Stocks Sold After Investors Surrender to Central Bank Messaging: City Index

- Written by: Fawad Razaqzada, Analyst at City Index

-

Image © Adobe Images

Stock markets are under pressure as investors realise they got it wrong when expecting an aggressive rate-cutting cycle to begin as early as the first quarter of 2024.

Global stock markets have fallen sharply so far today, led by Hong Kong and China yet again, with falls of 2.9% for Hang Seng and 1.9% for China A50 indices.

The Japanese Nikkei slumped, ending its good run of form of late. The FTSE 100 in the UK was hurt badly by a surprise rise in UK inflation to 4% while growing concerns over China’s economy hurt shares of miners.

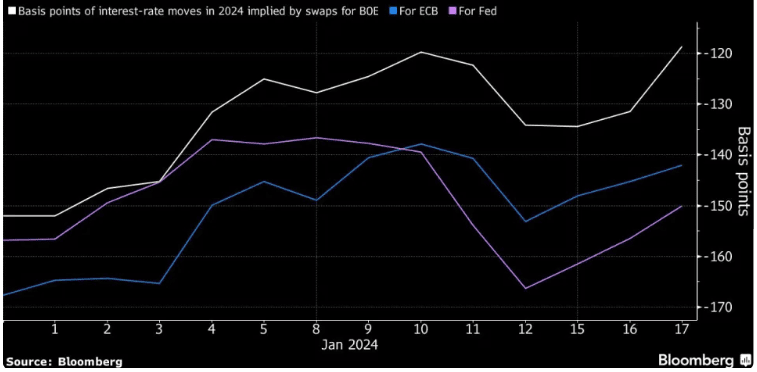

Above: Rate cut bets for the Bank of England, Federal Reserve and European Central Bank have retreated.

US futures were showing large losses after a late day recovery yesterday helped to trim their losses following Fed Governor Christopher Waller’s hawkish comments, who downplayed the need for an early rate cut.

In addition to concerns about China, which is a big market for German exports, investors are starting to wake up to the reality that the European Central Bank may not cut interest rates as soon as much as the markets have been pricing in recent months.

We have seen several ECB officials leaning against aggressive market pricing.

The ECB’s Chief Economist Philip Lane has taken the lead in pushing back against rate cut bets during the weekend.

He cautioned against premature policy recalibration, particularly emphasizing that comprehensive wage data would only be available by the end of April, aligning with the June policy meeting.

This means that for Lane at least, any rate cuts would have to be delayed until June.

Then, at the start of the week, two of the most hawkish ECB members, Robert Holzmann and Joachim Nagel, echoed their perspectives.

Holzmann pointed out early wage data indicated pay pressure could be higher than expected, boosting inflation, and warned against relying on rate cuts this year due to potential price implications from supply chain and energy disruptions in the Middle East.

The head of the Bundesbank was also cautious about rate cut discussions, arguing that the direction of wages is the "great unknown."

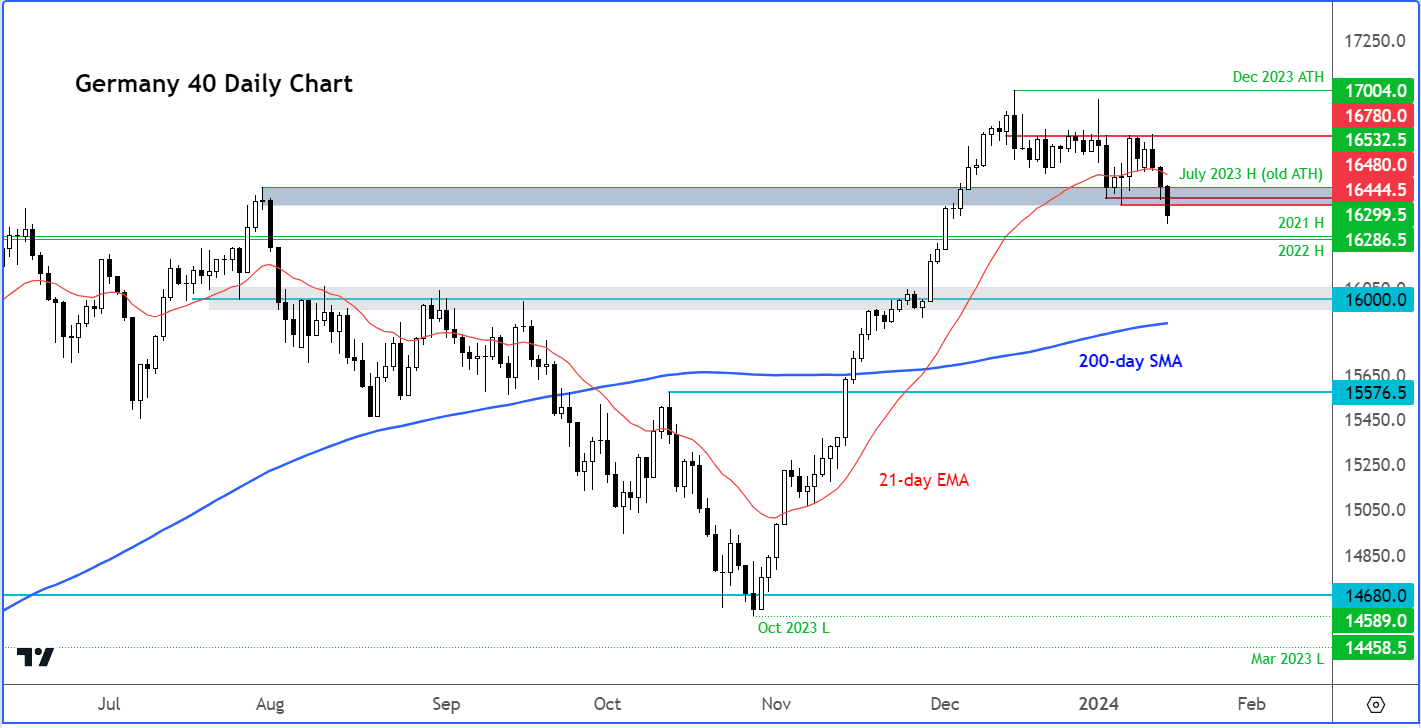

Image courtesy of City Index.

The DAX could potentially stage a deeper correction if macro worries intensify.

It has already broken back below the previous record high that was set in July of last year at 16532. In doing so, it has also moved below the 21-day exponential moving average to suggest that the short-term bullish trend is over.

Additional downside targets include the highs from 2021 and 2022 at 16300 and 16286 respectively. Below these levels, there’s nothing obvious in terms of potential support until 16,000.

On the upside, the low from the first week of 2024 at 16445 is the first line of defence now for the sellers, followed by 16480 and that July peak at 16532.

A move above all these levels is needed to tip the balance back in the bulls’ favour in the short-term.

We have also heard from Fed’s Chris Waller who caused the dollar to surge and stocks to dip yesterday. The probability of a March rate cut has fallen further, now standing at less than 60% from around 80% at the of last week.

If this is a sign that investors are finally realising that the Fed won’t be so aggressive in its rate cuts, then there is a risk we may see a deeper correction on Wall Street, given how much of a lift the markets got at the end of last year in anticipation of aggressive rate cuts.

Image courtesy of City Index.

Overnight, China’s GDP estimate came in a bit weaker than expected, while industrial production was a touch stronger. Retail sales were considerably weaker than expectations.

Headlines showing China’s population decline accelerated further in 2023 seem to have done a bit of damage to financial and property developer stocks. The data came hot on the heels of a sperate report showing new home prices slumped 0.4% last month, the fastest drop since early 2015.

It is not just economic signals from China that markets in Europe are taking notice, but also the breakdown in the stock market.

The China A50 index has been stuck in a multi-year bear trend, ever since topping out in February 2021. In recent weeks, it has broken several support levels, including the lows of March 2020 (11569), October 2022 (11161) and now that of the December’s (1098).

Could it potentially get all the way down to the January 2019 low at 10179 next?