Euro Demand to Surge Further say HSBC, GBP/EUR Rate Forecast @ 1.0 for Duration of 2018

- Written by: Gary Howes

- Quotes:

- The Pound to Euro exchange rate today: 1 GBP = 1.1006 EUR

- The Euro to Pound Sterling exchange rate today: 1 EUR = 0.9085 GBP

Analysts at HSBC Holdings have said the Euro's rally might only be getting started, and this is one reason to expect parity against Pound Sterling in 2018.

In a briefing seen by Pound Sterling Live, HSBC say they have considered six aspects of market positioning and sentiment to assess whether the EUR has become a target of irrationally exuberant price action.

i.e has the Euro rallied too far, too hard against the likes of the Dollar and Pound over recent months?

The answer to this would be no; the rally is sustainable and should be self-sustaining for longer.

The key findings of recent research into currency markets suggests that while the “short-term money” appears to have gone long EUR, the slower-moving investment and reserves managers have not yet shifted to a more positive view on the region.

“We believe that, as this gradually changes, demand for the EUR will increase even further,” says Bloom.

The Rally Might only be Beginning

One standout point in the research concerns the potential for an imminent shift in portfolio investment intentions.

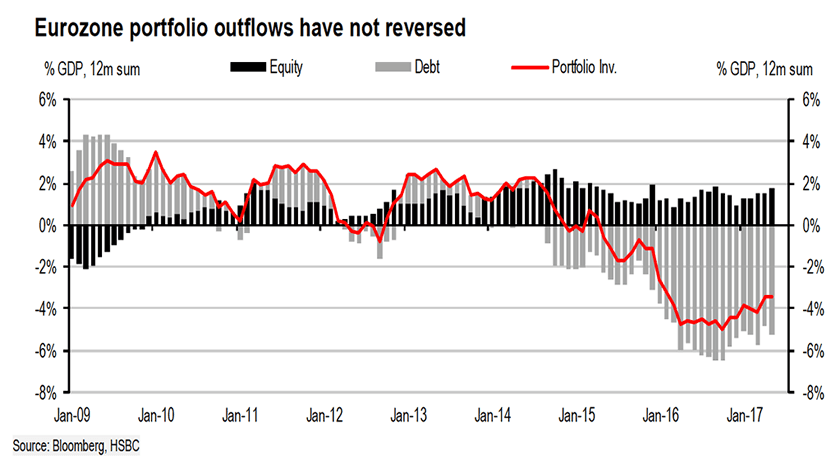

Looking at portfolio flows in the Eurozone Balance of Payments, it is clear to HSBC that negative sentiment towards the Eurozone was expressed mainly through sales of European debt. This led to notable outflows on the portfolio account.

Net debt outflows reached a peak of over 6% of GDP in the middle of 2016.

“There are signs that these outflows are slowing, as sentiment towards Europe improves,

rate differentials narrow in the EUR’s favour and sovereign risks diminish. But according to May’s data, the latest flow is still out of Europe, on a net basis,” says Bloom.

“The potential for a sizable shift here, and for much stronger EUR support, is significant. If portfolio investment as a whole were to reverse the net outflows seen since the start of 2015 – when those outflows originally started to accelerate – it could mean over EUR1trn of inflows into Eurozone debt. Looking from this angle, the rally in the EUR may only just be beginning,” adds the analyst.

Forecasts

HSBC believe if the ECB continue to avoid explicitly commenting on the Euro rally, as Draghi did at the July meeting, this gives the green light for additional Euro strength helping EUR-USD to rally through the rest of the year.

HSBC see EUR-USD at 1.20 by year-end and EUR-GBP at 1.0.

That’s "a 20% move and that’s quite something. It’s very unusual that we make such, what was at that time, an outrageous forecast," says Bloom.

"We are roughly half way there and we believe in it,” adds the analyst.

The call comes at a time of heightened focus on Sterling’s outlook with media attention being directed at investment bank Morgan Stanley last week owing to their call for the GBP/EUR exchange rate to fall to parity in early 2018.

The reason Morgan Stanley are expecting a decline in GBP/EUR is largely down to an expected rally in the Euro over coming months.

“Since the start of the year, the Fed's broad USD has lost 7%, pushing EURUSD up to our 1.18 year-end projection early. While USD is unlikely to maintain its current pace of downside momentum, we expect EUR to stay strong as pension funds and insurance companies (such as those in Switzerland and Japan) start to increase their net EUR currency exposure from historically low levels,” says Morgan Stanley’s Hans Redeker.

Is the fall in value of Sterling impacting your international payments? Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

The Euro Looks Overbought Near-Term - But is a Pullback Likely?

While the Euro remains a favourite amongst traders and the analyst community alike, there certainly is a sense that a pullback might be due.

The rally higher in EUR/GBP has been strong and some would advocate that now is not the time to bet on further strength.

“The EUR has been supported since the start of the week. However, with speculative oriented investors’ selling interest in the single currency rising and as there is limited scope of policy differentials diverging further to the benefit of majors such as EUR/USD, we advise against buying at these levels,” says Manuel Oliveri at Credit Agricole.

Micaella Feldstein at Natixis also identifies the Euro as being ripe for a correction saying the EUR/GBP exchange rate, "can rally further but we see profit takings against 0.9089/98."

We also note that latest data from the US Commodity Futures Trading Commission suggest traders are now getting wary of adding to the substantial pro-Euro bets that already exist in the market.

As such, the Euro could be due a bout of weakness but it's tricky to say just when this might happen.

However HSBC aren't concerned that a significant pullback is imminent.

"The fast money has become more positive on EUR but not to such a degree that it implies a pull-back is imminent. Additionally, the ECB has not shown any undue concern about the EUR rally which could give these investors the green light to continue to buy," says Bloom.

Furthermore it is noted that the slower moving investors have shown little sign of turning more bullish. "If they start to follow the speculators’ lead, then EUR-USD could move significantly higher," says Bloom.

Brexit: UK Seeks Custom Union as Position Papers Roll Out

The UK Government are due to release a number of position papers that will set out their negotiating objectives in upcoming Brexit discussions.

The first position paper due for publication on Tuesday is set to reveal that, for a brief period, the UK will seek a deal allowing the transit of goods across borders to continue as now – perhaps by striking a “temporary customs union”.

Ministers hope this will avoid economic disruption by giving businesses and officials time to gear up for a new customs regime; while sidestepping the constraint that full members of the customs union are not allowed to strike independent trade deals with non-EU countries.

The market's reaction to the news has been muted.

No specific time limit for the interim deal has been spelled out by the government, but ministers involved in the negotiations believe anything longer than two years would be unlikely to secure the backing of Britain’s EU partners.