Polish Zloty Powers Ahead, GBP/PLN Risks Major Breakdown

- Written by: Sam Coventry

Image © Adobe Images

Poland's central bank unexpectedly left interest rates unchanged at 5.75%, boosting Polish sovereign bond yields and the attractiveness of the Polish Zloty.

The Zloty rose across the board after Narodowy Bank Polski (NBP) defied expectations to cut interest rates by a further 25 basis points, saying it was now prepared to wait and assess the effects of previous rate cuts on the economy.

The NBP's forecasts showed inflation would remain above the targetted level for an extended period, even as recent inflation readings have shown an ongoing rapid fall in price increases.

"The unexpected pause in NBP easing raises yet more questions around the central bank's reaction function, particularly in light of inflation that continues to fall rapidly. Whilst disinflation progress is expected to slow, today’s announcement appears inconsistent at first glance with decisions taken over recent months," says Nick Rees, FX Market Analyst at Monex Europe.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

However, the foreign exchange market was more welcoming of the NBP's decision, potentially seeing this as a welcome break from seemingly unorthodox policy decisions taken over recent months, sending the Zloty higher against most peers.

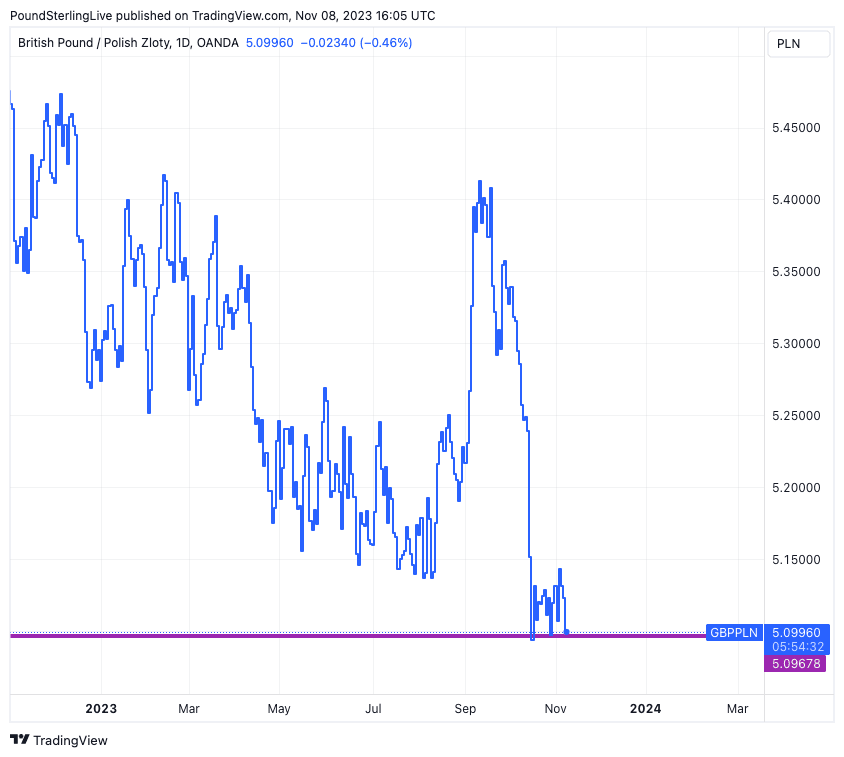

The Pound to Zloty exchange rate slid half a per cent to 5.0997, the Euro to Zloty is down a third of a per cent at 4.44, and the Dollar to Zloty is down by a similar margin at 4.14.

"For now though, the move is being welcomed by FX markets, with today’s announcement seeing the zloty rally around half a percent as traders upgrade prospects of a more hawkish approach to policy easing from the NBP," says Rees.

Above: GBP/PLN at daily intervals. Set up a daily rate alert email to track your exchange rate OR set an alert for when your ideal exchange rate is triggered ➡ find out more.

The above chart shows that the exchange rate is testing a horizontal support level that could offer Sterling some support against further losses.

Some consolidation could, therefore, take place, but we would view this as likely being short-lived given the context of the strong down move of recent months.

The balance of risks lies to the downside, and a break lower is likely.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes