Budget 2017 and Pound Sterling: Potential Moves vs. Euro and Dollar

- FX market quotes at last update:

- Pound-to-Euro exchange rate: 1 GBP = 1.1257 EUR

- Pound-to-Dollar exchange rate: 1 GBP = 1.3250 USD

- "We think that GBP risk is skewed to the downside" - Barclays.

- "Long GBP/USD is our trade of the week and we eye 1.3400 on a well-received Budget" - ING.

The most significant event for the British Pound this week is the Autumn Budget statement which will be delivered on Wednesday, November 22.

The Statement will be the next test of credibility for the UK Government and provide insights into the economy's potential growth trajectory which should in turn impact on the value of Sterling.

While updated economic growth and productivity forecasts will be key, arguably of greater importance for Sterling will be the degree of support the budget conveys to Theresa May and her Government; currencies like stability and recent months have shown the Government to be anything but.

Budgets are of political importance for any government as in the past we have seen their popularity wane on poorly received budgets - recall George Osborne's 'omni-shambles budget' of 2012 where support for the Cameron Government slipped notably on perceived policy blunders presented in that budget.

Neither Theresa May or Philip Hammond can afford for such an outcome from this budget as it would make a forgettable 2017 even more forgettable for the current administration.

"It is critical not only for the Government’s self-imposed fiscal goals (2% deficit by 2021, balanced by mid-2020s) but the survival of May’s Government due to mounting political pressures domestically and around Brexit," says Tim Riddell at Westpac.

"A successful budget could relieve some pressures with a sound fiscal hand, support struggling parts of the population and strained public departments and even allow for a firmer approach towards Brexit," says the analyst.

Success could translate into a stronger Pound we are told.

"Long GBP/USD is our trade of the week and we eye 1.3400 on a well-received Budget," says Viraj Patel, an analyst with ING Bank N.V. in London.

Also of importance to the Pound - beyond the implications for Government credibility - is whether the budget is growth-friendly and offers the potential for an increase in productivity levels - if the answer is yes, it could help strengthen the Pound.

There is a possibility the budget could include more generous public spending, especially on housing, and if so, this has the potential to boost the Pound.

Increased public spending tends to increase economic activity, which can generate growth, inflation, and then higher interest rates.

Higher interest rates tend to boost the Pound by attracting more capital inflows from foreign investors seeking somewhere to park their money where it will earn higher returns.

"It's clear that the global investment community are in dire need of some Churchillian-like words of inspiration over the future of Britain. While this is being billed as a ‘Budget for Homes’, what will be equally important is whether we see a marked step away from the austerity years and more focus on public sector spending – where anything beyond the already planned lifting of the 1% pay cap for employees could be seen as winning political brownie points with disillusioned voters. This may prove tricky for the fiscally prudent Hammond," says Patel.

Chancellor Philip Hammond is under pressure to increase public spending but remains hamstrung by a weaker set of OBR fiscal forecasts which limit his ability to increase spending if he is to avoid missing his target on reducing the country's debt burden.

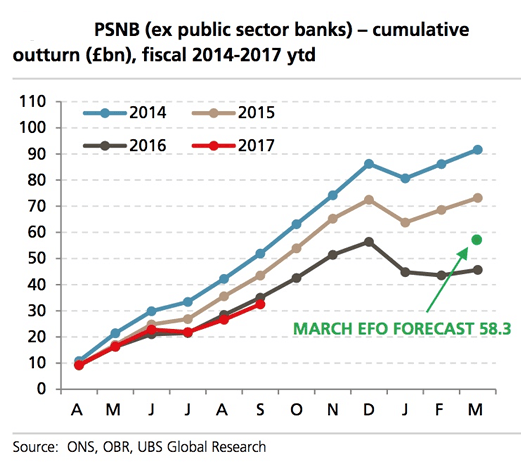

Above: UK borrowing is coming down

Above: ... but the UK's debt pile continues to grow

"The chancellor has come under increasing pressure to deliver a popular ‘big and bold’ budget that includes increased spending as a means of reviving spirits in the struggling and divided government," says a briefing from TD Securities.

Whether or not the Chancellor will take such a bold step, given productivity forecasts are expected to be lowered once more, remains questionable.

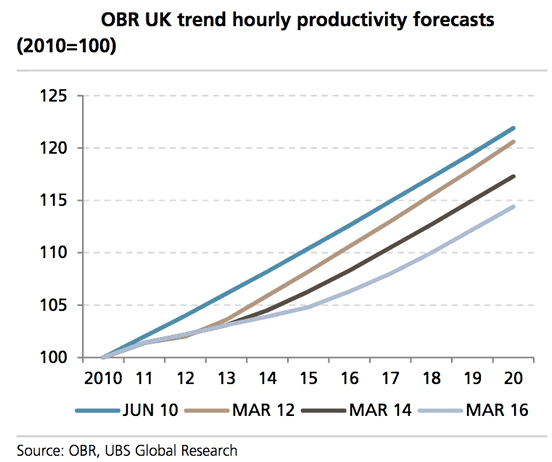

"Output per UK worker continues to disappoint and suggests that a downward revision is appropriate," says Hamish Pepper, an FX analyst with Barclays. "We think that GBP risk is skewed to the downside."

In a recent speech, the chairman of the Office for Budget Responsibility, Robert Chote, noted that their assessment of the UK’s productive potential had previously been too optimistic and that the OBR was minded to “significantly” revise down its productivity growth assumptions.

"That should be reflected in higher borrowing across the forecast horizon. Moreover, with the Chancellor expected to stick to his fiscal rules and mindful of the risks to the UK’s economic outlook, his scope for significant giveaways are likely to be limited," says Nikesh Sawjani at Lloyds Bank Commercial Banking.

Above: Forecasts for future productivity of the UK workforce continue to be cut suggesting weaker income tax receipts in the future

Lower productivity growth means lower income growth for UK workers over the forecast period, which should result in higher government net borrowing forecasts between 2018 and 2022.

Yet Hammond has promised to continue targeting a structural fiscal deficit below 2% in the 2020/2021 fiscal year even if economic circumstances change.

"This target, however, introduces a worrying scenario for GBP if the OBR delivers more sizeable downward revisions to its GDP growth forecasts and the government is forced to reduce spending in order for the target to be met," says Pepper.

Pepper warns fiscal austerity at a time when the BoE is encouraging market expectations of rate hikes "could leave the currency isolated and GBP depreciation the only release valve for the economy to stabilise."

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.