Polish Zloty Struggles On EU Frontline as Russians Reach Ukrainian Capital

- Written by: James Skinner

- PLN underperforms despite global market rebound

- Losses continue as Russia besieges Ukraine capital

- Markets rise on misplaced sanctions; CEE FX limps

- Russian conquest makes EU frontline of CEE region

Image © Adobe Images

The Polish Zloty remained under pressure against many currencies in the final session of the week as Russia’s invading force encroached upon the Ukrainian capital and global markets rose broadly in relief over the absence of meaningful economic sanctions or other actions from outside.

Poland’s currency was an outlier on Friday as it sustained further losses against the U.S. Dollar, leading to widespread declines against other currencies that were mostly trading higher against the greenback in response to a broad rebound in financial markets elsewhere.

“After all, no real sanctions and less Fed hikes, perhaps. Putin probably expected this Western weakness given an unalloyed record of vacillation and empty rhetoric for most of the past two decades,” says Michael Every, a global macro strategist at Rabobank.

Europe, the U.S., UK and others each responded to Russia’s attempted conquest of Ukraine with further economic sanctions over the course of Thursday and Friday although none of the measures announced are expected to have any impact on Moscow’s energy sector.

Above: USD/PLN trades higher as many other USD exchange rates fall. Source: Netdania Markets.

- GBP to PLN reference rates at publication:

Spot: 5.5173 - High street bank rates (indicative band): 5.3242-5.3628

- Payment specialist rates (indicative band): 5.4676-5.4897

- Find out about specialist rates, here

- Set up an exchange rate alert, here

Russia’s energy sector is the key driver of the country’s substantial current account surplus, which underpins both economy and currency; neither of which have been targeted by any of the sanctions announced thus far.

“Russia’s current account surplus is sizeable: It recorded a record surplus of USD19bn in January alone,” says Murat Toprak, a CEEMEA FX strategist at HSBC, who sees the Dollar-Rouble pair as likely to stabilise around 84.0 but has warned that further depreciation could seen by the Zloty.

With the Rouble aside, Poland’s Zloty sustained the heaviest losses out of all Central and Eastern European currencies on Thursday, which were each and all the market’s biggest fallers after Ukrainian borders were overrun by military forces coming from Russia and Belarus.

“The President's Office confirmed the report that a column of Russian tanks broke through near Ivankiv and was heading to Kyiv from Vyshgorod. "Tanks are coming. We are fighting. Fights are coming," the President's Office said,” Ukraine’s national news agency Ukrinform reported on Friday.

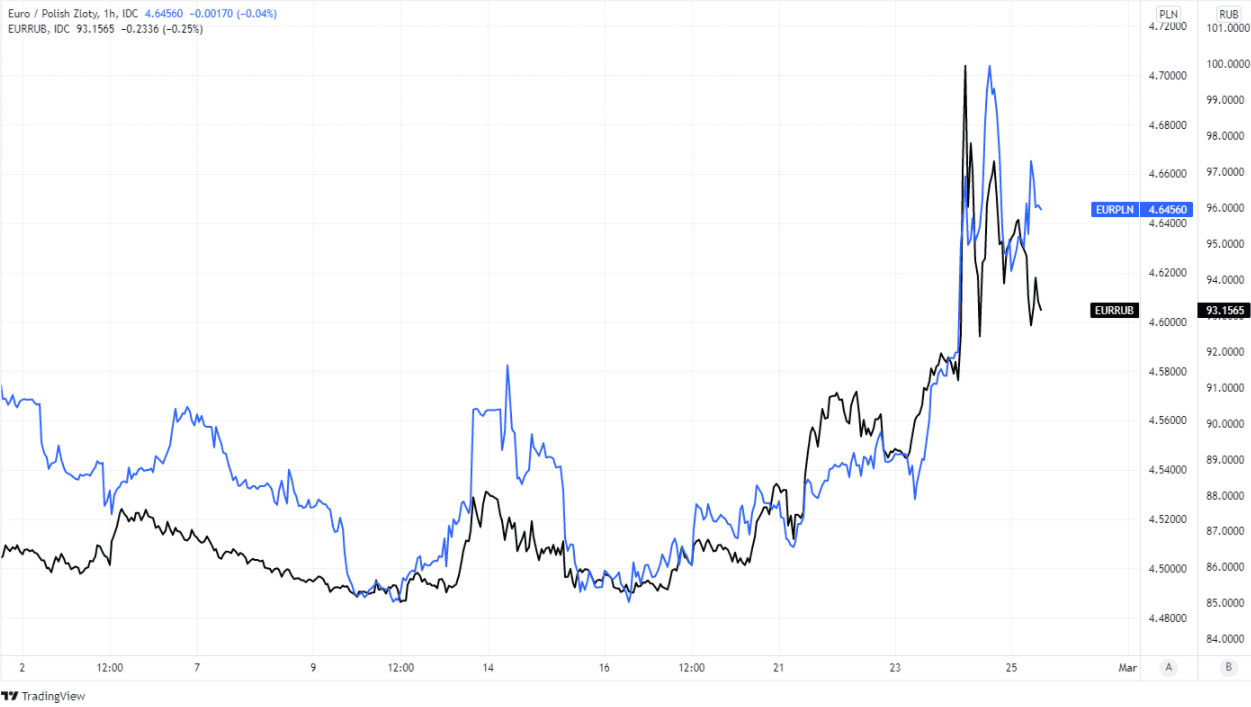

Above: Euro-Zloty rate shown at hourly intervals alongside Euro-Rouble rate.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

“At the same time, the General Staff of the Armed Forces of Ukraine told Ukrinform that the convoy of tanks had been stopped. "The bridge was blown up, we stopped them," the General Staff said,” the report continued.

Friday’s tentative underperformance in Polish exchange rates came as Russian forces bore down on Ukraine’s capital city, leading President Volodymyr Zelenskyy to call for urgent assistance from European neighbours.

"Today our defenders have done a lot. They defended almost the entire territory of Ukraine, which suffered direct blows. They regained the one that the enemy managed to occupy. For example, Hostomel near Kyiv. This gives more confidence to the capital," Zelenskyy previously said late on Thursday.

"I tell all the partners of our state: now is an important moment - the fate of our country is being decided. I ask them: are you with us? They answer that they are with us. But they are not ready to take us to the Alliance. Today, I asked the twenty-seven leaders of Europe whether Ukraine will be in NATO. I asked directly. Everyone is afraid. They do not answer," Zelenskyy also told the press conference.

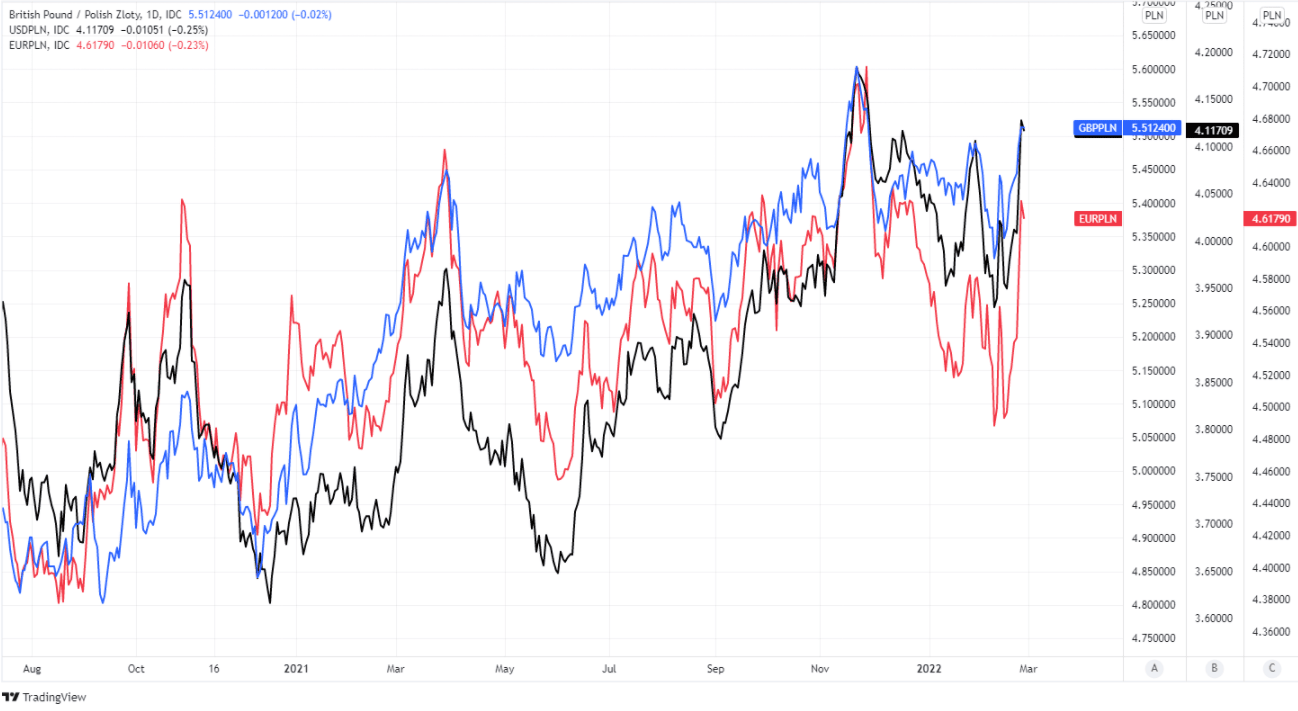

Above: GBP/PLN, USD/PLN and EUR/PLN shown at daily intervals.

Poland’s shared border with Russia, Belarus and Ukraine is one prospective reason for why many Polish exchange rates saw such heavy losses on Thursday, and there is the possibility that it makes Poland as well as its neighbouring countries the site of a new ‘iron curtain.’

Even with the humanitarian aspects of the current tragedy aside, much could depend on whether Ukraine’s armed forces are able to reverse the Russian tide; especially for currencies and economies in Central and Eastern Europe.

“All these central banks are currently in aggressive tightening cycles and will have more incentive than usual to prevent weaker currencies triggering an unwelcome easing of monetary conditions,” says Chris Turner, global head of markets and regional head of research for UK & CEE at ING.

“It would be no surprise for investors to start assuming that the local central banks could start offering EUR near levels such as 4.70 in EUR/PLN, 25.00 in EUR/CZK, 370 in EUR/HUF and 4.95 in EUR/RON,” Turner and colleagues said on Friday.

Above: EUR/PLN, EUR/CZK, EUR/RON and EUR/HUF shown at daily intervals.