Traders Raise Bets Against Pound Sterling to Hit Highest Level Since May 2017 but Extended Positioning Could Limit Scope for Further Losses

Image © Andrey Popov, Adobe Stock

- Bets against the British Pound at highest level in over a year

- However, potential for relief as positioning could now be stretched

- "Far too early to signal the all clear" - ING

Foreign exchange markets continue to increase bets against Pound Sterling in anticipation of further downside moves.

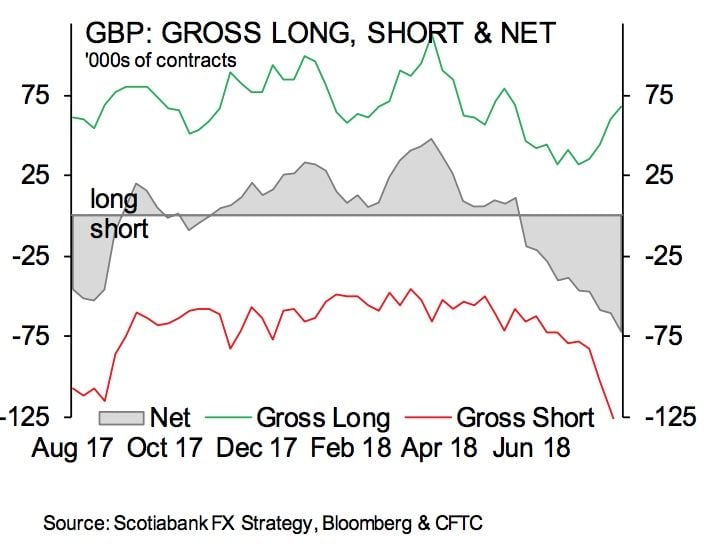

The most recent set of data from the Commodities Futures Trading Commission (CFTC) shows the foreign exchange community are engaged in significant bet against the Pound - in fact the market is now sitting on its largest bet against the Pound since May 2017.

According to the CFTC's Commitments of Traders (COT) report, the number of 'shorts' on the Pound have risen from 12K to 72K in the matter of a week. A 'short' is a bet that a financial product - in this case the Pound - will fall in the future.

The net short on the Pound is valued at $5.8bn. According to analysis from Goldman Sachs, the bets taken against Sterling has primarily been driven by hedge funds.

The ongoing shift in positioning is suggestive of a growing negativity towards the UK currency and is evidence of the market growing increasingly wary that the UK and EU will not reach a Brexit deal before a November deadline.

The angst is reflected in an ongoing weakness in Sterling: the Pound-to-Euro exchange rate has fallen by 2.0% in 2018 and now sits close to 11-month lows, while the Pound-to-Dollar exchange rate has fallen 4.5% in the same period.

Latest #FX positioning monitor: Start of the long USD positioning unwind

— Viraj Patel (@VPatelFX) August 28, 2018

- $JPY $NZD $EUR registering short-term bullish signals

- $GBP extremely bearish (markets positioned for #Brexit)

- Leveraged funds shortest on $EUR since Apr 2017. Out of sync with the fundamental narrative pic.twitter.com/TJtqgpWhGl

There is a good correlation between how the trading community are betting and the direction a currency will take in the future. While the trading covered by the CFTC report makes up a small part of the $5 trn-a-day foreign exchange market, it provides the most in-depth insight available on market sentiment towards a given currency.

The data therefore could be indicative of further losses in Sterling over coming days and weeks.

Oversold

However, it can also be noted that when positioning gets to extremes the trend can stall as the market is so committed to a given trade that it becomes difficult to find further entrants into the market required to keep the move alive.

Indeed, often when positioning is extreme the move can stall, and often reverse on the slightest of good news as traders book profit and / or are forced out of the trade as stop-loss orders are triggered.

If we look at the following graphic we can see some evidence that perhaps the market in Sterling is at extremes:

Positioning on the US Dollar remains positive, but there are concerns that it is now extended.

"Extreme long USD positioning means that we think the broad dollar index has most likely put in a short-term cyclical top now," says analyst Viraj Patel with ING Bank N.V.

Should the Dollar's rally fade due to extended positioning, the opposite might just be true of the Pound which is suffering extended downside positioning.

Patel is however not optimistic that any notable recovery might materialise anytime soon.

"When it comes to GBP and political risks, it is far too early to signal the all clear; the biggest test for the pound will be the return of a divided UK parliament from their summer recess and the upcoming Party Conference Season. A murky UK political backdrop may continue to put a dampener on GBP in the near-term," says the analyst.

However ING reckon the risk-reward ration may now no longer favour chasing the Pound much lower from these levels.

ING think GBP/USD at 1.27 and GBP/EUR at 1.0990 reflects "a good chunk of Brexit negativity – and look for a stable, yet volatile, GBP."

"It’s clear that a lot of bad news is priced into a pound plagued by twin sources of risk premia. But when it comes to Brexit and the currency, talks between the UK and the EU are not necessarily the primary short-term risk. In fact, some investors may have found comfort from the Raab-Barnier press conference over the past week – especially as it was clear that the EU isn’t actively looking to push the UK off any Brexit cliff edge," adds Patel.

Our own technical studies of the Pound-to-Euro exchange rate find that the pair is now close to the first downside target in the 1.10s at 1.1025 which suggests the market may be close to bottoming - at least temporarily.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here