Sea of Red: Data Shock Sends British Pound Down Against the Euro and Dollar

- Pound to Euro exchange rate today (8-7-17, markets closed): 1.1300, down 0.48%

- Pound to Dollar exchange rate today: 1.2885, down 0.65%

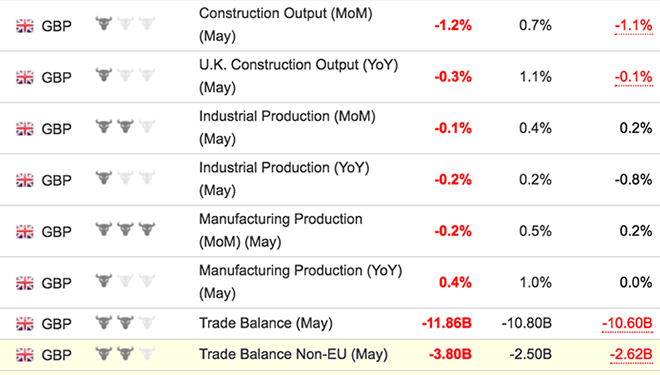

Latest data suggests the UK's manufacturing and industrial sectors are in contraction while the country's addiction to imports remains as strong as ever.

Pound Sterling has been hit by a tranche of poor data ahead of the weekend that questions the idea that the economy is recovering from a soft start to the year.

The ONS reports that manufacturing production in the May period fell 0.2% on the previous month's figure. Economists had forecast a reading of +0.5% which would have signalled impressive growth.

The miss is a massive one; of the scope that tends to move currency markets.

Industrial production data shows a monthly decline of 0.1% where analysts had forecast growth of 0.3%.

And, to top of this tranche of disappointment, the ONS reports the UK's trade deficit widened to £11.86BN where analysts had forecast a widening to £10.80BN.

Sea of Red: Data released ahead of the weekend did not go the way of Sterling.

Recall, that the longer-term stability of Sterling lies with the country’s ability to close this deficit. As long as the deficit remains as big as it is, the country will continue to rely on foreign inward investment to prop up the currency.

While this foreign investment is still forthcoming - at record levels actually - there is no guarantee that it will last.

The country really does need to become better at exporting.

"Today’s flurry of UK activity data casts some doubt on the likely strength of the bounce-back in overall activity in Q2," says Ruth Gregory, UK Economist at Capital Economics. "Not only did production and construction growth disappoint expectations, but output has now fallen for the second month in a row for the latter."

For Sterling the implications of the data are clear: The Bank of England might be foreced to row back from its recently communicated desire to raise interest rates.

"Taken together with survey data for the quarter so far, today’s weak outturns for the ‘hard’ production and construction output data push down our estimate of GDP growth for 2017 Q2 to 0.3%q/q. That takes it below the Bank of England’s assumption of a 0.4%q/q outturn," says Nikesh Sawjani, UK Economist at Lloyds Bank.

The Pound has found support of late on suggestions a rate rise might be imminent but comments from the Bank have always made it clear a rate rise was conditional on UK economic data.

The weakness in the manufacturing sector now casts doubt on whether now is the time to push the cost of borrowing higher.

For a complete table of GBP/EUR and GBP/USD forecasts from 45 investment banks and brokers download here

The Manufacturing and Industrial Production Data

The largest contribution to the fall in manufacturing came from the highly volatile pharmaceutical industry along with a range of other industries while the fall in energy supply was due largely to warmer temperatures.

What is striking is the bigger picture shown by the graph above: This sector of the economy has simply not recovered from the recession.

However, expectations for next month's release are positive.

“Weakness in the production sector has reflected the volatile phamaceuticals sector as well as the effect of May’s warm weather weighing on utility output, so we may see some reversal of the recent weakness in the coming months,” says Gregory.

The Trade Data

The ONS says the widening of the trade deficit in the 3 months to May 2017 reflects a higher rise in imports than the rise in exports of goods, in particular transport equipment.

This comes despite the massive fall in value of Pound Sterling seen following last year's EU referendum. It is clear that the Pound must fall further if we are to see exports rise and UK consumption to opt for domestically-produced goods.

However, Ruth Gregory at Capital Econonics sees some bright spots in the trade figures:

"May’s trade figures provided more encouraging news. While the overall trade deficit widened a little from £2.1bn in April to £3.1bn (consensus £2.5bn), the three-month growth rate of goods export volumes (excluding oil and erratics) was 3.3% in May, above the 1% rise in imports. This suggests that net trade should make a stronger contribution to GDP growth in Q2."