Pound-New Zealand Dollar Rate Forecast: Battle Line Drawn

- GBP/NZD stuck at a major resistance point

- A break higher could open the door to fresh highs

- NZ employment data dominates domestic agenda

Image © Adobe Stock

- GBP/NZD spot at publication: 1.9119

- Bank transfer rates (indicative guide): 1.8450-1.8580

- FX transfer specialist rates (indicative guide): 1.8520-1.8900

- More information on accessing specialist rates, here.

The Pound-to-New Zealand Dollar exchange rate (GBP/NZD) has been butting its head against a solid resistance level for two months now and market participants will be looking for a decisive break to open the door to higher levels over coming days and weeks.

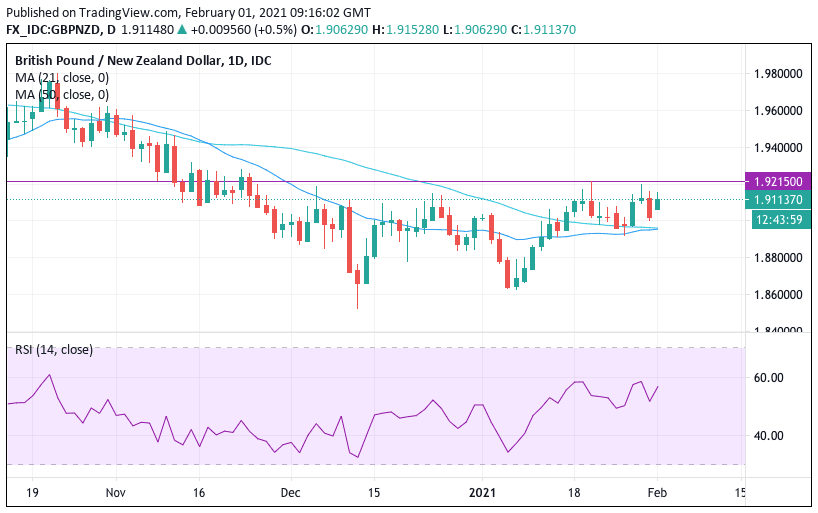

The technical setup that underpins the GBP/NZD exchange rate in the near-term is broadly positive given that a number of short-term momentum signals advocate for further gains, with the price being above both the 21-day and 50-day moving averages:

Furthermore, the Relative Strength Index (lower pane in the above) is at 56 and is positive, confirming Sterling holds the upper hand.

But, a cursory look at the daily chart shows GBP/NZD has been trading in a sideways pattern since November 2020 and since December an area of resistance against Sterling advances has built.

The January 20 high at 1.9215 - the purple line - in the above chart provides some indication of where near-term rallies could fade.

Indeed if we zoom out and look at the multi-month and multi-year chart we observe that price action in the past two months has been dictated by this resistance level:

Looking back further, we can see this line does broadly serve as a fulcrum to price action in the exchange rate.

A break above this level on a sustained basis would open the door to further gains and a more confident stance on a bullish GBP/NZD setup as a new higher range is developed.

A look at the fundamental drivers of both Sterling and the Kiwi could explain the current impasse in the exchange rate as reflected in the charts.

The New Zealand Dollar has traditionally benefited when global stock markets appreciate, as this reflects reflects positive assumptions about global economic growth amongst investors.

The 'high beta' means the New Zealand Dollar could be expected to gain should stock markets rally over coming days, thereby putting downside pressure on GBP/NZD.

But, this assumption might be challenged as 2021 has seen Sterling adopt something of a new dynamic: the Pound has tended to appreciation alongside global equity markets now that Brexit has ceased to be a primary consideration for foreign exchange markets.

"The GBP has become more correlated again with global equity market performance this month which could reflect the fading impact of Brexit risk," says Derek Halpenny, Head of Research at MUFG.

Therefore, rising stock markets could benefit both the Pound and New Zealand Dollar, leading to a deadlock in GBP/NZD. This would be confirmed by further consolidation in GBP/NZD around current levels.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

From a domestic perspective, New Zealand Dollar performance could take some cues from the release of labour market data on Tuesday.

"In order to keep the NZD momentum going, the NZ 4Q jobs report will likely have to show some better-than-expected numbers. Consensus is expecting the unemployment rate to have moved up from 5.3% to 5.6%, which would still leave NZ in a relatively safe spot when it comes to the pandemic impact on employment," says Francesco Pesole, FX Strategist at ING Bank.

New Zealand is likely to see employment levels decrease -0.8% quarter on quarter in the fourth quarter of 2020, according to consensus estimates.

Should the rate come in smaller, then the New Zealand Dollar could benefit, but a deeper decline could trigger some NZD outflows.

The Reserve Bank of New Zealand (RBNZ) has been a significant driver of NZ Dollar value of recent months, with the currency dropping in 2020 as the RBNZ indicated it was seriously considering cutting the country's basic interest rate into negative territory.

But better than expected data releases through the second half of 2020 saw the RBNZ row back on this stance, aiding a New Zealand Dollar recovery.

"Domestically, the economy continues to display positive momentum, aided by strong business confidence. A rising inflation pulse is beginning to suggest that the starting point for the economy is better than otherwise thought," says Daniel Been, a foreign exchange strategist with ANZ Bank.

A downside risk to the currency is that a poor employment report starts to raise questions on RBNZ policy on negative interest rates once more.

However, economists say even a soft employment report will unlikely shift RBNZ policy in the near-term, and it will require a run of poor releases to start shifting the dial in a meaningful way.

"The odds of a negative OCR have reduced given how the RBNZ has sounded less dovish and made an upbeat assessment of the economy in November. Even if a negative OCR were to be implemented, it is likely to be implemented later or more gradually. Our call remains for the OCR to remain at 0.25% for now," says Lee Sue Ann, Economist at UOB.