Banking Stocks Rebound, Meta Shares Rally on Fresh Round of Job Cuts

- Banking sector stocks lead rebound

- U.S. inflation data puts Fed in a bind

- Meta slashes jobs

Image © Adobe Images

U.S. banking stocks are on a rollercoaster ride, rising sharply following the steep sell-offs yesterday as worries seem to be lifting a little about contagion from the SVB collapse.

Hope is rebounding that the backstop of deposits of failed banks will stem further withdrawals and that more generous loan terms to struggling banks could help restore confidence.

First Republic Bank shares have surged 44% but still haven’t made up the punishing losses of recent days, indicating that uncertainty remains about its robustness.

The FTSE 100 has been swept upwards in afternoon trade, helped by the tailwinds from Wall Street.

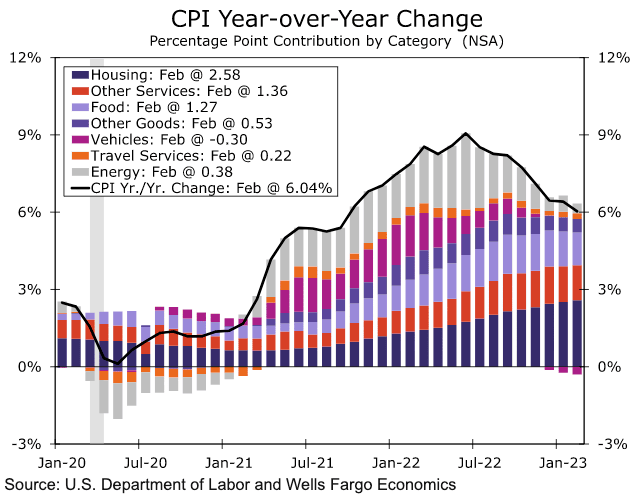

U.S. Inflation Data Puts Fed in a Bind

There was also relief that US CPI data showed consumer prices rises cooling a little, adding to expectations that the Fed will press pause or at the very least go slow on rate hikes next week.

However, with core prices rising 0.5%, slightly more than expected, it shows that inflation is still sticky and that the Fed is in a jam.

Inflation is hot, but as worries continue to bubble about potential contagion from the SVB fallout the responsibility for maintaining financial stability is being pushed higher up the agenda.

While sentiment is improving a little, there are concerns that bigger banks could become more risk-averse in lending, which could dip the economy into a sharper downturn.

This core inflation number is far from helpful for the Fed right now, as it decides where to head on a monetary policy journey which appears to have sparked the events leading to this state of high nervousness.

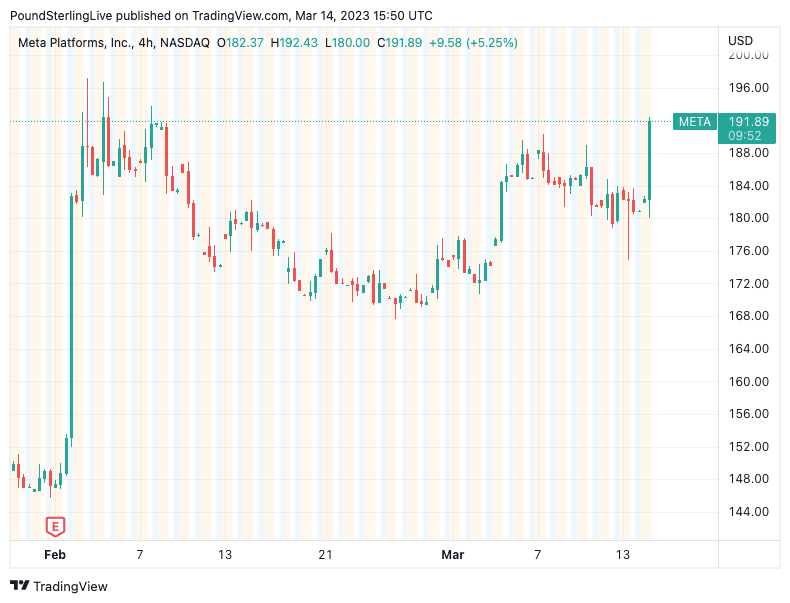

Meta Shares Jump on Job Cuts News

Meta is slimming down to try and cut costs as it deals with the fallout from lower advertising revenues while it continues to spend big on its AI ambitions.

It's axing another 10,000 jobs on top of the 11,000 announced in the Autumn.

It means the social network has axed almost a quarter of its workforce in just a few months.

Above: Meta shares jump on workforce layoff news.

It shows how desperate the company is to get costs under control as its revenues have fallen amid declining marketing budgets. Competition is super-fierce, and Meta is having to shape up fast to try and take on the tunes of TikTok while also ring-fencing investment for longer-term projects that it hopes will provide a fresh jet of revenue in the future.

Virtual reality is an expensive business to be in, so while it maps out a path through an uncertain landscape, it needs to find efficiencies elsewhere.

Investors have welcomed the news with the share price rising 5% in early trade.

Market Report by Susannah Streeter, Head of Money and Markets at Hargreaves Lansdown.

Market Report by Susannah Streeter, Head of Money and Markets at Hargreaves Lansdown.