My WTI Oil Price Forecast is Positive says City Index's Razaqzada

- Written by: Sam Coventry

-

Image © Adobe Stock

City Index's Market Analyst, Fawad Razaqzada, has expressed a positive outlook on WTI oil prices despite concerns about demand.

"Despite elevated demand concerns, my crude oil outlook is still positive, and therefore think prices are headed higher – because of those OPEC cuts," Razaqzada said.

WTI has bounced back from losses on the back of US commercial stocks data to reach a new weekly high above $72 per barrel, up around 2.5% on the session.

The International Energy Agency (IEA) expects demand to exceed supply by more than two million barrels per day in the second half of 2023, largely because of OPEC+ removing significant supply from the market.

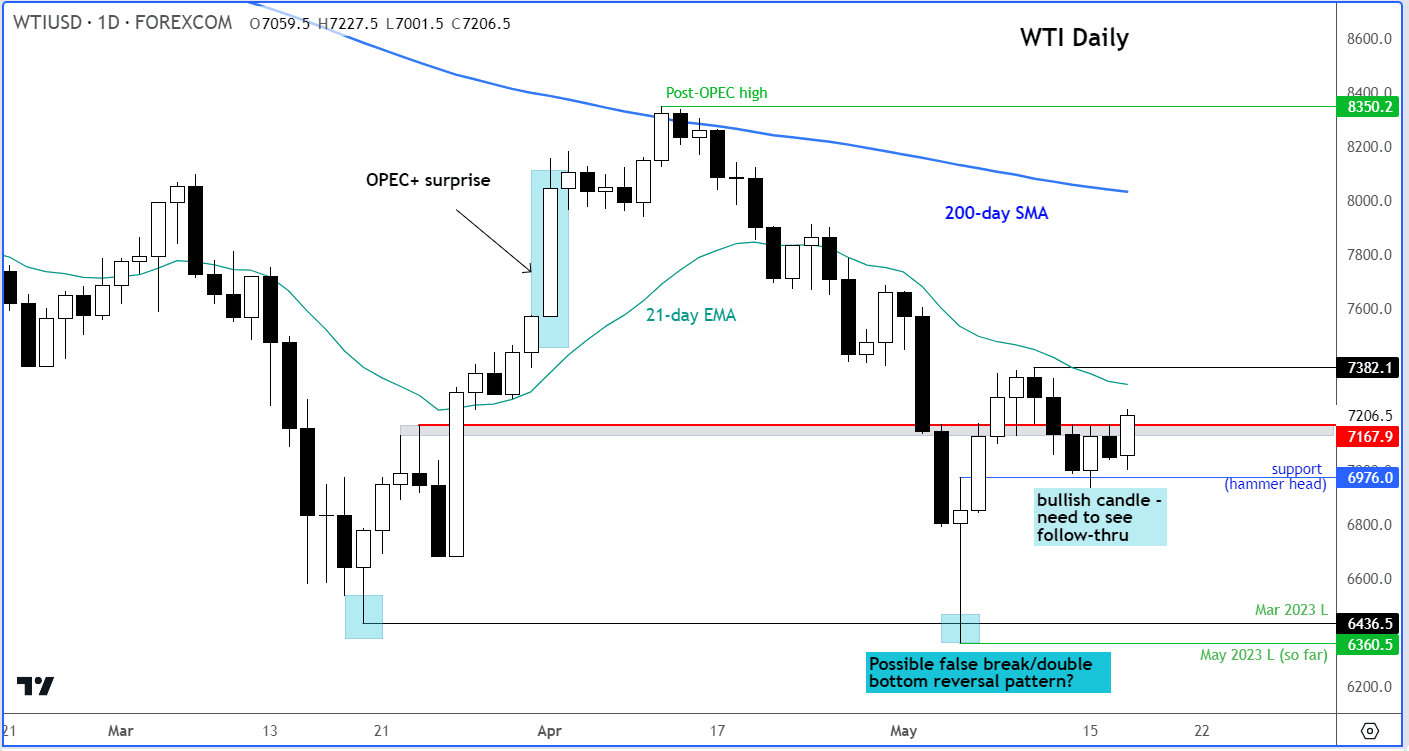

Razaqzada sees some bullish signals in the recent price action of crude oil, stating, "the attempted breakdown below the March 2023 low of $64.36 earlier this month was short-lived as WTI stormed back to close higher and create a hammer candle on the daily chart. I was waiting for a retest of this level from above, which we got on Monday."

However, Razaqzada notes that a move back below Monday’s bullish-looking candle would invalidate this week's overall bullish price structure.

"If we go below Monday’s range at some point this week, then that should trigger technical selling as disappointed bulls exit their trades. In that case, a move back down to this year’s lows would become likely again," he added.

Oil demand is meanwhile also seen as being supportive of prices with investors increasingly hopeful that there will be a resolution in U.S. debt talks, which is also contributing to the recent recovery in oil prices.

U.S. President Joe Biden recently spoke on the debt ceiling situation, saying he is confident in an agreement and that he will hold a press conference on Sunday. In response, there was an uptick in risk-sensitive assets, including crude oil.

Razaqzada remains positive on oil prices, pointing to the OPEC+ cuts as a reason for his optimism.

"Given that oil has been unable to find meaningful support on the back of the OPEC’s surprise decision to cut production, the onus is on the bulls to show up now...and judging by today’s price action, they are doing just that," he said.

"If that’s the case, I think WTI is more likely to rise to $80/$85 than fall to $60/65 from here," he adds.