Rupee Forecast Revised Lower By TD Securities

- INR is one of the weakest major currencies at the moment and TD have revised down their forecast

- A cocktail of influences mainly to do with the price of oil and trade imbalances weigh

- India is named as a currency manipulator by the US Treasury but given current downtrend it shouldn't matter

© DragonImages, Adobe Stock

The outlook for the Rupee worsens and investment bank TD Securities have revised down their official forecasts.

A general deterioration in the balance of payments with a rise in the price of oil combined with a fall in investor inflows are the main factors contributing to a fall in the Rupee.

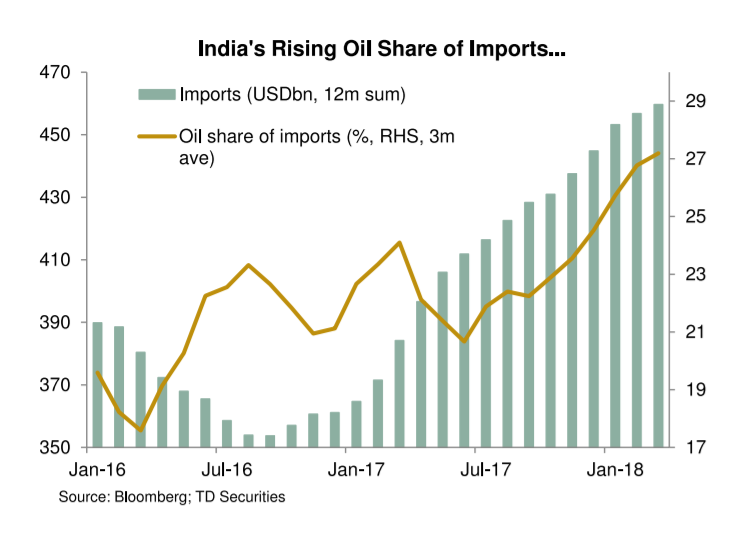

Oil, which accounts for over a quarter of Indian imports, is increasingly a factor in the exchange rate, and the recent rise in the price of crude has created a direct headwind for INR.

Yet it is not just the rising price of oil but also the rising demand for oil which has impacted on the balance of trade. India has an increased refinery capacity-hungry for more crude, thus from contributing 18% of imports two years ago, oil now accounts for 27%.

The future output for black gold is also bullish, notes Mitul Kotecha, Senior Emerging Markets Strategist at TD Securities.

"Oil prices show little sign of easing anytime soon. Middle East tensions - especially related to Saudi Arabia and Iran - have fuelled concerns about potential supply disruptions," says Kotecha, adding, "OPEC and Russia have announced that they would keep a very tight reign on output for the rest of the year."

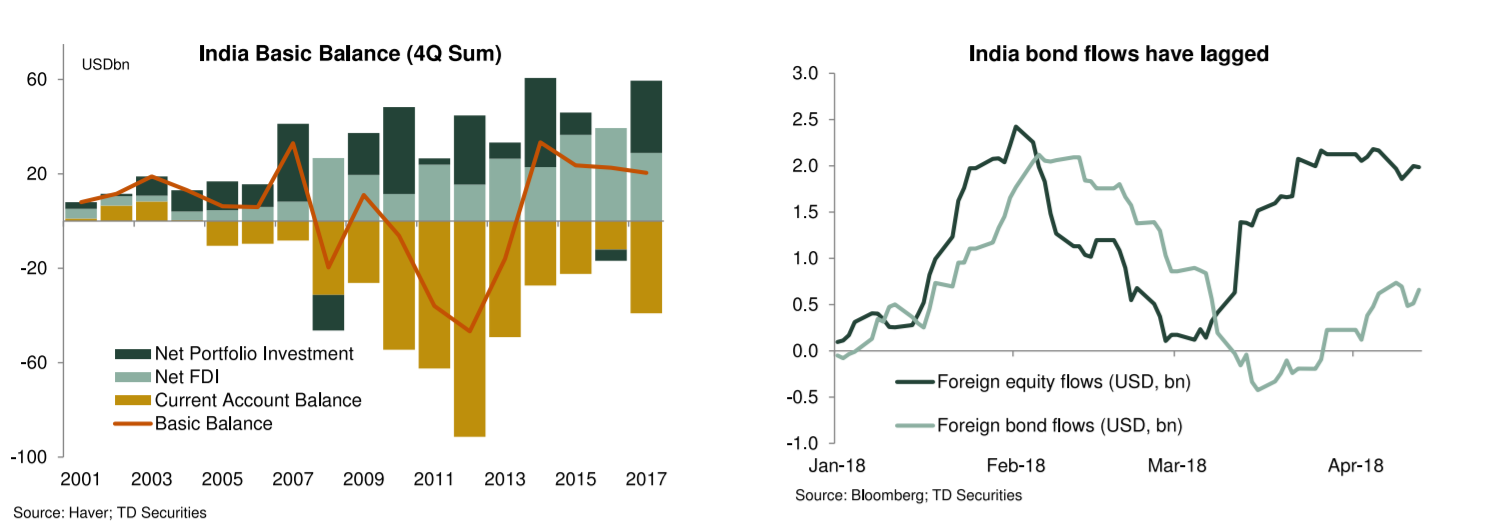

Up until now, India has had little trouble in funding its overspend, with domestic and foreign investors alike keen to lend either view the purchase of corporate bonds, shares in the stock market (portfolio flows), or directly as cash (foreign direct investment), yet the situation is changing.

"India has had little difficulty in financing its current deficit in recent years, with FDI and portfolio inflows, remaining robust. However, India’s broad basic balance position (sum of current account + direct investment + portfolio flows) is now worsening and Q1 2018 trade data points to a further deterioration in the current account over the past quarter," says Kotecha.

Portfolio inflows have stalled dramatically in the past year.

"India registered around USD 1.5bn in net foreign equity inflows and USD 1.2mn in bond outflows year to date. By comparison, India registered USD 6.5bn in equity inflows and USD 7.4bn in bond inflows over the same period in 2017," says the strategist.

Overall a "worrying combination" of factors is depressing the outlook for INR.

"We expect the pressure on the INR to persist over the coming weeks," says Kocheta.

As far as intervention goes, India's authorities are unlikely to intervene to prop up the Rupee as this would worsen the trade deficit - rather they are more likely to accept the Rupee's depreciation as an unexpected boon.

If the weakness starts to get too volatile then the Reserve Bank of India (RBI) has enough FX to bid the Rupee back up, although given its desire for a weaker currency it is more likely to simply smooth steep declines rather than fight the trend.

Overall the bearish revision means TD now forecast USD/INR rising to a higher 66.7 at the end of Q2 (vs 65.5 prev), moderating to 65.9 at the end of Q3 (vs 64.3 prev) and then falling to 65.4 at end of Q4 2018 (vs 63.6) previously.

Given the current spot price is 66.4 the forecast does not seem to bode that badly for the Rupee and falls in line with TD's medium-term bullish forecast.

The short-term bearish outlook for the Indian currency is shared by Morgan Stanley, which is also bearish the Rupee in a recent note, which highlighted the currency's recent sharp decline versus the Dollar as concerning.

"INR sold off 0.6% against USD despite DXY weakness this week...The trade balance continued to deteriorate, led by a fall in export growth," says Ellie Heatherill, CEEMEA analyst at Morgan Stanley.

India's inclusion on the US Treasury's FX Monitoring List is likely to have little impact on trade gave the Rupee's current weakness as the RBI is more likely to intervene to strengthen the currency than weaken it and this would not be a concern for the US Treasury.

In addition, "India remains a current account deficit economy and INR does not appear undervalued," says Heatherill.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.