The Pound-to-Euro Rate Breaks 1.12, Positive Momentum Seen Intact

- Written by: James Skinner

The GBP/EUR exchange rate has attained a multi-month best having reached 1.1225 in morning trade in London on Friday, September 15. Further gains are likely.

Further advances in the Pound are likely as the UK currency enjoys fresh momentum, courtesy of a shift in stance at the Bank of England.

The gains come as foreign exchange markets race to price in an earlier-than-forecast interest rate rise after the Bank of England blindsided markets with a warning that interest rates could rise over the coming months.

Minutes from the Bank's September policy meeting said interest rates, "could need to be tightened by a somewhat greater extent over the forecast period than current market expectations," adding, "some withdrawal of monetary stimulus is likely to be appropriate over the coming months in order to return inflation sustainably to target".

The Bank's message was reinforced later in the day when Governor Mark Carney told reporters that the majority of rate-setters see an imminent interest rate rise as appropriate. Confirmation that Carney is amongst those agitating for a rise gave Sterling an extra fillip.

Recall, markets walked into the September policy meeting assigning only a 30% chance of a 2017 rate rise with consensus market pricing implying the Bank of England would hold off on a rate hike until some time in 2019.

"If the economy continues to hold up, and there are clearer signs that wage growth is building, then the first hike could some somewhat earlier than we had previously envisaged, possibly as soon as the next meeting in November," says Paul Hollingsworth, an economist at Capital Economics.

Indeed, any increase in bank rate is contingent on inflation continuing to march northward during the months ahead and the economy maintaining a performance that has so-far been better than many had expected.

And recall, the Bank has a knack for not delivering on the 'imminent' rate rises it has promised in the past. But there is a sense that this time the Bank would risk reputation damage were it not deliver on a rate rise.

Indeed, 2017 is different with analysts pointing out that the 0.25% rate cut implemented in the wake of the EU referendum in 2016 is a low-hanging fruit that could be picked in order to feed a malnourished Sterling and dampen heating inflation.

The Pound-to-Euro rate gained close to 1% off the back of the bank's statement, trading above 1.1200 for the first time in six weeks, this means the EUR/GBP exchange rate down below 0.8900 pence.

Above: We might finally be seeing a floor in the GBP/EUR established at the August lows.

Following the event, analysts are suggesting the Pound is likely to experience further strength with Lee Hardman, a currency analyst with MUFG, saying he is reverting back to a "stronger Pound outlook".

"We are reverting back to our prior call for the first BoE rate hike to take place in November, and to our stronger Pound forecasts from the August FX Outlook report," says Hardman who acknowledges it was a mistake to veer away from previous convictions.

"The more bullish set of pound forecasts expect cable to rise towards the mid-1.4000’s by the middle of next year, while EUR/GBP is also expected to decline but more modestly towards the mid-0.8000’s," says Hardman.

EUR/GBP in the mid-0.80's is essentially a Pound-to-Euro rate in the 1.13-1.14 region.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

The Bounce After the Fall

Sterling's gains came immediately after an unchanged split in Monetary Policy Committee votes to maintain the status quo drove a brief plunge in the currency. Traders see the vote split before they are able to digest the contents of the statement. Many had expected an additional committee member to vote for a hike this month.

Sterling rose by more than 100 points against the US Dollar to trade above 1.3300, threatening a new one year high.

“If the economy continues to follow a path consistent with the prospect of a continued erosion of slack and a gradual rise in underlying inflationary pressure then...., some withdrawal of monetary stimulus is likely to be appropriate over the coming months,” says the MPC.

The committee noted that the fall in the Pound since the 2016 referendum has led inflation, which is expected to top 3% in October, to overshoot the BoE’s August forecasts.

But bank rate setters also flagged a better than expected performance from the economy and a continued strengthening of the labour market, both of which are expected to help return inflation toward its 2% target over the medium term.

“After recent warnings that markets were under-priced for potential interest rate hikes, the MPC appears close to following through and tightening its policy in response to above-target inflation," says Timothy Graf, head of macro strategy at State Street.

The Bank of England will release its next inflation report in November, which will contain the latest round of forecasts for everything between inflation, unemployment and economic growth. Some see this as providing an ideal opportunity for the bank to announce a change in rates.

"We stick to our forecast that the Bank of England will increase the bank rate by 25 bps in Q1 2018, and then leaving the bank rate unchanged throughout 2018 and 2019," says Andreas Wallstrom, an economist at Nordea Markets. "We would, however, not rule out a rate hike already at the November meeting, which will also be accompanied with an inflation report."

Carney Reinforces Message on Rates in Television Interview

Pound Sterling is seen near recent highs on Friday, September 15 as markets grow increasingly confident that the Bank of England will raise interest rates in November.

Bank of England Governor Mark Carney Governor has said in an interview that the possibility of the first U.K. interest rate hike in a decade had "definitely increased".

The comments come hours after Sterling rallied sharply in the wake of the Bank of England's September where it was suggested interest rates would need to rise faster than markets are presently expecting.

"The majority of members of the (Monetary Policy) Committee, myself included, see that that balancing act is beginning to shift, and that in order to ... return inflation to that 2 percent target in a sustainable manner, there may need to be some adjustment of interest rates in the coming months," the Governor said in an interview at a school in London while launching the new ten pound note.

"Now, we will take that decision based on the data. I guess that possibility has definitely increased," he adds.

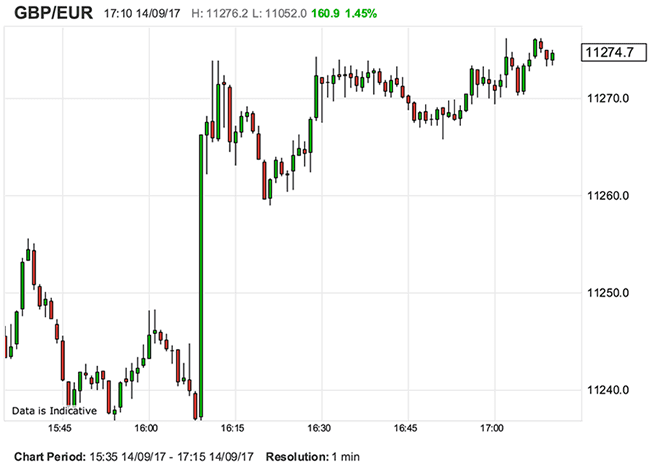

Above: Sterling gets a fresh leg up in late London trade as the Bank's message on interest rate rises are reinforced.

The comments come in the wake of the Bank of England's September policy update where it warned markets were too complacent in their pricing of future interest rate rises.

The comments appear to cement the communication that an interest rate rise is coming in November when the Bank delivers its next Inflation Report.

This will further underpin the Pound which has taken heart from signs the Bank is looking to raise interest rates in the near future.

The run higher in the British Pound continues as a result.