Pound-Indian Rupee Rate: Falling into the 'Buyzone'

- GBP/INR correcting back after rising in January

- Dominant uptrend expected to resume again shortly

- Price of oil could be key driver for Rupee

The Pound-to-Indian Rupee exchange rate is trading at 91.50 at the time of writing, after declining marginally on Monday due to Rupee strength as the Indian currency gained support after data appeared to show China’s slowdown had stabilised.

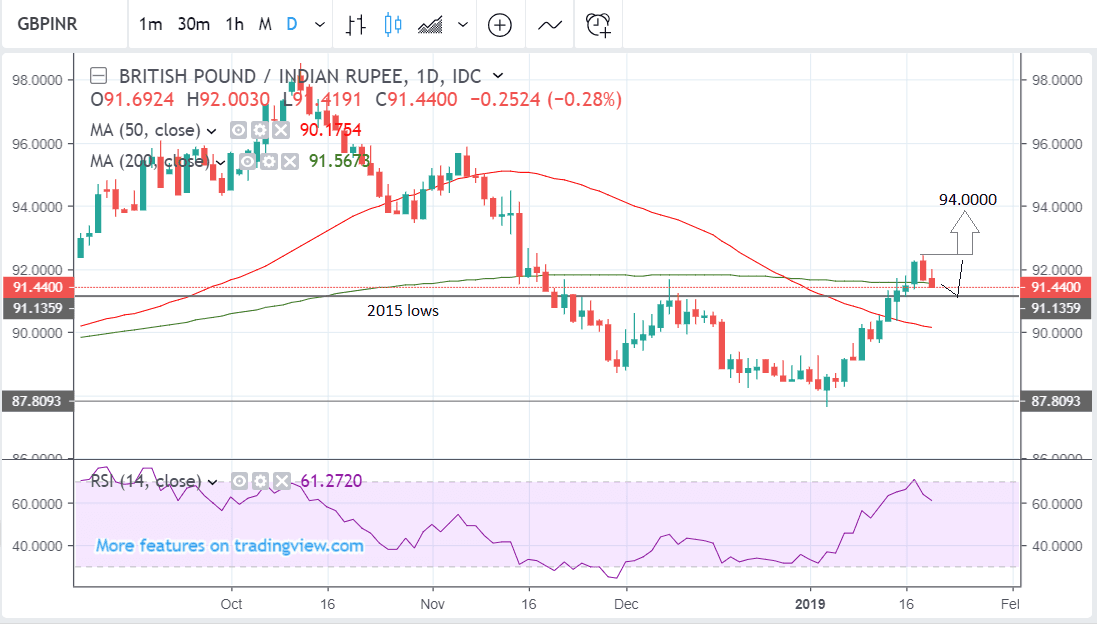

Charts continue to show the GBP/INR pair remains in an established short-term uptrend, which, given the old adage that the trend is your friend, is more likely to continue higher than reverse.

The pair has already broken clearly above several major levels, including the 2015 lows and the 200-day moving average (MA) - all signs of strong bullish conviction. We don’t, therefore, expect the current pull-back to last long before reversing higher.

Indeed, the previous resistance levels in the lower 91s are now likely to act as a supportive base for the exchange rate as it pulls back, and it could use them as a ‘floor’ from which to mount a recovery higher.

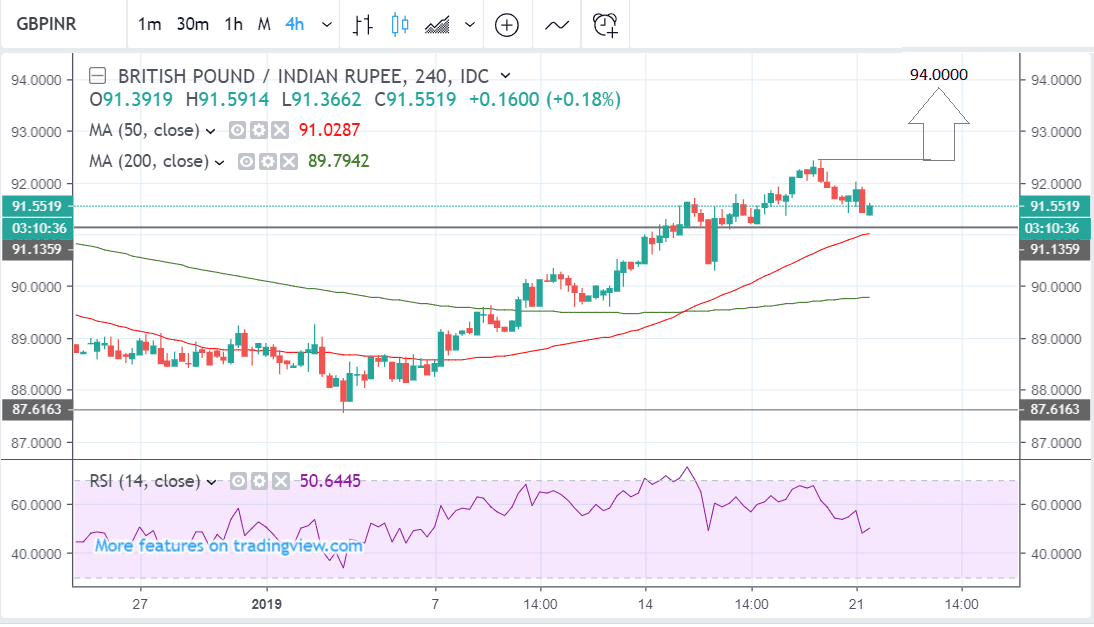

The decline from the highs established on January 20 is shown in more detail on the 4-hour chart above which also shows how bearish the RSI momentum has been during the subsequent sell-off. The RSI is at the same level it was at on January 4 when the exchange rate was in the 88s. This could be a sign the pair has deeper to fall.

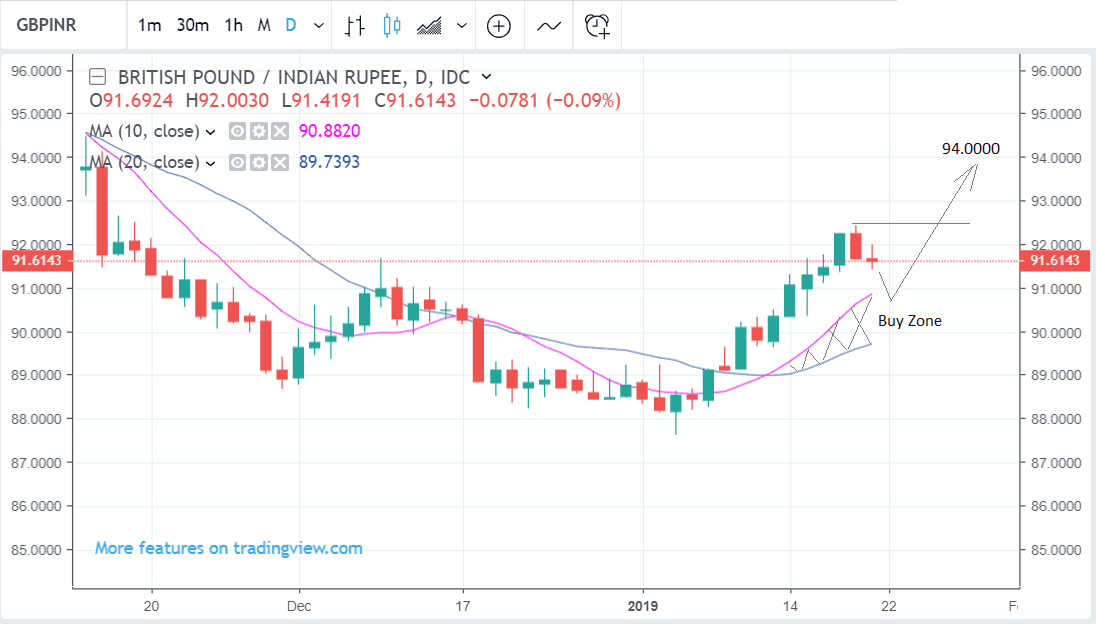

The pair could fall even lower. One possibility is that it could pull-back to the space between the 10 and 20-day MAs in the mid-90s, called the ‘buyzone’ because it is the optimum place to buy an uptrending asset.

The correction into the 'buyzone' on GBP/INR may lead to the perfect buying opportunity for the pair and a resumption of the uptrend from there. The formation of a bullish candlestick in the zone would provide the signal for the resumption.

It is interesting to note the close similarity between the 4hr chart of GBP/INR and that of WTI Oil, yet ultimately not surprising.

One of the most important fundamental drivers of the Rupee has been the price of oil because India has to import most of its fuel. Since it has to sell Rupees to buy the oil there is an impact linked to price, and the higher the price the more it tends to weigh on INR.

This is probably why the charts correlate - the rise in the Pound versus the Rupee has been driven by a parallel rise in the cost of Oil.

Whether Oil remains expensive or not may be a primary influencer of the Rupee going forward. Some think the longer-term trend for oil has changed and it will continue to trade at lower levels. If so it would be a helping hand for the Rupee. Traders should consider watching oil charts for a steer on the Rupee’s direction.

Another key fundamental driver is the outlook for China and trade talks. Key Q4 Chinese GDP data showed the Chinese economy losing momentum in line with estimates, although growth remained at 6.6% in 2018, which relatively speaking is still quite high. Some put this down to the massive stimulus measures, including an $83bn monetary injection by the Pboc at the start of the new year.

The bottom line is that because of Chinese wide influence over the whole of the Asian region, any economic news from China or regarding trade talks with Washington could also impact on INR.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here. * Advertisement