Fed Speakers Cool Rate Cut Bets: XS.com

File image of Vice Chair Jefferson. Image: Federal Reserve.

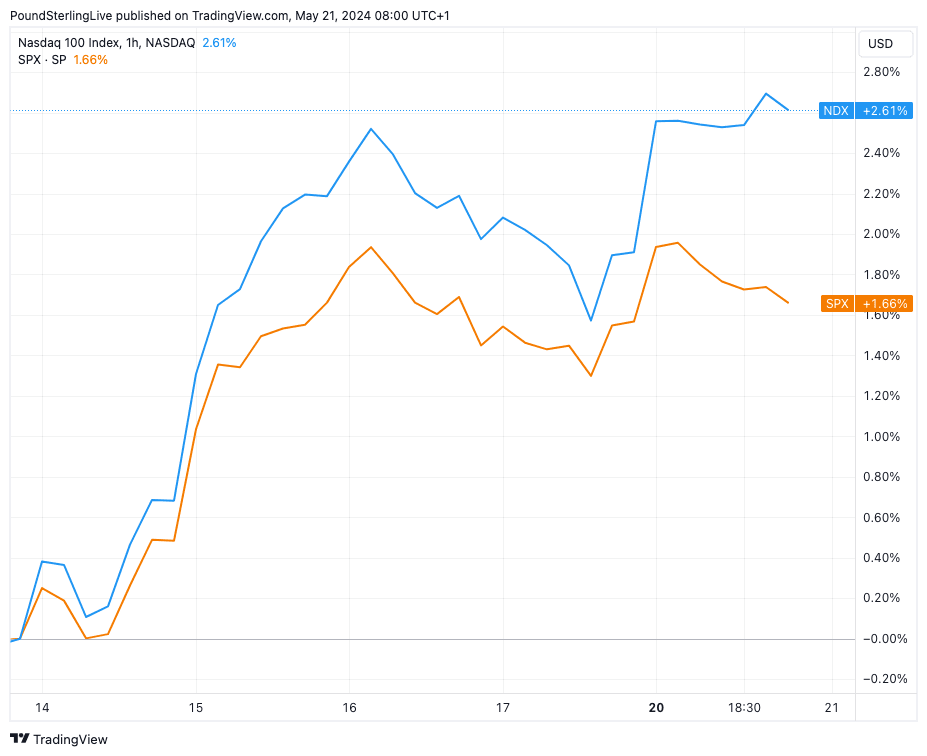

The Nasdaq surged to new records, but other markets stagnated as key members of the Federal Reserve cautioned that it was still too soon to discuss rate cuts.

The Nasdaq, a flagship stock index of the technology sector, reached a historic milestone this Monday, May 20, 2024, primarily driven by the stellar performance of Nvidia Corp. stocks.

This achievement stood out among the three major stock indexes in the United States as investors weighed the statements issued by the Federal Reserve in response to signals of possible cooling in inflation.

Above: The tech-heavy Nasdaq is outperforming the S&P 500, which has proven more responsive to caution over interest rate cuts.

Federal Reserve officials expressed concerns about inflation control and possibly reducing interest rates as a corrective measure. Philip Jefferson, vice chairman of the Fed, cautioned that it is too early to assert with certainty a lasting slowdown in inflation.

At the same time, Michael Barr emphasised that more time is needed to evaluate the effectiveness of restrictive policies.

The S&P 500 remained relatively stagnant, without significant changes, reflecting widespread caution in the market. On the other hand, the Dow Jones suffered a drop below the 40,000-point mark, closing in the 39,100.00 point range, representing a decrease of over 0.50%. These movements indicate growing concerns among investors about short-term economic stability.

Meanwhile, Raphael Bostic, president of the Federal Reserve Bank of Atlanta, pointed out that an extended period will be required before a sustainable declining trend in price growth can be trusted.

The notable performance of the Nasdaq, which recorded an increase of over 0.65%, reaching 18,675.00 points, contrasts with the widespread uncertainty prevailing in financial markets.

This optimism in the technology sector could be interpreted as a long-term bet on innovation and future growth despite immediate concerns about inflation and monetary policies.

In summary, the recent evolution of the stock markets reflects the complex interaction between economic factors and monetary policy decisions.

While the Nasdaq reached a historic high driven by the technology sector, persistent caution from the Federal Reserve and concerns about inflation have generated volatility in other indexes, such as the S&P 500 and the Dow Jones. In this context, investors must remain attentive to economic signals and policy decisions while carefully evaluating their short and long-term investment strategies.