Pound Sterling up 1.0% as UK Inflation Data Pushes Towards 3.0%

- Written by: Gary Howes

-

The British Pound has recorded a fresh one-year high against the US Dollar and is outperforming all key counterparts on the day following the release of stronger-than-forecast inflation data.

The numbers shook complacent markets with regards to 1) the oversold nature of Sterling and 2) the number of future interest rate rises required at the Bank of England.

The data was just the trigger required to expose the markets excessive negative positioning against the Pound and we are now seeing a run higher as traders exit their bearish bets, and indeed, eye the potential to profit on any extension in the rebound.

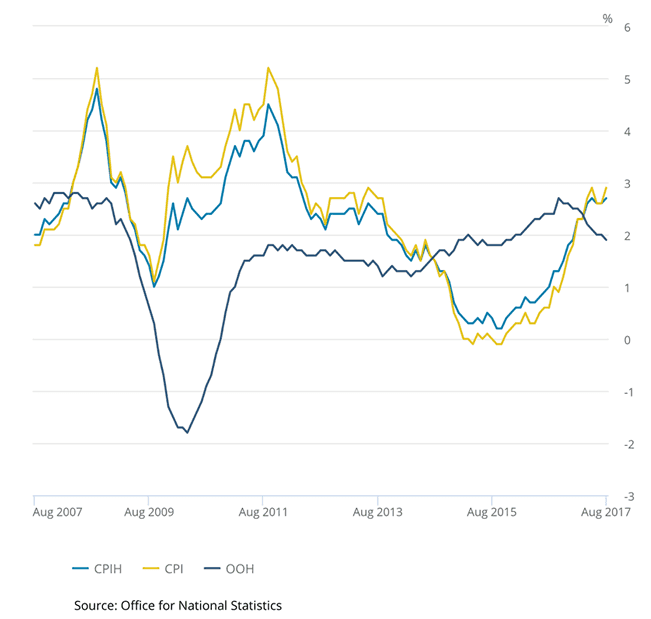

The Office for National Statistics reports headline CPI inflation for August read at 2.9%, ahead of the 2.8% expected by economists and above the 2.4% recorded in July.

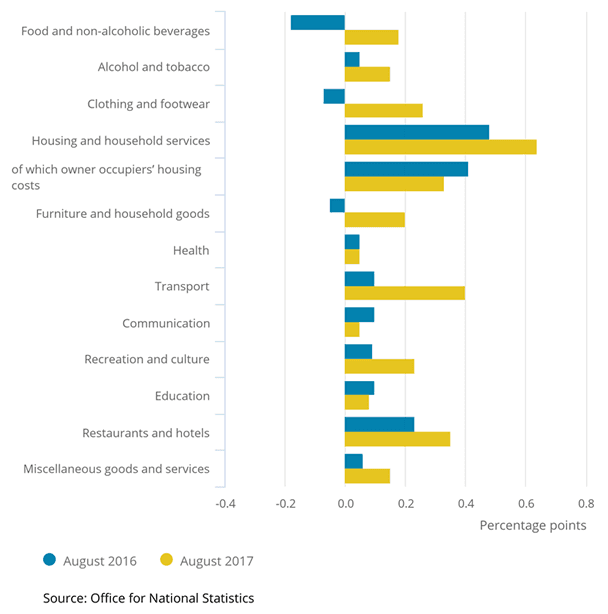

The rise in inflation comes as the ONS reports clothing and footwear inflation has reached a record of 4.6%.

But, the biggest contributor to the jump is attributed to housing and household services.

"The rise in August CPI provided further evidence of the continued impact of last year’s Sterling depreciation, with much of the increase due to those components of the CPI that are particularly sensitive to movements in the exchange rate," says Nikesh Sawjani, UK Economist at Lloyds Bank Commercial Banking.

There has been talk that much of the heding contracts taken out by importers are reaching expiration, exposing businesses to a new regime of exchange rates.

The increase in inflation is also seen being fuelled by higher energy costs, particularly for petrol and diesel prices.

Above: The Pound is easily the day's best performer on global exchange rate markets.

Economy Generating Heat

From a currency perspective, the figure that catches our eye is the core CPI number. Core CPI represents inflation that is generated by domestic conditions and excludes external drivers such as fuel and arguably gives a better insight into the inflationary pressures developing in the economy.

Core CPI rose by 2.7% in August, analysts had forecast a reading of 2.5%. The Bank of England will have to take note as there is now arguably a case to be made that domestic economic activity might be stirring inflation.

And It's Over to the Bank of England

The surge in August now leaves inflation over the quarter on track to exceed the Bank of England’s forecast of 2.7% for the third-quarter, which was made at last month’s Inflation Report.

"Post-release of the inflation data, Sterling has rallied strongly against both the Euro and US Dollar, suggesting that the market is looking for a reaction from Thursday’s MPC meeting. The BoE has shown patience with above target CPI prints, however some reduction in the dovish bias and a move towards a more neutral or even a few hawkish comments is currently expected by the market,” says Shilen Shah, Bond Strategist at Investec Wealth & Investment.

The bounce in inflation now heaps pressure on the Bank of England to consider raising interest rates in order to cool prices rises and add further support to the British Pound.

Recall, much of the recent jump in inflation comes on the back of the fall in the Pound, and therefore supporting the currency is key.

That said, the ongoing rally in GBP/USD does ease some of the pressure so there is a risk that markets push Sterling too far onto the other side of the tracks. The Bank might be content to allow inflation to pass through and would be wary of rocking the economy at a time of heightened uncertainty regarding Brexit negotiations.

Above: GBP/USD breaks above early-August highs and is well above its post-referendum lows suggesting the worst of the Sterling-inspired inflation surge should be over.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Markets Caught Napping

The Bank of England delivers its latest decision on Thursday and markets have been buying the Pound ahead of the event and in the process dealing a blow to Sterling bears that were eyeing ever-lower levels for the currency.

"Today’s figures are likely to provide further ammunition to the more hawkish members of the MPC at this Thursday’s meeting, and as a result we expect the vote to be split once again," says Paul Hollingsworth, UK Economist at Capital Economics.

UK CPI y/y comes in at 2.9% vs 2.8% expected. Sterling trading fresh highs against the euro and the US dollar #CPI #Inflation

— Godi Financial (@GodiFinancial) September 12, 2017

A key feature of currency markets in August has been the resilience of the British Pound which has risen against the Euro, US Dollar and all major currencies, apart from the Canadian Dollar.

This is certainly a relief-style rally as overall sentiment towards Sterling remains negative - as evidenced by the latest market positioning data - and there might be a sense that the negativity has gone too far.

With traders returning to their desks following the August holidays, there has been some position-covering in order to account for the possibility that perhaps there is too much negativity towards Sterling, particularly with regards to the Bank of England.

“The currency's resilience suggests that investors are positioning for hawkishness, which we find a bit surprising considering the central bank's dovish views last month. However a number of U.K. economic reports are due for release this week and if they are strong, we could see more optimism from the BoE,” says Kathy Lien, Director at BK Asset Management.

Above: Sterling jumps on inflation data release.

Neil Wilson at ETX Capital reminds us that the Bank has for a long time emphasised that interest rates were required to deal with building inflationary pressures:

"Whilst this inflation report is unlikely to mean the MPC votes for a rate hike Thursday, it does increase the prospect of interest rates raising sooner than the market currently anticipates.

"The MPC has stressed that rates may need to be tightened by a somewhat greater extent than financial markets are suggesting, while governor Mark Carney has said that one hike over the next three years would not be enough to tame inflation. The data today supports the Bank’s view that the market may be overestimating the Bank’s tolerance of above-target inflation."

Outlook for UK Inflation

The jump in inflation recorded in August might be the final push higher in prices with many economists suggesting upward impetus is likely to run out from here.

"We don’t think the rise in CPI inflation has much further to run. Indeed, we expect it to peak at 3.1% in October, before dropping back next year as the impact of the pound’s fall starts to fade," says Hollingsworth.

However, others say we are not yet at peak-inflation and see further price rises ahead and expect further pushes from a weaker Sterling and hikes in domestic energy tariffs.

"It seems virtually certain now that CPI inflation will rise to 3.0%, or even slightly above, next month. Our forecasts suggest that this should prove to be reasonably near to its peak. Even so, not all of the pound’s 13% decline since June last year has yet been felt on the high street, so it may take a while before inflation heads decisively towards its 2% target," says Phillip Shaw at Investec in London.

Investec warn that the Bank of England will maintain a stubborn reluctance to raise interest rates, even in the face of such inflation. They see the Bank waiting until 2019 before raising interest rates.

Lloyds also see further inflationary pressires having for some time expected inflation to rise a little more sharply than that expected by the Bank of England, peaking at 3.1% in Q4.

"Today’s report lends support to that view. While we continue to view the overshoot relative to the 2% target as one the MPC will be willing to look through, such a relaxed approach will require ongoing corroboration in signs of decelerating economic growth, notably in household spending and continued indications of subdued wage growth," says Lloyds Bank's Sawjani.

The key for the British Pound going forward is whether or not the Bank of England adopts a similar tone and emphasises upside risks to inflation.