Pound Sterling Forecasts vs Euro and US Dollar Upgraded at Lloyds Bank

- FX Quotes:

- Pound-to-Euro exchange rate today: 1 GBP = 1.1362 EUR

- Pound-to-Dollar exchange rate today: 1 GBP = 1.3397 USD

UK high-street lender Lloyds Bank have announced upgrades to their Pound Sterling forecasts following recent developments at the Bank of England.

Upgrades to the British Pound’s forecast profile at Lloyds Bank come largely as a result of the recent shift in tone from the Bank Of England (BoE) who at their September policy meeting indicated they are now likely to raise interest rates in the near-future.

"We now expect a 25bp hike in the Bank Rate in November, followed by a further 25bp in August next year. In line with this, we are revising up our near-term GBP/EUR forecast," says Lloyds Bank Commercial Banking's Quantitative Strategist, Gajan Mahadevan.

The shift in tone at the Bank of England caught the majority of the market by surprise as expectations were for the first rate rise to take place in 2019. Higher interest rates drive up currencies as they attract more foreign capital inflows.

The BOE's change in tone has probably been caused by recent improvements in the labour market, which are expected to lead to higher wages, growth and inflation.

Despite the upbeat assessment of the economy, risks remain, especially on the political front:

"UK PM Theresa May’s speech in Florence was somewhat subdued and the question remains as to whether negotiations will progress to the next stage, with the ‘divorce payment’, rights of EU citizens and Irish border all matters that remain unresolved," says Mahadevan.

A failure to make progress could set the Pound back.

However, the fourth round of Brexit negotiations had ended since the release of Lloyds Bank’s latest exchange rate forecasts and the tone we are getting from London and Brussels on the matter is more constructive.

Both EU negotiator Michel Barnier and UK negotiator David Davis welcomed the constructive atmosphere in the most recent round of talks; something that was absent in previous rounds with both citing May's Florence speech as being key in unblocking bottlenecks in the negotiating process.

This poses questions as to whether Lloyds are too pessimistic on Sterling when it comes to the issue of Brexit.

Lloyds warn clients to keep an eye on European politics, saying upcoming events could hamper the Euro.

The Euro has suffered this week from increased political risks after the German election saw the anti-EU Afd party's share of the vote increase to 13%, enabling them to potentially have a share of power in a coalition, and drive a wedge into Macron-Merkel's plans of deeper European integration.

Such integration would be positive for the Euro, but looks less achievable now - still greater risks may lie ahead:

But, ”the real outlier event may yet be ahead of us, with the Italian parliament due to be dissolved by 15th March 2018 and an election to follow by 20th May 2018," warns Mahadevan.

"Clearly there is a high degree of uncertainty around these risks, well reflected in analyst sentiment, which continues to show significant divergence in expectations.

Lloyds revise up their forecast from 1.09 at end-of-year to 1.12 - which is still, nevertheless, below the current 1.14 level and thus suggests a pull-back in the Pound in the remainder of H2.

"We see a re-test of the recent lows before the pair consolidates in a relatively narrow range through the Brexit negotiation process," says Mahadevan.

Consensus forecasts for end-2017 are for the Pound-to-Euro exchange rate to be at 1.10 with the highest forecast at 1.24 and lowest at 1.02.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Pound-to-Dollar Forecast Raised

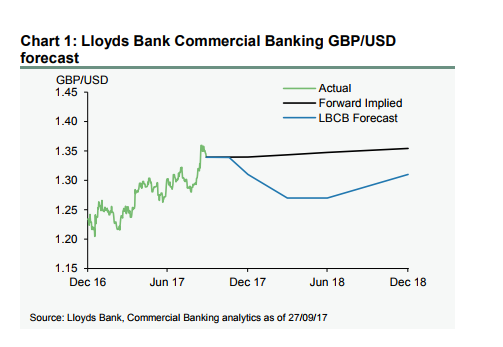

The Pound is likewise expected to fare rather better against the Dollar than previously imagined.

Again the catalyst is the change of tone from the BOE.

The shift has caused a change in the implied probability of a 25bp bank rate hike in November to rise from just above, "30% in the run up to, to almost 70% a week after September’s MPC meeting," said the strategist.

The pair is now close to its estimated 'fair' value of 1.40.

But the uptrend has stalled as the more hawkish Fed has in some ways 'cancelled out' the positive impact on the Pound of the more hawkish BOE.

Political risks are also important to GBP/USD as Brexit risks once again take centre stage, however, US political risk is also a major driver of the Dollar.

"The uncertainty around domestic fiscal developments and US foreign policy is a key concern for the market," says Mahadevan.

The Dollar has this week been boosted by the Trump administration's tax reform proposals which confirm significant cuts to personal and corporation taxes are coming which could boost the Dollar near-term, while analysts remain unconvinced of the longer-term positive effects.

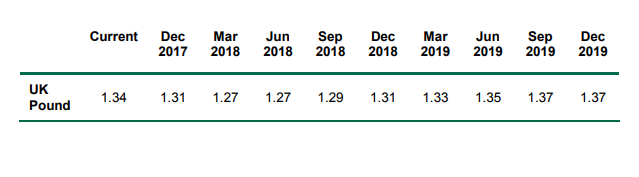

Nevertheless, Lloyds revise their end-2017 forecast to around 1.31 (from 1.28).

Then in 2018 they anticipates a deeper pullback towards 1.27, "potentially driven by further US monetary policy tightening and the possibility of a lack of progress in Brexit negotiations."

Beyond that in 2019 Lloyds see GBP/USD is likely to reach 1.37 by the end of the year.