Entain Plc Set for Strong Growth as BetMGM Turnaround Gains Momentum, Says Broker

- Written by: Gary Howes

-

Image: Entain Group.

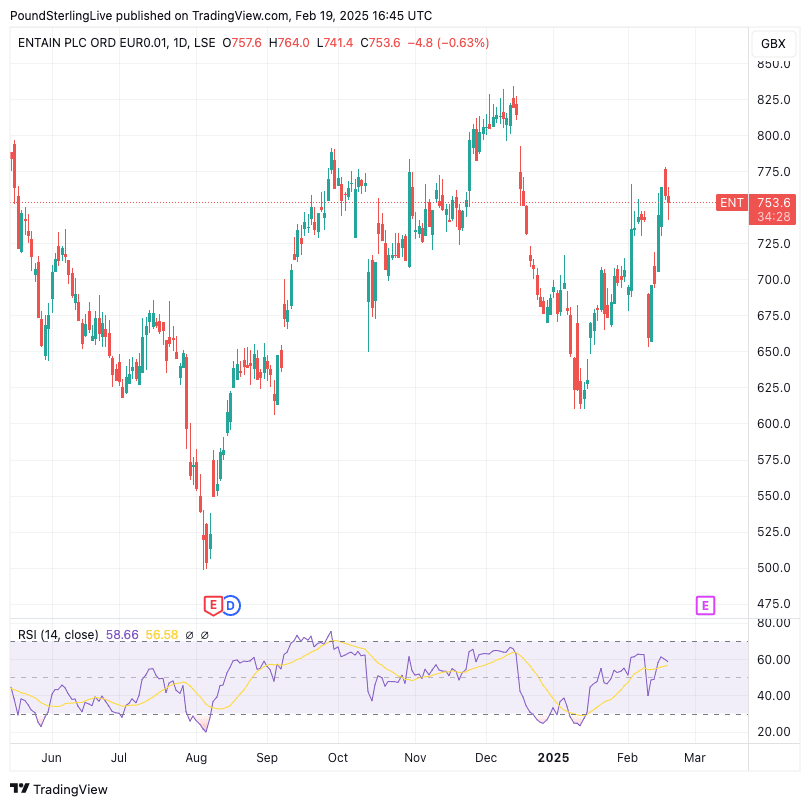

Entain plc (LON: ENT) remains a top pick in the leisure and gaming sector, with analysts at Berenberg reaffirming a 'Buy' rating and increasing their price target to 1,035p per share.

The latest financial update from the BetMGM joint venture highlights significant improvements in the U.S. business, setting a strong foundation for future growth.

BetMGM, Entain’s joint venture with MGM Resorts, reported a solid FY24 performance, registering 7% revenue growth. While the company posted an adjusted EBITDA loss of $244 million, this aligned with previous guidance despite headwinds from unfavourable sports betting results. Without this factor, BetMGM would have exceeded market expectations.

Above: Entain shares at daily intervals.

For FY25, BetMGM has provided guidance projecting positive EBITDA and net revenue in the range of $2.4 billion to $2.5 billion, reflecting a strong acceleration from the prior year’s growth.

The company remains on track to reach its long-term target of $500 million in EBITDA by FY27, reinforcing Berenberg’s confidence in Entain’s valuation.

Market Share and iGaming Performance

One of the key takeaways from the latest update is the stabilisation of BetMGM’s market share, a crucial step in restoring investor confidence. The company has successfully addressed product deficiencies, leading to steady user engagement growth and launching new brands designed to capture new market segments.

Active player numbers have risen substantially in 2024, and while average revenue per active user has decreased, this is attributed to broader user acquisition efforts and higher sports betting participation.

BetMGM’s iGaming segment, which contributes 70% of its total revenue, has remained a pillar of strength. The business delivered over $400 million in positive contributions in 2024, a trend expected to continue into FY25. Berenberg sees strong potential in BetMGM’s iGaming division, which remains a key differentiator from competitors such as FanDuel and DraftKings.

Sports Betting Gains and Growth Trajectory

BetMGM’s sports betting operations, which had seen market share erosion in previous years, have now stabilised.

Key initiatives, including improved product offerings and the integration of Angstrom for enhanced pricing capabilities, have bolstered its competitive positioning. The company anticipates that sports betting will outpace iGaming growth in FY25, further strengthening its revenue mix.

Despite adverse sports betting results affecting Q4 performance, BetMGM’s underlying trajectory remains positive, with a significant 38% year-over-year increase in bet count and handle.

Analysts at Berenberg believe these developments could drive a re-rating of Entain’s shares in the near term.

Valuation and Market Potential

Berenberg values Entain at 1,035p per share, representing a 40% upside from the current trading price of 743p. The valuation is derived through a sum-of-the-parts (SOTP) approach, assigning 620p per share to Entain’s ex-U.S. business and 415p per share to its U.S. operations, primarily driven by BetMGM.

Notably, the analysis suggests that BetMGM’s embedded value within Entain’s stock is significantly underestimated. The current market valuation implies an FY25 enterprise value-to-revenue (EV/revenue) multiple of just 0.89x for BetMGM, compared to DraftKings' 3.3x. Berenberg argues that even at a discounted multiple relative to peers, the U.S. business is worth significantly more than what is currently reflected in Entain’s share price.

While Entain’s outlook remains promising, regulatory challenges and competition in the U.S. market remain key risks. Additionally, the potential for stricter regulatory environments in core markets such as the UK and Brazil could impact future growth.