 2023/24 before returning to contractionary territory in subsequent years (-2.0%, -1.7%, and -1.2%).

This frontloaded impulse coincides with the period when the RBNZ is still striving to quash inflationary pressures.

Moreover, other measures of the fiscal stance, such as the structural budget balance, also indicate expansionary settings during the early part of the forecast period.

This poses challenges for the RBNZ in its pursuit of price stability and sustainable economic growth, as the interaction between fiscal policy and interest rate decisions becomes crucial.

As the RBNZ evaluates the budget's implications, it will carefully balance the need to address inflationary pressures while fostering an environment conducive to economic growth.

The outcome of these considerations will shape the RBNZ's interest rate decisions and influence New Zealand's economic outlook in the coming months, as the central bank seeks to strike the right balance between containing inflation and supporting economic recovery.