2024 is "Prime Time for Bonds" Says PIMCO

- Written by: Gary Howes

-

Image © Adobe Images

2024 is "prime time for bonds", says PIMCO, one of the world's largest fixed-income investors.

"The global economic outlook along with market valuations and asset class fundamentals all lead us to favour fixed income," says PMICO's Erin Browne in a recent investment briefing.

The call comes following a period of chronic underperformance by global bonds as investors fret about the prospect of a protracted spell of elevated inflation, typically considered an anathema to bondholders.

The decline in bonds has boosted the yield they offer, raising the cost of finance across the globe and leading to fears a number of major countries will fall into recession in the coming months.

PIMCO's economists look for a slowdown in developed markets growth in 2024 and, in some regions, the potential for contraction next year as fiscal support ends and monetary policy takes effect.

But, "after a turbulent couple of years of high inflation and rising rates that challenged portfolios, investors may see a return to more conventional behaviour in both stock and bond markets in 2024," says Browne.

PIMCO's economists see a 50% chance of a U.S. recession in 2024 as the point of peak growth passes, but slowing growth also means slowing inflation, and this is good for bonds.

"As price levels get closer to central bank targets in 2024, bonds and equities should resume their more typical inverse relationship (i.e., negative correlation) – meaning bonds tend to do well when equities struggle, and vice versa," says Browne.

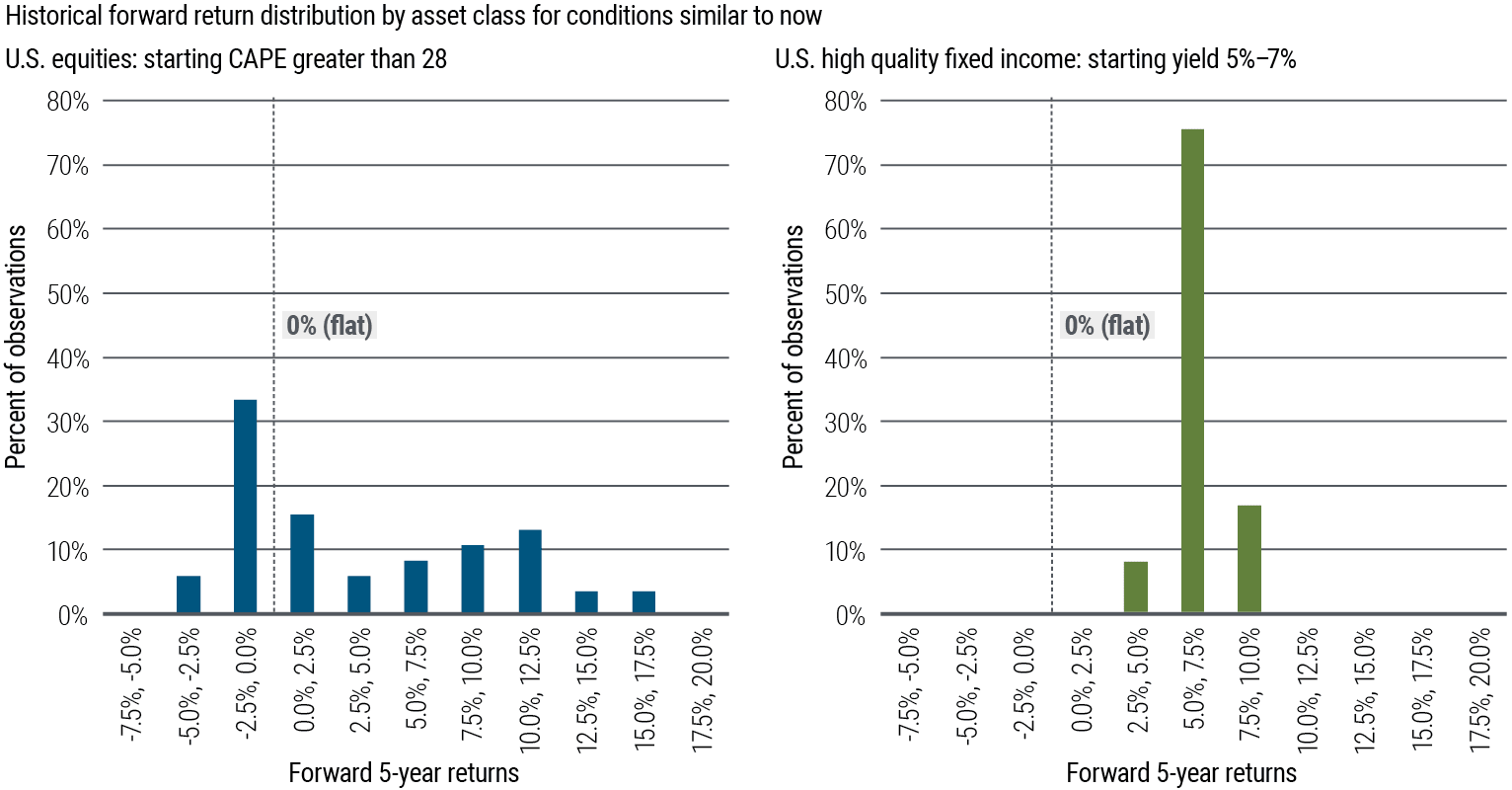

PIMCO's research shows the starting levels of bond yields or equity multiples have historically tended to signal future returns.

Above: "Looking ahead from here, starting levels favor fixed income over equities" - PIMCO. Image source: Bloomberg, Barclays Live data (January 1976 – September 2023), PIMCO calculations. "Conditions similar to now" are defined as a cyclically adjusted price/earnings (CAPE) ratio of greater than or equal to 28 for the S&P 500 Index, and yield-to-worst in a range of 5%–7% for the Bloomberg U.S. Aggregate Index.

On this basis, the above shows that current yield levels in high-quality bonds, on average, have been followed by long-term outperformance.

Typically, this outperformance is estimated at "an attractive" 5%–7.5% over the subsequent five years.

"Today’s level of the cyclically adjusted price/earnings (CAPE) ratio has tended to be associated with long-term equity underperformance. Additionally, bonds have historically provided these return levels more consistently than equities," says Browne, referencing the tighter (more 'normal') distribution of the return outcomes.

"It’s a compelling statement for fixed income," she says.