Norwegian Krone: GBP/NOK Set for Strongest-ever Weekly Close

- Written by: Gary Howes

Image © Adobe Images

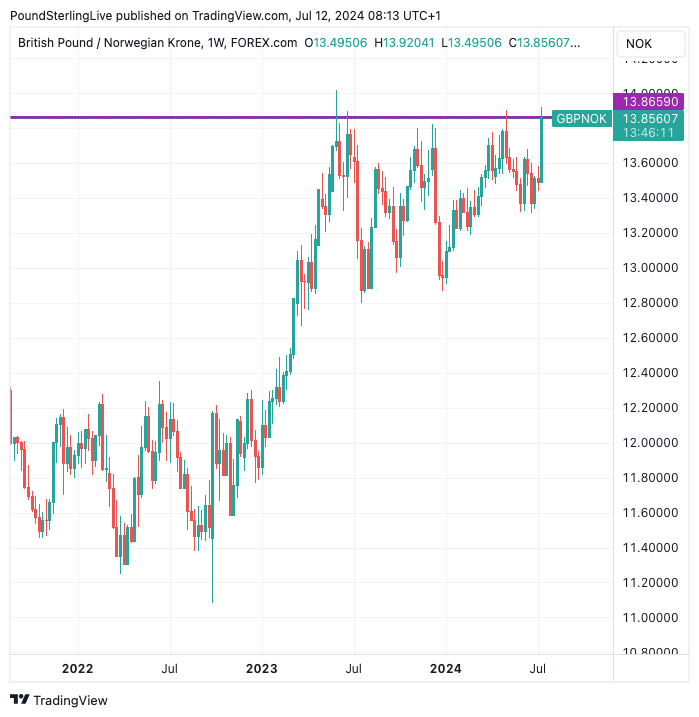

A mixture of British Pound outperformance and a marked decline in the Krone has set up GBP/NOK for its strongest-ever weekly close.

The Pound to Krone exchange rate (GBP/NOK) is at 13.84, and if it closes the week here, we will record the highest weekly close since 1975.

"The NOK has been on the defensive since the middle of June," says Daragh Maher, Head of FX Strategy at HSBC, but he notes the decline has extended "in a marked way."

This follows the softer-than-expected Norwegian CPI, released this week, which showed headline CPI inflation fell to 2.6% year-on-year in June, raising the odds of rate cuts at the country's central bank.

Accelerating Krone losses were reflected in the all-important Euro to Krone exchange rate, which is about to experience its biggest weekly loss (-2.0%) since October of 2023. The pair is at 11.64, having been at 11.42 on Monday.

"This allowed the exchange rate to break above the 50-day, 100-day and 200-day moving averages, perhaps causing a dash to the exit that means it is the worst performing currency in G10 FX spot over the last three weeks," says Maher.

GBP/NOK has surged by 2.54% this week alone, helped by a strong UK GDP reading and growing caution over the prospects of an August rate cut at the Bank of England.

Above: GBP/NOK at weekly intervals. Track NOK with your own alerts, find out more here.

Can the NOK sell-off extend?

"The pace of the EUR-NOK rally has outpaced the shift in the German-Norway 2Y yield differential," warns Maher. "However, NOK bears might argue that the strength in the NOK earlier in June also looked a little exaggerated relative to moves in yield differentials."

Norway is a major oil and gas producer, which can have a bearing on the NOK's value. However, Maher says oil provides no explanation as NOK was stronger when oil prices were falling during April and May, and has been weaker despite oil prices trending higher in recent weeks.

"Rates remain the key driver, but the pace of the NOK sell-off in the last couple of days points to a positioning squeeze and thin liquidity that has hit the NOK more than fundamentals might warrant," says Maher.