Pound-to-Indian Rupee Rate Falls Half a Rupee After Reserve Bank Keeps Rates at 6.0%

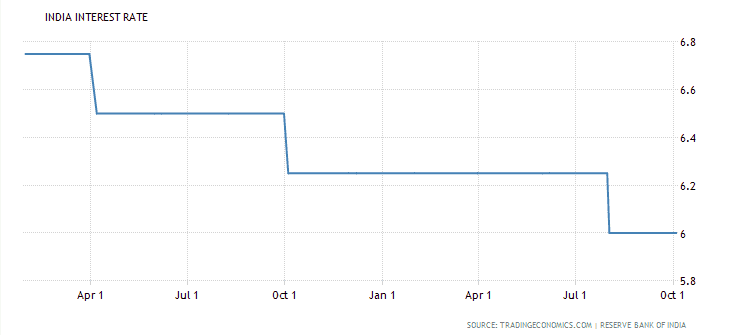

The Rupee strengthened on Wednesday after the Reserve Bank of India (RBI) took some traders by surprise by not cutting base interest rates from their current 6.0% level.

The currency fell from 88.75 to the Pound to a post-meeting level of 88.25 – a fall of half a Rupee.

Currencies move in tandem with interest rates so the decision by the RBI not to cut its base rate supported the Rupee.

The decision to ‘stand pat’ was surprising given the RBI’s recent trend of cutting interest rates and the 25bps cut in August.

Policymakers said the decision was consistent with a, “neutral stance of monetary policy aiming to reach the medium-term target for inflation of 4 percent +/- 2 percent, while supporting growth,” said an RBI press release.

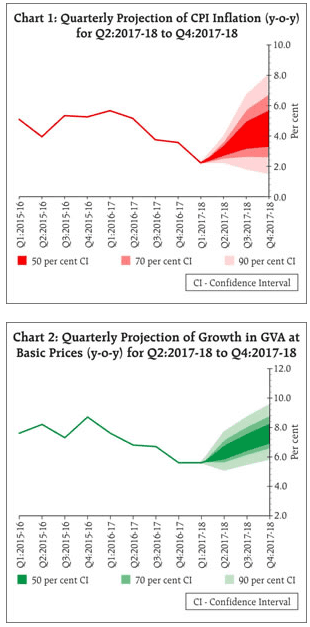

The central bank also increased its inflation forecasts for October-March to a range of 4.2% to 4.6%, from a previous 3.0%:

“The extent of the rise in inflation excluding food and fuel has been somewhat higher than expected,” said the RBI.

However, the Reserve bank said it did not think that the higher trend in inflation would last.

A poor food harvest was one of the main reasons for the rise in food inflation, however, this was not expected to extend into the future.

“The assessment of food prices going forward is largely favourable, though the first advance estimates of kharif production pose some uncertainty,” said the Bank.

Inflation linked to the implementation of the Good and Services Tax (GST) has already started to be absorbed, the Bank said.

International crude prices, which had started rising from early July, have firmed up further in September, they said, further adding to the inflation burden.

“Taking into account these factors, inflation is expected to rise from its current level and range between 4.2-4.6 per cent in the second half of this year, including the house rent allowance by the Centre,” concluded the Bank.

The outlook for growth was not spectacularly positive however:

“Turning to growth projections, the loss of momentum in Q1 of 2017-18 and the first advance estimates of kharif foodgrains production are early setbacks that impart a downside to the outlook,” said the RBI.

However, their assessment of global growth was unanimously positive, which should boost the outlook for Indian trade.

Charts Show Rupee at Critical Juncture

Although the Rupee has recovered against the Pound after reaching a yearly low of 88.47 on September 22 and now trades back at 86.88, it is still technically in an downtrend, albeit a tentative one (GBP/INR is in an uptrend when the Rupee is the weaker currency in the pair) .

As such we still have to consider the possibility of a break back above the September highs to a target at 89.00, although the bearish turn also looks compelling and suggests a strong possibility the September highs could have been a major market turning point for the pair.

Looking at the four hour chart, we note that the pair appears to have just completed a three wave corrective a-b-c pattern lower.

A further break below the c-wave lows would probably indicate a continuation to the downside and would make a strong case for a reversal of the trend and the start of a more bearish phase; such a move would indicate a probable sell-off down to the next target at 86.39.

The MACD is crossing its signal line on the daily chart also indicating further weakness is likely; on the four hour it is already below the zero-line suggesting the very short-term trend is already bearish.