Could "Revenge of the Remainers" lead to a Recovery in the Pound?

One important theme of the electron has been the so-called ‘revenge’ vote of resentful Remainers.

This appears to explain much of the swing to Labour who ran on a policy of a ‘soft’ Norway or Switzerland-style Brexit manifesto.

Commentators have noted the high correlation between Labour and Conservative gains and Remain and Leave voting areas.

The Swing to Labour in London for example is a clear sign of Remain protest whilst the Conservative’s success in the North testament to the pro-Leave majority there.

Responses from other countries have echoed the theme of Brexit as a principle cause of the Tory demise and Labour recovery.

German Daily Frankfurter Allgemeine, called it: "A vote against a hard Brexit."

The Sun reported that, “the German employers' association has said it hopes Brexit negotiations will now be conducted with more realism and pragmatism,” as a result of the close-run election.

If this is so and Remain have spoken – how will this impact on Brexit negotiations going forward, and more importantly how will it effect Sterling?

Was Sterling’s Immediate Response Knee-Jerk?

The Pound’s initial response was to weaken by 2.0% after the exit polls suggested a hung parliament.

This led GBP/USD to fall from the 1.29s to a low of 1.2708 just after 10pm when the exit polls were published.

There were further loses in the morning when the results hammered home the expectation of a hung parliament.

The fall was caused by increased uncertainty for the economy - but also more specifically in relation to Brexit the fear of not getting a deal.

Official Brexit negotiations begin on June 19 but without a government in power they are unlikely to get very far, and there has been talk of them being rescheduled and delayed.

However, there is only a limit of 2-years from the triggering of article 50 to settle Brexit and this involves the negotiation of thousands of statues and hundreds of treatises.

It now seems unrealistic to expect this to be possible within a less-than 2-year timeline, and this increases the chances of a harsh cliff-edge Brexit to WTO tariffs as the only option.

This is the main reason what Sterling has fallen so sharply since the exit poll result.

A DUP Coalition

Without a clear majority Theresa May will have no other option that to form a coalition with the Northern Ireland DUP (Democratic Unionists) party, but the problem with that is that the DUP want a soft Brexit, and a “frictionless border” with southern Ireland.

“The DUP are rumored to have indicated that a “soft” Brexit may be the price that the Conservatives have to pay for its support – although this may be an untenable position for the more Eurosceptic Tory MPs,” said Capital Economics’ Paul Hollingsworth.

The big question with a coalition with the DUP would be how the two parties would come to a joint agreement on Brexit, and how the Conservatives would manage their strongly euro-sceptic contingent.

If the Conservatives and DUP managed to agree a middle way on Brexit – which is by no means a given – this would probably support the Pound as it would increase the chances of the UK remaining in the common market or the customs union.

If the Tories and DUP were not able to agree a coalition then Theresa May might try to form a government without the DUP. She would, however, run the risk of failing to get a vote of confidence on June 19 after the Queen’s Speech – which is also the same day as the start of official EU negotiations.

If she failed a vote of confidence she would not be able to govern and the country would have to return to the polls for another election.

“If another election was held, and a “progressive alliance” were able to form a majority, then a softer Brexit, and also the possibility of a second referendum on the final terms of the deal, would look possible,” said Paul Hollingsworth.

In the event of a “progressive alliance” kidnapping Brexit from the jaws of the Conservatives, Sterling would probably rise at the much more probably likelihood of a Switzerland or Norway-style soft Brexit.

This view is supported by Société Générale’s chief strategist Kit Juckes, albeit with a lagged time effect.

Initially he expects GBP/EUR to fall to 1.11 but then it could recover if a progressive alliance were to gain traction.

“The possibility of a labour-led coalition that could trigger a much softer Brexit with access to the Single Market - or even another vote - isn't really being considered yet. GBP might eventually benefit from a Labour win, but only after a period of even greater uncertainty weakened it further,” says Juckes in a note to clients.

Abn Amro are not as optimistic and see a higher chance of a no-deal resulting from the hung parliament, rather than a soft-deal.

“The Conservatives will now likely need to rely on support from the DUP, meaning an unstable UK government will conduct the negotiations for Brexit. Brexit negotiation process looks to have become even more complex with a greater risk now of a ‘no-deal’ scenario. Further downside for sterling if markets price in a ‘no-deal’ outcome,” said Abn Amro’s Nick Kounis.

The involvement of the DUP means that whilst the election has increased the possibility of No Deal, whilst it has also simultaneously lessened the chances of a hard Brexit.

“Any Brexit deal would need to pass through parliament, and therefore, the government would need to have all the pro-Brexit Conservatives MPs on its side as well as the DUP. From that perspective, a hard-Brexit deal (which significantly restricts trade and the free-movement of people) may have become less likely,” said Abn Amro.

Another less onerous possibility for sterling would be to lengthen the 2-year negotiation time for a Brexit and implement a longer-term transitional arrangement with the EU.

This would support Sterling by taking the pressure off and reducing the chances of a cliff-edge.

Different Post-Election Scenarios and their Impact on Sterling

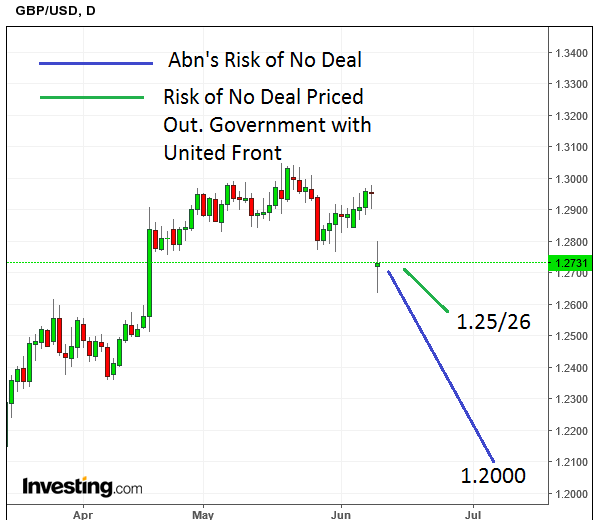

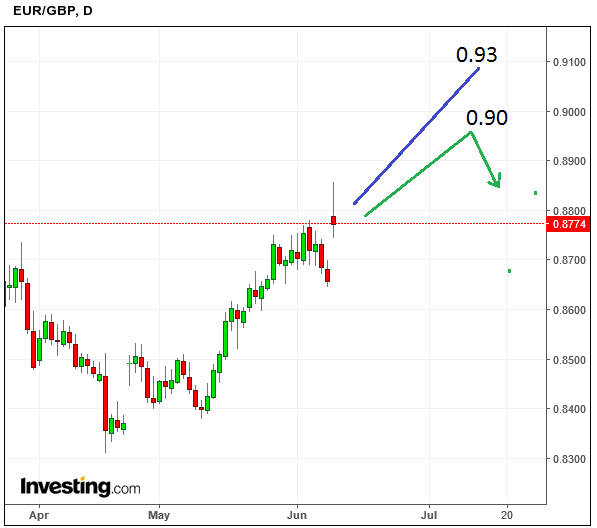

The downside risks to sterling have risen because of this higher ‘no-deal’ risk, say Abn Amro.

If financial markets price in a ‘no-deal outcome, GBP/USD could fall to 1.20 and EUR/GBP could rise above 0.93.

If the May along with the DUPs or a progressive alliance of Labour and others formed a government with a clear, broadly-supported strategy, markets may somewhat price out the ‘no-deal’ risk.

“In this case, we would expect GBP/USD to find support in the 1.25-1.26 area and EUR/GBP to top before 0.90,” said Abn Amro’s Kounis.

“Overall, we remain of the view that sterling is cheap on the basis of long-term valuation metrics,” concluded the Abn strategist.