Swedish Krona Analysts Worry About Outlook Ahead of Riksbank Decision

- Written by: James Skinner

"Our quantitative model for currencies, which is based on how global and local factors such as equities, interest rates and commodity markets drive exchange rates, shows that the krona has little correlation with Swedish interest rates (instead, it correlates well with global equity)," - SEB.

Image © Adobe Stock

The Swedish Krona is the second worst performing major currency of the year and local analysts are worried about the outlook ahead of September's Sveriges Riskbank interest rate decision, which is set to be announced next week and ahead of a series of other central bank policy pronouncements.

Sweden's inflation rates were the second highest among G10 economies in August, behind only those of the United Kingdom, and the data out this week likely leaves the Sveriges Riksbank and Swedish economy in an awkward position ahead of next Tuesday's interest rate decision.

"The fact that the krona is so weak probably stresses the Riksbank (a stronger krona would dampen imported inflation) and comments from the Riksbank indicate that they will try to raise faster than the ECB (to support the currency)," says Filip Carlsson, a strategist at Skandinaviska Enskilda Banken or SEB.

"However, the risk is obvious that the economy will be negatively affected at the same time as it does not have the desired effect on the krona (if you believe our models). This will be a balancing act and tough balances for the executive board to make in the future," Carlsson said on Thursday.

Above: USD/SEK shown at weekly intervals with 02-year U.S. and Swedish government bond yields.

The Riskbank raised its interest rate by half a percentage point to 0.75% in June and said the benchmark would likely rise to just less than two percent by the start of next year, although shortly after that the Swedish Krona fell to some of its lowest levels since March 2020.

It's not clear if the Swedish Krona's losses were a response to June's projection for the Riksbank interest rate to top out around the same level that was indicated as likely in April, which was the 1.75% level, or if it was a response to rising U.S. government bond yields and falling stock markets overseas.

However, local analysts are worried that there may be a risk of further declines no matter what the Sveriges Riksbank does next Tuesday.

"Our quantitative model for currencies, which is based on how global and local factors such as equities, interest rates and commodity markets drive exchange rates, shows that the krona has little correlation with Swedish interest rates (instead, it correlates well with global equity), Carlsson said on Thursday.

"Households' sensitivity to interest rates via variable mortgages is well known (and in focus among many institutions abroad) and the Riksbank's rapid interest rate increases will continue to put pressure on Swedish consumption and house prices in the coming months, add to that the concern about winter electricity bills mong households," he wrote in a Thursday market commentary.

Above: GBP/SEK shown at weekly intervals alongside EUR/SEK.

Above: GBP/SEK shown at weekly intervals alongside EUR/SEK.

Whatever the impact on the Krona, there may be a risk of the Riksbank lifting its interest rate by more than half a percentage point next Tuesday and some prospect of the bank lifting its projection of the level that interest rates may need to rise to in order bring inflation back to the 2% inflation target in good time.

These risks were alluded to in a late August speech by Deputy Governor Martin Flodén, who said while speaking at DNB in Stockholm that a strong domestic labour market and optimism among manufacturing companies were adding to inflation risks stemming from this year's increases in energy prices.

"Over the summer, inflation has been quite a lot higher than the Riksbank expected in its forecasts. At the same time, the prices of several international input goods, such as commodities and petrol, have begun to fall. This is because monetary policy measures around the world have begun to restrain demand and supply problems have begun to decline," he said in part.

"In June, our assessment was that raising the policy rate more in the short term would reduce the risk of high inflation in the longer term and thereby also reduce the need for greater monetary policy tightening further ahead. Developments over the summer underline the need to continue to act decisively so that inflation returns to the target of 2 per cent. But exactly how much the policy rate needs to be raised is something we will return to on 20 September," he added.

Since this speech was made Swedish inflation rates have risen further with the Consumer Price Index with a Fixed Interest Rate having reached 9% for the August month following an 8% increase in the prior month.

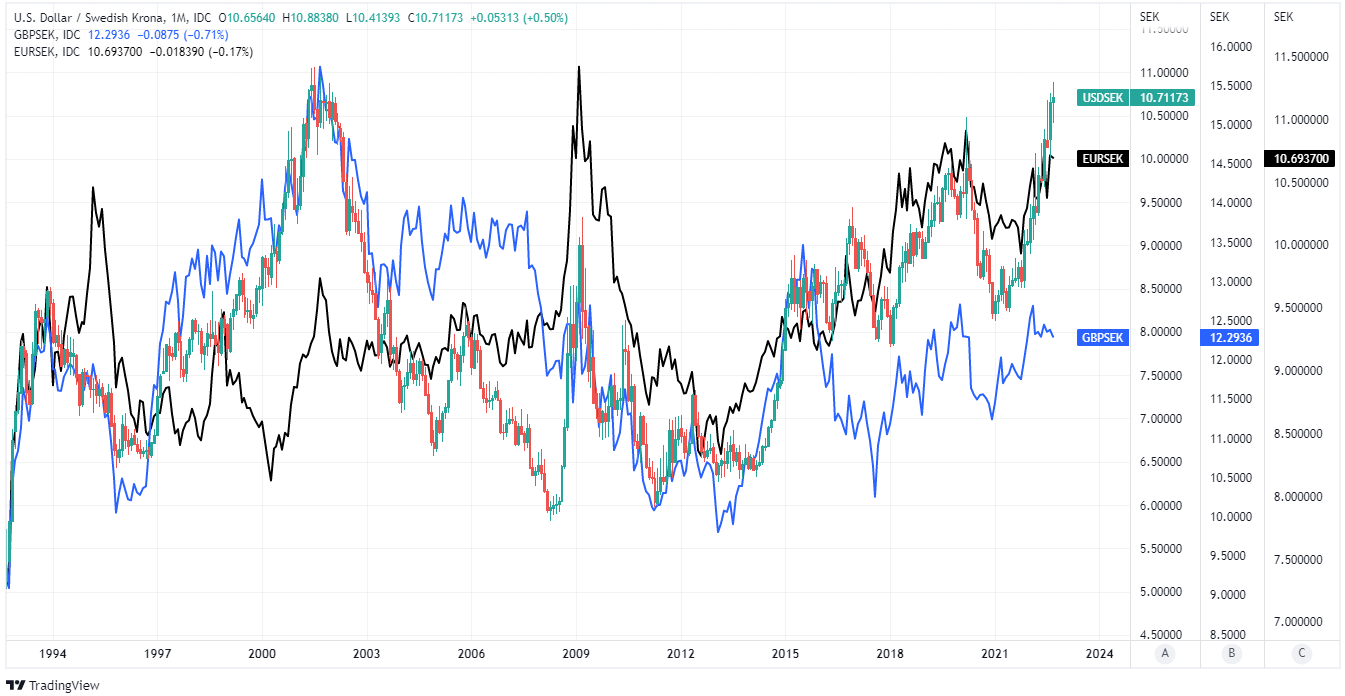

Above: USD/SEK, GBP/SEK and EUR/SEK shown at monthly intervals.