Big Recovery in British Pound vs. Euro and Dollar Expected if May Goes Soft on Brexit

- Pantheon Macroeconomics says Theresa May will ultimately deliver a soft Brexit

- Potential for investment surge on soft Brexit sizeable

- Pound above 1.25 against the Euro forecast, 1.40 in GBP/USD possible

Image © Adobe Stock

The independent economics research house Pantheon Macroeconomics has have shone a light on the potential boost to the UK economy, and British Pound, on a pivot to a so-called soft-Brexit by the UK government.

The call comes at the start of a busy week in terms of the UK's Brexit journey with Monday bringing with it news of a 'third way' for a future trading relationship being proposed by the UK government while the week will be book-ended by a critical meeting of the Cabinet to push for an unified stance on what the future relationship will look like.

The details of the new 'third way' will not be revealed until after the meeting of the Cabinet at the Prime Minister's country retreat, known as Chequers, and the coming week will therefore be prone to speculation over the matter.

For Sterling, there will be little by way of hard information to trade off, and the malaise the currency has suffered over recent weeks, primarily against the US Dollar, and more recently against the Euro too, will therefore likely extend.

After all, the risks posed by a hard-Brexit and the ongoing uncertainty as to what the future EU-UK relationship looks like give investors little incentive to stock up on exposure to Sterling, lest the whole process unravels.

The UK economy is lagging its developed nation peers with businesses apparently intent to sit on their hands when it comes to making new investment decisions, thereby keeping UK growth levels throttled below full potential.

"We doubt that business investment will make a meaningful contribution to GDP growth in the second half of 2018. Hefty profit margins, severe capacity constraints and low borrowing costs suggest that capital expenditure should surge. But businesses are warning ever more loudly that continued uncertainty about Brexit is prompting them to put new capital expenditure on ice," says Samuel Tombs, Chief UK Economist with Pantheon Macroeconomics.

Pantheon Macroeconomic expect GDP to rise by just 1.2% year-over-year in 2018 while the Bank of England's policy-making body, the MPC, thinks trend growth is about 1.5%. Hence, Pantheon believe disappointment with UK growth will lead the Bank to keep interest rates unchanged this year.

Markets are pricing in a 60% chance of an interest rate rise in August, if these expectations are proven to be too optimistic we could very well see another pulse of GBP selling in response.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.

2019 Rebound

While the outlook for the remainder of 2018 appears subdued, Pantheon tell clients 2019 should see a rapid improvement in fortunes for the economy, and Sterling by extension.

"We remain optimistic, however, that the economy will regain momentum in 2019, enabling the MPC to raise Bank rate twice, to 1.0% by the end of next year. The Chancellor likely will choose to pause the fiscal consolidation in the Autumn Budget. He is on track to meet his goal - reducing cyclically - adjusted borrowing to less than 2% of GDP by 2020 - two years early, so he can scrap all the austerity measures planned for 2019," says Tombs.

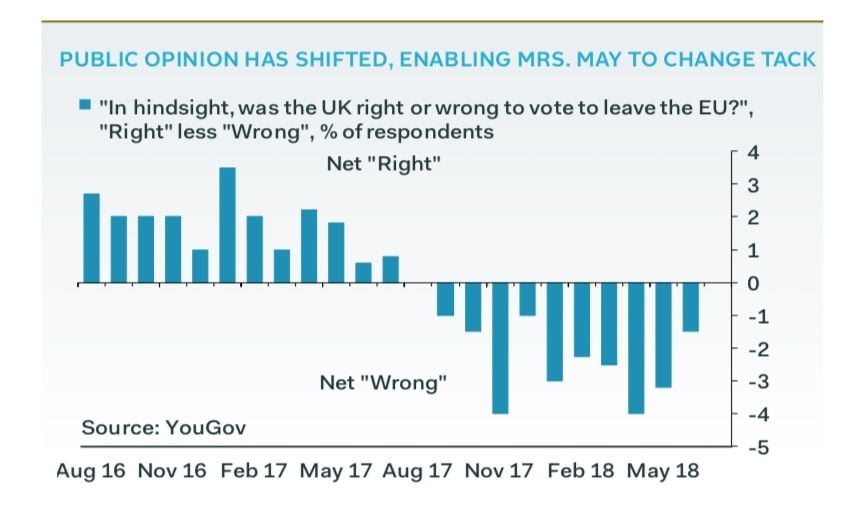

Much of the assumption for a revival in UK economic activity does however rely on notable shifts in Brexit sentiment; there is scope for business and investor confidence to "revive following a pivot by the government towards a soft Brexit later this year," adds tombs.

Tombs notes "neither of the options considered by the cabinet for facilitating trade outside the customs union meet the government’s commitment to maintaining a frictionless border in Northern Ireland, or command enough support in parliament, or will be agreed by the EU."

Therefore, news of a third option being spun up by the UK could well unlock progress.

However, Tombs runs some assumptions that will be very difficult for Theresa May to deliver without risking a mutiny as he expects the government to agree to stay in the customs union but to leave the single market after the transition period ends in December 2020, "and then ultimately to change its mind on leaving the single market too."

Conservative Party backbench MP Jacob Rees-Mogg says the PM risks a revolt if the type of Brexit she promised is not delivered. Writing in the Daily Telegraph, Mr Rees-Mogg said he and other members of the 60-strong group of Eurosceptic Tory MPs he leads, known as the European Research Group, would reject a deal that did not amount to a clean break with the EU.

"Tory Brexiteers won’t like Mrs. May’s volte face, but they will struggle to oust her. Most will realise that changing the leader won’t lead to a different Brexit outcome and they won't want to trigger a general election, which they may lose," says Tombs.

A Surge in the Economy and the Pound

The move to a soft Brexit will be intrumental in shaping a strong rebound in the value of the British Pound according to Pantheon Macroecnomics.

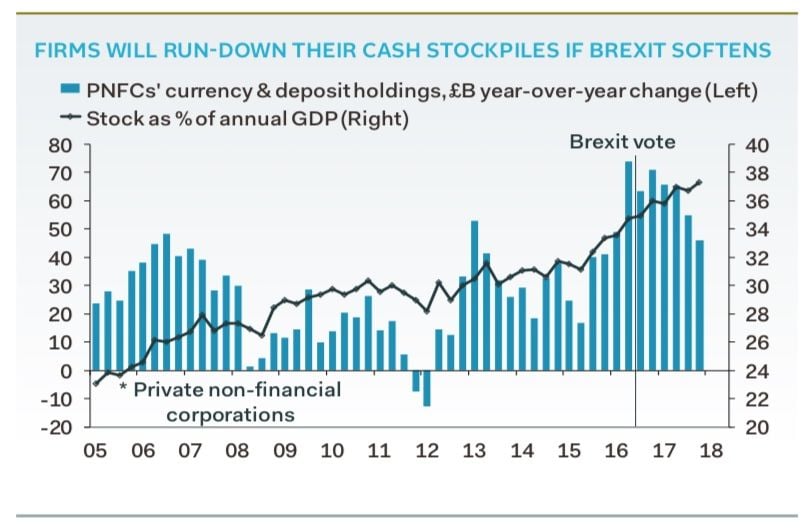

"The scope for a burst of investment-led growth following a soft Brexit decision is widely under-appreciated," says Tombs.

Pantheon Macroeconomics note firms currently hold cash equal to 37% of GDP on their balance sheets, up from 34% since the Brexit vote. Even if a fraction of this surplus cash was spent, GDP growth would accelerate appreciably.

Exchange rate forecasts for a soft Brexit and two rate hikes in 2019 suggest Sterling should appreciate notably, with a Pound-to-Dollar exchange rate of 1.40 being mooted and a Pound-to-Euro exchange rate of 1.27 by the end of next year.

This is well ahead of consensus forecasts as most analysts we have heard from don't hold a similar assumption for a soft Brexit instead seeing a hybrid deal that sees the UK leave the EU's single market.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.