"Aggressive" Upgrades to Pound Sterling Forecasts Announced at ING

- Quotes to reference:

- Pound to Euro exchange rate: 1.1787

- Euro to Pound Sterling exchange rate: 0.8481

- Pound to Dollar exchange rate: 1.2883

The world’s largest and most influential financial service institutions continue to tear up their old assumptions on the British Pound’s outlook and scribble down new numbers.

We have seen a flurry of changes to forecasts for the British Pound since Theresa May announced a snap General Election for June 8 with more than one institution calling the move a ‘game changer’ for the UK currency.

The news has been good for importers and those hoping for a stronger Pound thanks to the stability expected to flow from a bigger Conservative party majority being achieved on June 8.

The shift in sentiment all this has generated towards Sterling now has analysts at ING Bank N.V. estimating the Pound to Euro exchange rate is now undervalued by up to 12% on a long-term basis.

They see Sterling heading higher against the Euro as a result. This is highlighed below via their expectations for EUR/GBP:

However, it is ING’s hike to their Pound to Dollar exchange rate forecast that really raises eyebrows.

Stronger Government Mandates = a Stronger British Pound

Pound Sterling has traded higher since Theresa May called the June 8 election with an eye to securing a larger parliamentary majority.

Foreign exchange markets have reached the assumption that a stronger mandate will allow her to seek a more market-friendly Brexit deal and importantly negotiate the kind of transitionary period required to see the new relationship take shape.

Incidentally, we reported recently that not everyone agrees with this view with UBS suggesting we could end up with quite the opposite. The piece is worth the read if you are one inclined to a contrarian argument.

ING are confident in the assumption that a stronger majority is beneficial to the Pound.

Analysts have played with some graphs and come up with quite an interesting observation - stable and strong UK governments tend to correspond with a stronger Pound.

The above figure, “tends to point to a stable to strong Pound under large government majorities. Coincidentally, some of the largest Sterling declines (apart from the the 2008/09 Global Financial Crisis have come under weaker Conservative governments,” says Chris Turner, ING’s Head of Foreign Exchange Strategy.

“Should the Conservatives manage to secure a 100+ majority on 8 June, we would expect GBP to enjoy a modest bounce = largely on the view Theresa May would be able to marginalise the more ardent Brexiteers in her party,” says Turner in a note dated May 3.

The benefits of a Conservative win are however likely to only provide near-term relief as, “the timing of a more significant Sterling rebound, is probably a function of real evidence of compromise between the UK and EU policymakers.”

Pound Below Fair-Value in Short-Term

The bigger picture is all about Brexit though.

“Market perceptions of the style of Brexit have implications for both where GBP trades today and where investors expect it to trade in the longer-term,” says Turner.

ING’s own studies of the Pound’s short-term fair-value against the likes of the Euro and US Dollar suggest the Pound traded up to 10% under fair-value at October’s Conservative Party conference and during that flash-crash that soon followed.

Currently the model suggests the exchange rate is not far away from short-term fair value so we are not near the extremes seen back in October.

This suggests to ING that there is scope for short-term GBP upside should the Conservatives win big in the election.

Longer-Term Undervaluation Extreme

However, looking at a longer timeframe modelling of the Pound’s fair-value, ING say the GBP/EUR exchange rate is now materially undervalued.

The cross is currently 12% undervalued and outside an acceptable one-and-a-half standard deviation.

This suggests to Turner and his team that a good deal of bad news is already priced into GBP.

This isn’t the 2008 Financial Crisis

Is the Pound’s undervaluation justified?

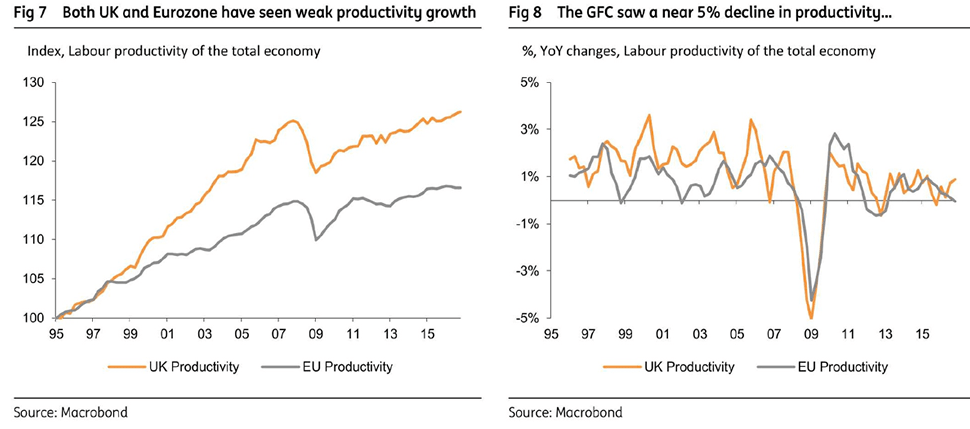

Such undervaluation would be justified were there to be a massive hit to labour productivity under a hard-Brexit scenario argue ING.

“The uncertainty around the nature of Brexit - and particularly its impact on trade openness and FDI trends - has generated much guess-work as to how much UK productivity slows relative to the eurozone,” says Turner.

ING’s analysis suggests that the current GBP/EUR undervaluation factors in a 10% drop in UK labour productivity.

“In our view, this looks too extreme,” says Turner. “For example, the productivity shock to the UK economy during the 2008/09 financial crisis was worth -5% from peak to trough, half of what is currently priced into GBP accoutring to our BEER model. From this perspective, plenty of bad news seems to be already priced into GBP.”

Above: The Pound is trading as if Brexit were to be as bad as the great financial crisis of 2008.

Even the most ardent of ‘Remainers’ who would like to see the UK pay dearly for its decision to quit the EU would agree that Brexit represents nothing nearly as dangerous as the financial crisis.

Changes to ING’s Forecasts

ING say that forecasting the EUR/GBP to trade near 0.88 over the next three years requires an assumption of the hardest possible of Brexits.

And as we have seen above, the bar to such a negative scenario is set unrealistically high.

0.88 in EUR/GBP equates to 1.1363 in GBP/EUR.

“Instead we see periods when the market prices in a more benign outcome for GBP,” says Turner. “Those periods could well be at the end of this year, on the assumption a divorce bill is reached.”

Another period in which a benign exit might be reached is at the end of 2018 when ING are assuming a mutually-beneficial deal can be brokered through the implementation/Transition phase 2019-2022.

“A big Tory win at the 8 June election makes such a scenario path more likely, in our view,” says Turner.

The EUR to GBP exchange rate forecast of the third quarter 2017 is downgraded from 0.90 to 0.88.

The end-of-year forecasts is downgraded from 0.88 to 0.85.

The first-quarter 2018 forecast goes from 0.87 to 0.83 and the mid-year 2018 forecast from 0.86 to 0.85.

The end-year 2018 forecast goes from 0.85 to 0.80.

This equates into upgraded GBP to EUR exchange rate forecast targets seen at 1.1364, 1.1765, 1.2048, 1.1765 and 1.25 respectively.

The Euro is expected to catch a bid as the ECB looks to exit its quantitative easing programme, but this should ultimately give way once more to Sterling’s recovery.

The GBP/USD exchange rate is upgraded from 1.22 to 1.31 for the end of the third-quarter 2017.

The end-2017 forecast is upgraded from 1.27 to 1.35.

By the end of the first-quarter 2018 the forecast is seen at 1.39 having been at 1.30 previously.

Mid-2018 sees the rate at 1.41 instead of the previous forecast for 1.33.

By the end of 2018 1.51 is now forecast as opposed to 1.35.

“We struggle to see Cable getting back to 1.20 now, given that we look for EUR/USD to stay supported into the summer - on the back of more ECB optimism and Trump policy mix, where the extreme outcomes of aggressive reflation or aggressive protectionism have been curtailed,” says Turner.

“1.35 is not a particularly aggressive GBP/$ call for year-end 2017, but 1.50 by year-end 2018 is. Here GBP/$ should be dragged higher by the tail-wind of EUR/USD, where the start of the ECB tightening cycle in 2h18 should be lifting European currencies - and GBP - higher across the board,” adds the analyst.