Pound-Indian Rupee Exchange Rate at Key Level, Surge in Inflation could Cement Support for INR

Above: Above average winter rainfall in India suggests food prices will not remain elevated. File image © Adobe Images

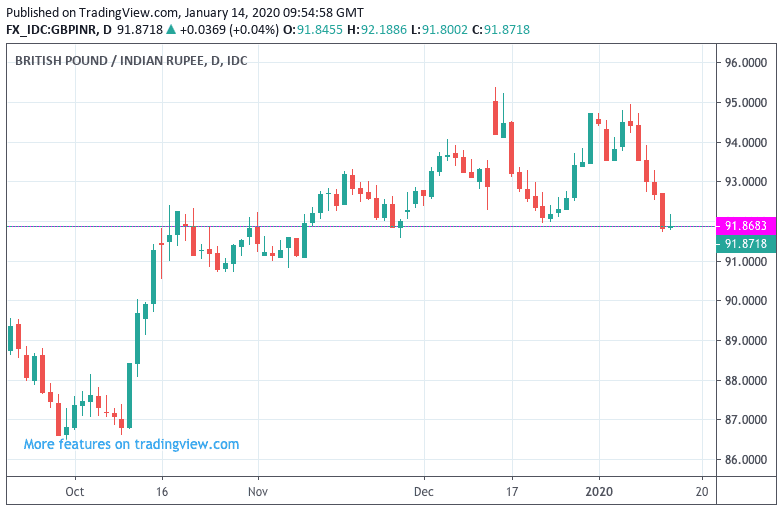

- GBP/INR has been falling over past week

- However, charts hint support could soon arrive

- Surging Indian inflation could boost INR further

The Pound has fallen down to a key level against the Indian Rupee on a day it is reported inflation in India has reached a 5-year high, and whether or not GBP/INR falls below this key point could well set the tone for future moves in the exchange rate.

The Pound-to-Rupee exchange rate is currently quoted at 91.87, and a look at the charts shows that this level coincides with a technical support line, that has characterised trading since mid-October.

The line located in the vicinity of 91.85-91.88 has over recent months been the point at where the rallies either hit resistance and fail, or where declines find support and reverse higher.

This suggests market participants are prone to laying orders to buy and sell the currency around this level, and if fundamental conditions prove supportive, this activity can ultimately determine where the exchange rate moves.

Because 91.85-91.88 is acting as support, we would first look for the Pound to find some buying interest and the recent trend of declines might come to an end.

However, the Pound has been under pressure against the Rupee for the past week, and momentum in GBP/INR therefore remains soft, at least in the short-term.

However, downside in GBP/INR looks relatively well protected all the way to the 91 level: back in October 2019 we saw the exchange rate consolidate in the 91-91.80 level and there is a decent chance that this might be in store again.

Time to move your money? The Global Reach Best Exchange Rate Guarantee offers you competitive rates and maximises your currency transfer. They offer great rates, tailored transfers, and market insight to help you choose the best times for you to trade. Speaking to a currency specialist helps you to capitalise on positive market shifts and make the most of your money. Find out more here. * Advertisement

Surging Inflation Should Provde INR with Temporary Support

The technical findings in the GBP/INR exchange rate coincide with the release of India's latest inflation statistics that could well have an impact on future direction in the Rupee.

Inflation in India rose to 7.4% year-on-year in December, a five year high, according to official statistics. This means inflation is well above the Reserve Bank of India's (RBI) target for inflation to be at 2-6%.

Central banks tend to raise interest rates when inflation starts accelerating: this has the impact of cooling the flow of money in the economy, which in turn brings inflation back down. However, a side effect of higher interest rates is a stronger currency, as higher interest rates attract foreign inflows of capital as global investors seek out higher returns.

Therefore, that India's inflation is heading higher should be a supportive development for the INR, particularly as it should convince the RBI that their policy of cutting interest rates should be paused.

However, Charlie Lay, FX & EM Analyst at Commerzbank, says the RBI might not be too concerned by the recent uptick in inflation.

"The situation is not as gloomy as it appears as the surge was driven mainly by higher food prices. They account for a large weight in the CPI basket at 46% and rose 12% yoy. Within this category, it was mainly vegetable prices which have an 8% weight and climbed over 60% with onion prices the main culprit. The good news is that the winter rainfall has been above average and points to a good winter harvest from April. In other words, the jump in inflation is expected to be transitory. It has probably peaked and food prices should moderately swiftly from April," says Lay.

Lay says inflation in India is "not cost driven and this is also reflected in core inflation (excluding food and fuel) which held around 3.7% and below the 4% mark for the past four months."

According to Lay, the implications are:

1) RBI is expected to leave rates unchanged again in the 6-February meeting at 5.15%;

2) the government would have to adopt a more pro-growth and expansionary budget in February given the slowdown; and

3) for USD-INR, RBI would prefer stability rather than a strong INR. As such, we could see consolidation near term between the 70-72 range.

A consolidation in USD/INR could well feed into similar price action being experienced by GBP/INR, and this coincides with our view that the recent decline in GBP/INR could soon give way to a period of sideways action.