New Zealand's Inflation Bounce Not Enough to Delay Interest Rate Cut if Growth Outlook Deteriorates say ANZ

- Written by: James Skinner

© Naru Edom, Adobe Stock

- NZ inflation surprises on the upside in September.

- But signs of pickup in core inflation remain elusive.

- Analysts divided over what it means for RBNZ policy.

The New Zealand Dollar rose Tuesday after official data revealed a stronger than antipicated pickup in third-quarter inflation, which left the consumer price index close to the midpoint of the Reserve Bank of New Zealand target.

Inflation rose by 0.9% during the third-quarter, up from 0.7% for the three months to the end of June, when markets had looked for just a 0.7% gain.

That took the annual consumer price index up to 1.9%, from 1.5% previously, when consensus had been for it to rise only as far as 1.7%.

This was the result of a pickup in so called tradeables inflation, which refers to commodity items. Prices of commodities traded on global markets, such oil, have risen sharply in 2018.

"Today’s outturn was significantly stronger than the RBNZ’s August MPS forecast for a 0.4% q/q rise (1.4% y/y). However, less so on the non-tradables side, which tends to be more persistent," says Miles Workman, an economist at Australia & New Zealand Banking Group (ANZ).

The Reserve Bank of New Zealand has said in no uncertain terms that it will not be compelled into action by any pickup in inflation that is driven only by an increase in commodity prices.

It wants to see domestically generated inflation pressures pick up further before it considers changing its interest rate policy. However, non-tradeables inflation remains lacklustre in New Zealand.

After food, energy and other volatile commodity items are excluded from the goods basket, third-quarter inflation was still a long way off from the midpoint of the Reserve Bank of New Zealand's 1% to 3% inflation target range.

Core inflation, which excludes commodity items to make the index number more representative of domestically generated inflation pressures, rose at an annualised pace of just 1.2% during the recent quarter.

This echoes the tone of earlier price data that has shown inflation pressures languishing far below the midpoint of the Reserve Bank of New Zealand (RBNZ) target for much of the time since 2012.

"The solid CPI print does not take the possibility of an OCR cut off the table. Patchy data-flow alongside global uncertainties suggest risks to the RBNZ’s medium-term activity and inflation forecasts are skewed to the downside," Workman adds.

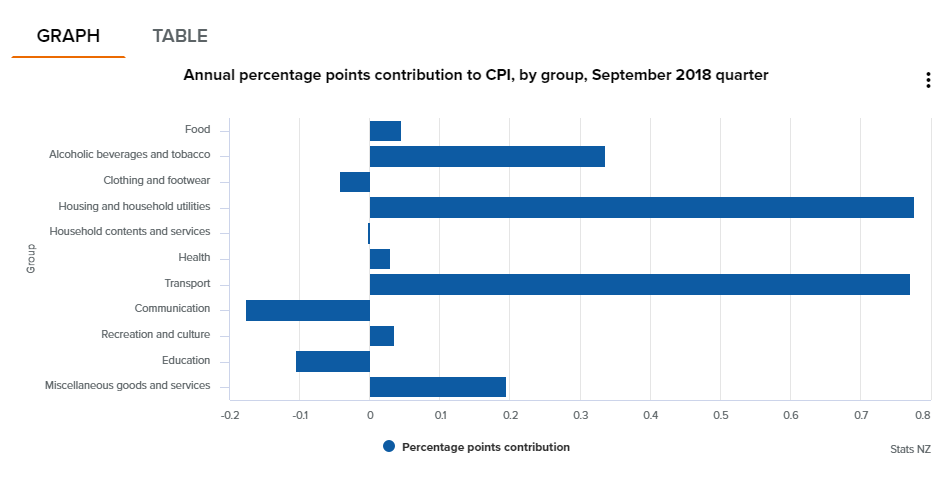

Above: Statistics New Zealand graph showing contributions to inflation by category.

Markets care about the inflation data because it has a direct bearing on Reserve Bank of New Zealand interest rate policy.

Changes in interest rates are only made in response to movements in inflation but impact currencies because of the push and pull influence they have on international capital flows and their allure for short-term speculators.

The RBNZ has held its interest rate at its current record low of 1.75% ever since the end of 2016, citing weak wage growth and an outlook for the economy that are both placing attainment of its inflation target in jeopardy.

ANZ's currency and economics teams say Tuesday's data does not remove or meaningfully reduce the risk of a rate cut in the months ahead but others disagree, particularly those at Antipodean banking rival, Westpac.

"The RBNZ has warned that if the data failed to support a pickup in inflation, it would reduce the OCR. We took that seriously at the time, but our central view was that a range of more positive data would most likely dissuade the RBNZ from cutting. That is the way things are panning out," says Michael Gordon, an economist at Westpac. "TFinancial markets have taken a similar view."

Above: NZD/USD rate shown at daily intervals.

The NZD/USD rate was quoted 0.09% higher at 0.6577 Tuesday after having risen around 50 points in the overnight session, although the Pound-to-New-Zealand-Dollar rate was up 0.22% at 2.0051.

Above: Pound-to-New-Zealand-Dollar rate shown at daily intervals.

RBNZ officials have warned repeatedly since early July that they could cut interest rates if the economic growth outlook does not pick up in a way that encourages a return of the consumer price index toward the upper end of the target band.

Since then, second-quarter GDP data has shown the economy growing faster than almost all observers had imagined for the three months ending in June, but a series of influential surveys have shown business confidence declining to lows not seen since the financial crisis.

Some analysts have said since that the outlook for Kiwi interest rates is hinged upon economic growth in the third-quarter. The data will be released toward year-end and until then the New Zealand Dollar is seen at the mercy of developments in the offshore space.

"The already well developed downtrends in AUD/USD and in NZD/USD received an additional push via the latest down-reversal’s in leading risk markets like the S&P 500," says Thomas Anthonj, a strategist at J.P. Morgan, in a recent note to clients. "We expect this down-consolidation to drag on for most of October, if not into November, before the classical year-end rally could unfold."

Anthonj says that, as a so called risk asset, the Kiwi could decline as far as 0.6236 against the Dollar during the weeks ahead if global stock markets continue the downtrend that began earlier in October.

This means developments in the "trade war" between the U.S. and China will remain key to the Kiwi Dollar outlook and so too will the evolution of market expectations for Federal Reserve monetary policy.

The U.S. Federal Reserve has raised its interest rate eight times since the end of 2015, taking it up to 2.25%, which is more than 50 basis points above the New Zealand cash rate.

This widening interest rate differential has put pressure on the New Zealand Dollar in 2018, driving it more than 8% lower against the greenback, as traders reward the higher relative returns available from U.S. assets by shunning the Kiwi while bidding for the greenback.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here