British Pound (GBP) on 21/01: Sterling Firm, Technical Considerations of Importance

By Gary Howes

Sterling to euro exchange rate (GBP to EUR): 0.2 pct higher at 1.2146. Sterling to US dollar exchange rate (GBP/USD): 0.04 pct lower at 1.6421. Sterling to New Zealand dollar (GBP/NZD): 0.3 pct higher at 1.9786. Sterling to Australian dollar (GBP/AUD): 0.3 pct higher at 1.8700. Sterling to Canadian dollar (GBP/CAD): 0.25 pct higher at 1.8033. Sterling to South African Rand (GBP/ZAR): 0.18 pct lower at 17.8293.

BE AWARE: All the above quotes are taken from the wholesale inter-bank markets. Your bank will affix a spread to the rate at their discretion when passing on a retail rate. However, an independent FX provider will guarantee to undercut your bank's offer, thus delivering more currency. Please learn more here.  Tomorrow's big event is the release of the UK unemployment rate. The bank of England is targeting a rate at 7% before considering raising interest rates.

Tomorrow's big event is the release of the UK unemployment rate. The bank of England is targeting a rate at 7% before considering raising interest rates.

Daniel Vernazza, UniCredit Bank's UK economist expects that the unemployment rate will fall to 7.2%, lower than consensus expectations of 7.3%. At the same time he expects that the BoE minutes will have included a prominent line that low rates will likely remain on hold, even after the unemployment rate hits the MPC's threshold of 7%.

Additionally, with inflation now on target and exports looking increasingly dismal, he thinks that the bank will say that further sterling appreciation is a risk to the strength and balance of the recovery.

After all, since the previous meeting in December (when the BoE expressed for the first time its discomfort about further appreciation) and up until the latest meeting on the 8-9th of January, the BoE effective sterling index has risen by around 1.5%, something which should amplify concerns, at least at the margin.

Latest exchange rates

BE AWARE: All the above quotes are taken from the wholesale inter-bank markets. Your bank will affix a spread to the rate at their discretion when passing on a retail rate. However, an independent FX provider will guarantee to undercut your bank's offer, thus delivering more currency. Please learn more here.

16:20: Why GBP is higher on Tuesday

James Collins at Afex tells us why markets have taken the British pound higher on Tuesday:

"Sterling is trading at one-year highs against the euro and near three-year highs against the dollar. The pound climbed this afternoon after the IMF raised its growth forecast for the UK. It now expects the economy to grow 2.4% this year, compared to the previous forecast of 1.9%.

"This growth would be faster than any other major European country and, for comparison, the IMF expect the Eurozone as a whole to grow by 1% this year. However, growth in the US is forecast to be slightly higher than the UK at 2.8%.

"Many banks expect further gains for the pound this year, although not necessarily against the US dollar. Analysts think that the US central bank will wind down quantitative easing this year and this means sterling-dollar could be due a correction lower at some point.

"This week’s most important data will be unemployment figures and minutes from the Bank of England, both due tomorrow. Recent jobs data has been supportive for sterling but there is always the chance the Bank of England try to talk down the pound a little."

"Sterling is trading at one-year highs against the euro and near three-year highs against the dollar. The pound climbed this afternoon after the IMF raised its growth forecast for the UK. It now expects the economy to grow 2.4% this year, compared to the previous forecast of 1.9%.

"This growth would be faster than any other major European country and, for comparison, the IMF expect the Eurozone as a whole to grow by 1% this year. However, growth in the US is forecast to be slightly higher than the UK at 2.8%.

"Many banks expect further gains for the pound this year, although not necessarily against the US dollar. Analysts think that the US central bank will wind down quantitative easing this year and this means sterling-dollar could be due a correction lower at some point.

"This week’s most important data will be unemployment figures and minutes from the Bank of England, both due tomorrow. Recent jobs data has been supportive for sterling but there is always the chance the Bank of England try to talk down the pound a little."

16:03: GBP/CAD straining at the leash

Shaun Osborne at TD Securities updates us on where sterling is trying to go against the Canadian dollar:

"GBPCAD continues to strain at the leashes of the range that has held up the progress higher through 1.80. A marginal new cycle high today keeps the focus clearly on the topside but despite the clear push through 1.80 this week — aided and abetted by strongly positive trend momentum studies - there is little sign that the GBP is reaching escape velocity.

"We may remain 1.78/1.80 for a little longer. The overall trend remain constructive though and we continue to think that the market will eventually make clearer headway to 1.8200/50 and we continue to think that 1.90 is reachable further out."

"GBPCAD continues to strain at the leashes of the range that has held up the progress higher through 1.80. A marginal new cycle high today keeps the focus clearly on the topside but despite the clear push through 1.80 this week — aided and abetted by strongly positive trend momentum studies - there is little sign that the GBP is reaching escape velocity.

"We may remain 1.78/1.80 for a little longer. The overall trend remain constructive though and we continue to think that the market will eventually make clearer headway to 1.8200/50 and we continue to think that 1.90 is reachable further out."

15:50: The Bank of England Minutes should be interesting

KBC Markets give their view ahead of tomorrow's Bank of England MPC minutes release:

"The Minutes might be interesting. This might provide an indication whether Carney and Co are still mulling a change in forward guidance (lowering the reference unemployment rate). We are no fan of such a scenario, but the uncertainty on the issue might hamper a new up-leg in EUR/GBP. So, even if EUR/GBP would go for a test of the 0.8325 support, we will probably have to wait for confirmation till tomorrow. That said, we expect the pressure in EUR/GBP to remain to the downside, especially as EUR/USD is struggling, too."

"The Minutes might be interesting. This might provide an indication whether Carney and Co are still mulling a change in forward guidance (lowering the reference unemployment rate). We are no fan of such a scenario, but the uncertainty on the issue might hamper a new up-leg in EUR/GBP. So, even if EUR/GBP would go for a test of the 0.8325 support, we will probably have to wait for confirmation till tomorrow. That said, we expect the pressure in EUR/GBP to remain to the downside, especially as EUR/USD is struggling, too."

14:23: What will happen to Sterling if UK unemployment falls to 7.2%?

Following on from the previous entry, UniCredit's Head of Global FX Vasileios Gkionakis, tells us how GBP can be expected to react to an unemployment reading of 7.2%:

"If the unemployment rate falls to 7.2% as we expect this will be unequivocally GBP positive; the complication arises due to the simultaneous release of the minutes. The dovish tone that the BoE is likely to have adopted regarding the time horizon that rates will stay low alongside any reference to the risks that an appreciating sterling poses to growth should offset the positive impact from the lower unemployment rate.

"In fact, because central bank verbal intervention tends to have a meaningful negative effect on currencies (at least in the short term), we think that the net impact on GBP in the immediate aftermath will be negative with the currency breaking below 1.64 and testing the 1.6350 or even below.

"We also remain comfortable with our 1.59 forecast for the 1Q14 because 1. sterling has a negative beta to US 10Y yields which should rise further from current levels on the back of Fed's tapering and 2. too much optimism is already built into the price of GBP while the bar for actual data to beat consensus expectations has been raised significantly."

"If the unemployment rate falls to 7.2% as we expect this will be unequivocally GBP positive; the complication arises due to the simultaneous release of the minutes. The dovish tone that the BoE is likely to have adopted regarding the time horizon that rates will stay low alongside any reference to the risks that an appreciating sterling poses to growth should offset the positive impact from the lower unemployment rate.

"In fact, because central bank verbal intervention tends to have a meaningful negative effect on currencies (at least in the short term), we think that the net impact on GBP in the immediate aftermath will be negative with the currency breaking below 1.64 and testing the 1.6350 or even below.

"We also remain comfortable with our 1.59 forecast for the 1Q14 because 1. sterling has a negative beta to US 10Y yields which should rise further from current levels on the back of Fed's tapering and 2. too much optimism is already built into the price of GBP while the bar for actual data to beat consensus expectations has been raised significantly."

14:13: UniCredit see UK unemployment @ 7.2%

Tomorrow's big event is the release of the UK unemployment rate. The bank of England is targeting a rate at 7% before considering raising interest rates.

Tomorrow's big event is the release of the UK unemployment rate. The bank of England is targeting a rate at 7% before considering raising interest rates. Daniel Vernazza, UniCredit Bank's UK economist expects that the unemployment rate will fall to 7.2%, lower than consensus expectations of 7.3%. At the same time he expects that the BoE minutes will have included a prominent line that low rates will likely remain on hold, even after the unemployment rate hits the MPC's threshold of 7%.

Additionally, with inflation now on target and exports looking increasingly dismal, he thinks that the bank will say that further sterling appreciation is a risk to the strength and balance of the recovery.

After all, since the previous meeting in December (when the BoE expressed for the first time its discomfort about further appreciation) and up until the latest meeting on the 8-9th of January, the BoE effective sterling index has risen by around 1.5%, something which should amplify concerns, at least at the margin.

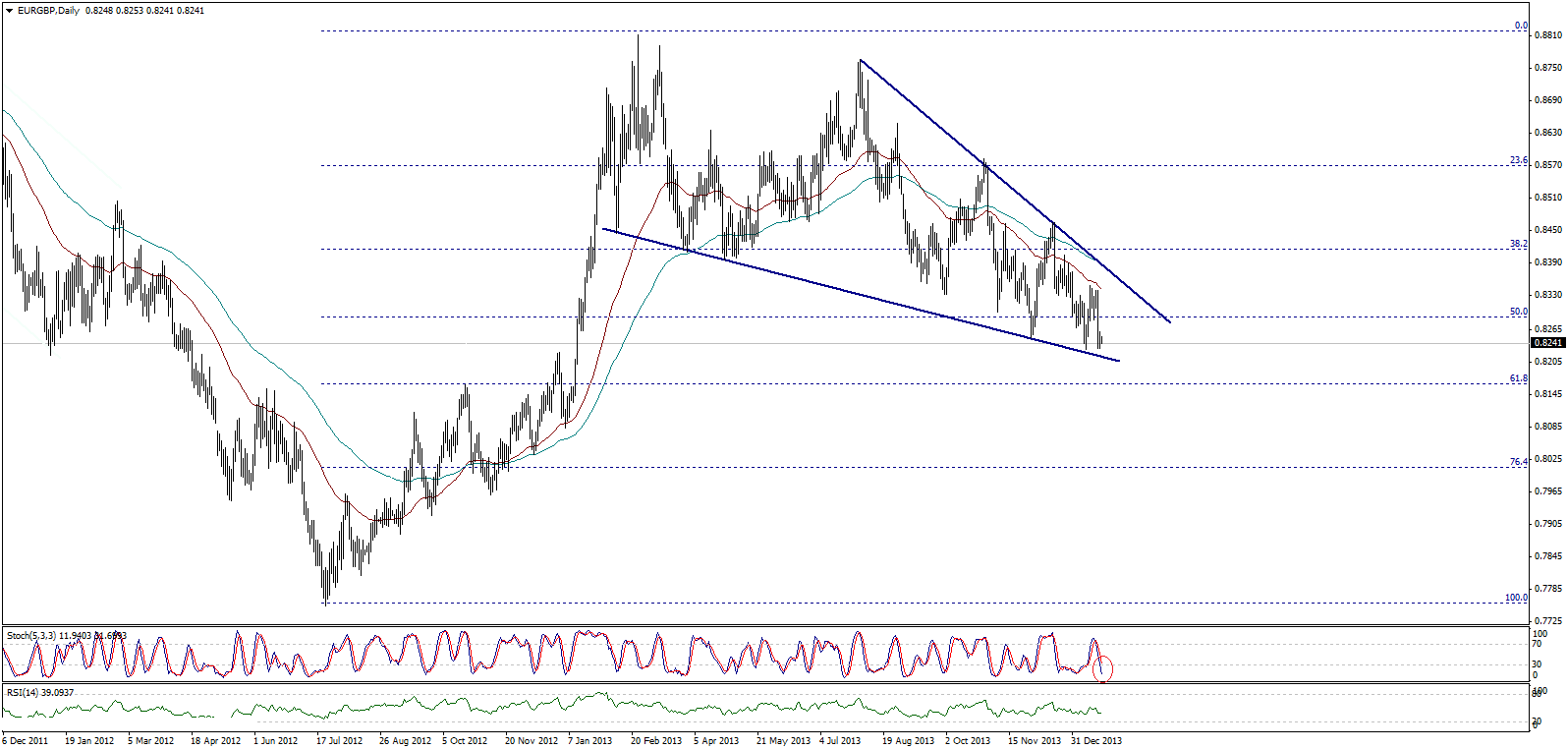

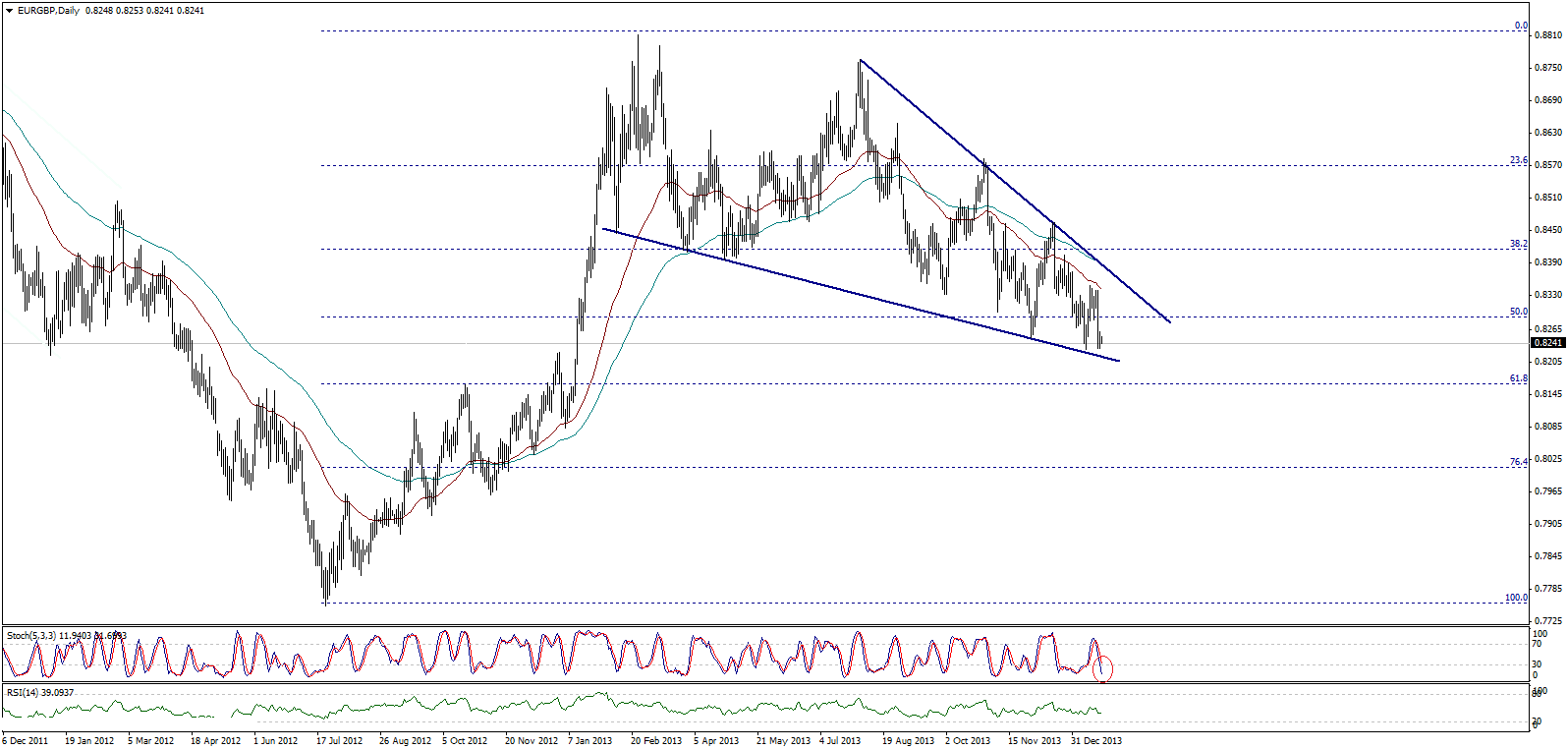

12:47: Critical short-term support ahead for EUR/GBP

ICN Financial advise the following on EUR/GBP:

"The pair is stable around the support of the main Falling Wedge shown on graph at the time Stochastic enters oversold areas supporting the upside rebound from those areas targeting 0.8385 areas. Breaching the resistance will extend the gains toward 0.8570, while a break below 0.8215 will push the pair to test the critical short-term support at 0.8165.

"Based on the above, buy the pair above 0.8215 targeting 0.8290 then 0.8355 and stop-loss below 0.8165."

Click to Enlarge

"The pair is stable around the support of the main Falling Wedge shown on graph at the time Stochastic enters oversold areas supporting the upside rebound from those areas targeting 0.8385 areas. Breaching the resistance will extend the gains toward 0.8570, while a break below 0.8215 will push the pair to test the critical short-term support at 0.8165.

"Based on the above, buy the pair above 0.8215 targeting 0.8290 then 0.8355 and stop-loss below 0.8165."

Click to Enlarge

12:41: UK manufacturing confidence remains robust

Despite the disappointing reading from the CBI earlier today, Stephen Gifford, CBI Director of Economics, paints a positive picture on UK manufacturing:

"The recovery in the manufacturing sector is continuing to build and confidence has improved.

"Growth in the volume of total new orders has reached its highest rate since April 2011, and this is encouraging. However, now is not the time to relax and take our foot off the gas. There are still risks ahead and our manufacturers need help to break into high-growth export markets."

Growth in new manufacturing orders was the strongest since April 2011, according to the latest CBI quarterly Industrial Trends Survey. In the three months to January 2014, domestic orders rose, uncertainty about demand fell and investment intentions for the year ahead picked up.

The survey of 367 manufacturers found that growth in total order books and domestic orders was the most rapid since April 2011. Output growth remained solid, albeit slightly lower than that recorded in November and December.

"The recovery in the manufacturing sector is continuing to build and confidence has improved.

"Growth in the volume of total new orders has reached its highest rate since April 2011, and this is encouraging. However, now is not the time to relax and take our foot off the gas. There are still risks ahead and our manufacturers need help to break into high-growth export markets."

Growth in new manufacturing orders was the strongest since April 2011, according to the latest CBI quarterly Industrial Trends Survey. In the three months to January 2014, domestic orders rose, uncertainty about demand fell and investment intentions for the year ahead picked up.

The survey of 367 manufacturers found that growth in total order books and domestic orders was the most rapid since April 2011. Output growth remained solid, albeit slightly lower than that recorded in November and December.

11:28: A big miss on the CBI Industrial Trends number

CBI Industrial Trends Survey - Orders (MoM) (Jan): Came in at -2, analysts had expected 10, last month read at 12. Sterling largely unchanged as this is second-tier data.

11:06: GBP/USD lacks clear direction

More from Ozkaredeskaya, this time forecasting the GBP/USD:

"The Cable holds support at the uptrend channel bottom, yet lacks clear direction ahead of jobs data due tomorrow. The 3-month ILO unemployment rate is expected to have improved from 7.4% to 7.3% in November; any positive surprise should revive the BoE hawks and give momentum to GBP-bulls later this week."

"The Cable holds support at the uptrend channel bottom, yet lacks clear direction ahead of jobs data due tomorrow. The 3-month ILO unemployment rate is expected to have improved from 7.4% to 7.3% in November; any positive surprise should revive the BoE hawks and give momentum to GBP-bulls later this week."

11:03: Further declines ahead for EUR/GBP

"EURGBP consolidates losses below the 30-min daily cloud top (1.82550). We keep our key support at 0.8220/25 (2013-2014 downtrend channel bottom / Dec 2012 double top), if broken should open the way to our 0.8160 target (fibo 61.8% on July 2013 - Feb 2013 rally). We remain sellers on rallies for a daily close below 0.83000," says Ipek Ozkardeskaya at Swissquote Bank.

10:01: Eurozone data misses the mark

The Eurozone ZEW Survey for Economic Sentiment (Jan) beat expectations coming in at 73.3, markets had priced in a rise to 70.2 from December's 68.3.

But, Germany has missed the mark and this should hamper any EUR gains. The German number came in at 61.7, below expectations for 64, and this is actually below December's 62. GBP/EUR is now 0.2 pct higher on last night's close at 12147.

But, Germany has missed the mark and this should hamper any EUR gains. The German number came in at 61.7, below expectations for 64, and this is actually below December's 62. GBP/EUR is now 0.2 pct higher on last night's close at 12147.

10:00: GBP priced for perfection, but forecasted to fall by year end

Camilla Sutton at Scotiabank says GBP is fairly priced at present, but like the majority of currencies, should fall through to year-end:

"This week will mark some important fundamental developments, including the release of employment and the BoE minutes, which should provide a foundation for the path of GBP. We suggest that the currency has been priced for perfection and even in an environment of improving employment, with inflation at target, the BoE will remain cautious for longer than the market currently expects. We hold a year‐end GBP target of 1.59."

"This week will mark some important fundamental developments, including the release of employment and the BoE minutes, which should provide a foundation for the path of GBP. We suggest that the currency has been priced for perfection and even in an environment of improving employment, with inflation at target, the BoE will remain cautious for longer than the market currently expects. We hold a year‐end GBP target of 1.59."

"This week will mark some important fundamental developments, including the release of employment and the BoE minutes, which should provide a foundation for the path of GBP. We suggest that the currency has been priced for perfection and even in an environment of improving employment, with inflation at target, the BoE will remain cautious for longer than the market currently expects. We hold a year‐end GBP target of 1.59."

"This week will mark some important fundamental developments, including the release of employment and the BoE minutes, which should provide a foundation for the path of GBP. We suggest that the currency has been priced for perfection and even in an environment of improving employment, with inflation at target, the BoE will remain cautious for longer than the market currently expects. We hold a year‐end GBP target of 1.59."09:52: Volatility in GBP/USD, USD/CAD, EUR/USD at favourable levels for trend followers

The below table is supplied by Easy Forex and serves to indicate the low volatility in the likes of GBP/USD. Those trading trends would do well to be positioned on those currency pairs highlighted in green. Higher volatility is indicated by reds and yellows. Click to enlarge.

08:50: CBI Industrial data today, employment figures tomorrow

There will be interest in today’s CBI industrial trends survey for any indications on the momentum of the economy in January, but the focus will mainly be on tomorrow’s labour market data. The CBI data is due at 11AM, markets are expecting a reading of 10, down from last month's 12.

"A dip in the unemployment rate to 7.3% would provide further support to the GBP bull case. We would not expect anything from the MPC minutes to discourage this at this stage." - Lloyds Bank.

"A dip in the unemployment rate to 7.3% would provide further support to the GBP bull case. We would not expect anything from the MPC minutes to discourage this at this stage." - Lloyds Bank.

08:36: Bond markets will benefit Sterling

"We still see some value in GBP on a dip, particularly against the EUR and CHF, as the strength of UK growth and the declining trend in unemployment does suggest the possibility of a steady widening of yield spreads in favour of the GBP." - Lloyds Bank Research.

08:32: Speculators strike a healthy approach to British Pound (GBP) should benefit from a healthy balance between buyers and seller in speculative markets

While British pound (GBP) positioning is still showing as modestly net long on the close on the 14th January, GBP came under pressure through most of last week and it is likely that positioning was close to 50/50 coming into the retail sales data on Friday. This is a desirable outcome with regards to stability.

"The surprising strength of these numbers triggered a GBP rally, but it is doubtful that there was time for the market to re-establish long positions in response to the data. So while GBP is now at similar levels to those seen last Tuesday, positioning may now be flatter than it was, suggesting more potential GBP upside. The UK labour market data this week, and to a lesser extent the MPC minutes, could be a trigger for this," says a comment on the positioning issued by Lloyds Bank Research.

Data from the major US futures & options exchanges (CFTC) are released each Friday evening and report positions up to the close of business on the previous Tuesday.

Traders are classified as either commercial or non-commercial. The positioning of the non-commercial traders can be used as a proxy for the speculative side of the market. Extreme net long or net short positions are taken as an indication of the market’s vulnerability to a sharp reversal and are identified by the interpretation of positioning ‘percentile’ vs historical norms.

So with GBP positioning being seen as being well balanced the possibility of hefty technical reversals is less likely.

"The surprising strength of these numbers triggered a GBP rally, but it is doubtful that there was time for the market to re-establish long positions in response to the data. So while GBP is now at similar levels to those seen last Tuesday, positioning may now be flatter than it was, suggesting more potential GBP upside. The UK labour market data this week, and to a lesser extent the MPC minutes, could be a trigger for this," says a comment on the positioning issued by Lloyds Bank Research.

Data from the major US futures & options exchanges (CFTC) are released each Friday evening and report positions up to the close of business on the previous Tuesday.

Traders are classified as either commercial or non-commercial. The positioning of the non-commercial traders can be used as a proxy for the speculative side of the market. Extreme net long or net short positions are taken as an indication of the market’s vulnerability to a sharp reversal and are identified by the interpretation of positioning ‘percentile’ vs historical norms.

So with GBP positioning being seen as being well balanced the possibility of hefty technical reversals is less likely.

08:20: IMF to upgrade UK growth outlook

The International Monetary Fund (IMF) is poised to increase its projection for UK growth in 2014 from 1.9% to 2.4%. Although the Fund will also lift its forecasts for world economic growth, the UK upgrade is significantly stronger.

This is just a further indicator as to the vitality of current UK growth and another piece of pressure that would be brought to bear on the Bank of England to raise interest rates sooner than it would like.

With this in mind, pound sterling awaits tomorrow's employment figures and Bank of England MPC minutes for further guidance.

We expect direction in the currency to be largely technical in nature today.

This is just a further indicator as to the vitality of current UK growth and another piece of pressure that would be brought to bear on the Bank of England to raise interest rates sooner than it would like.

With this in mind, pound sterling awaits tomorrow's employment figures and Bank of England MPC minutes for further guidance.

We expect direction in the currency to be largely technical in nature today.