British Pound to Struggle Against Euro, Dollar on Bank of England Meet

Pound Sterling startet the new week on a convincing footing but we believe it might not hold onto these gains in the teeth of several major events.

Indeed on Tuesday, March 14, the Pound to Euro exchange rate has slipped back to 1.1419 and the Pound to Dollar exchange rate to 1.2160 as much of the advance recorded at the start of the week is reversed.

Looming large on the horizone is the Bank of England's monthly policy decision to be delivered on Thursday March 16 at 12.00 G.M.T where policy-makers are expected to keep interest rates unchanged.

Whilst the BoE meeting on Thursday is likely to result in no-change in policy, there is an increasing possibility that the minutes could show more dovish discussions, following the spring budget statement.

The Bank's stance should help keep the yield on UK Government bonds (interest rates) under pressure, which in turn feeds into a weaker Pound.

"GBP/USD remains near the lows, pressured by the widest rate spreads on record. Typically the UK and US business cycles are synchronised, but the different implications of Trump and Brexit for trans-Atlantic monetary policy is stark. Two year sovereign spreads are now 127bp," says a note from ING.

ING belive the Pound is at risk of losing more of its reserve status as a result of the UK bond yields unsyncing from US counterparts and say this should keep the currency under pressure.

The Bank Has no Choice but to Keep Rates Low

So what Sterling needs is a Bank of England that is willing to hint at higher interest rates in the future.

But the recent budget provided only limited stimulus for the economy via the tax and spending channel, leaving most of the stimulatory 'heavy lifting' to monetary policy at the Bank.

This means the Bank is more likely to keep rates on hold than raise them, as raising them could constrain growth.

Since interest rates have a profound effect on currencies, continuing to keep them down could keep the Pound weak, especially against nations where interest rates are being lifted more aggressively, such as the United States.

Although the chancellor ostensibly gave way 3bn extra in fiscal stimulus in the budget, the figure’s significance was distorted by the increased tightening in the previous year.

“Admittedly, part of this movement is a genuine easing back of the fiscal squeeze, with a £3bn net policy giveaway – including extra spending on social care and increased personal injury payments. But the change mainly reflects a number of timing factors which are unrelated to economic activity and mean that the implied loosening in 2017-18 is just a reflection of the larger implied tightening in 2016-17,” says Scott Bowman at Capital Economics in a note seen by Pound Sterling Live.

The timing factors include a fall in revenue from the higher tax on dividend payments in 2017-18 compared to the previous year.

A fall in corporate tax revenue after 2bn was shifted from 2017-18 to 2016-17.

Finally, a change in timing of requests of payments made to the EU budget meant 2bn of spending was taken out of 2016-17 and moved to 2017-18.

The result is that in effect the budget represents a squeeze on fiscal spending, not an expansion.

“Taking these timing factors into account suggests an underlying tightening of the fiscal stance of around 0.3-0.4% of GDP in 2017-18, followed by 1% in each of the two subsequent fiscal years. This is very similar to the cumulative amount contained in the Autumn Statement,” said Capital’s Bowman.

The fiscal squeeze is expected to lead to a significant drag on GDP over the next few years.

“The squeeze of 1.0% of GDP in 2019-20 still appears particularly large considering that is in the year before the next General Election. This suggests that the Chancellor might not follow through with all of the fiscal tightening contained in his plans,” added Bowman.

The upshot of this squeeze is that the BOE will need to keep monetary policy accommodative – perhaps more than it would have if the Chancellor had been more generous.

Nevertheless, Capital do not now completely rule out a rate rise in the future, arguing their view on the economy is that it will outstrip current growth forecasts, forcing the BOE to raise interest rates anyway.

The path of interest rates, may be gentler than previously expected.

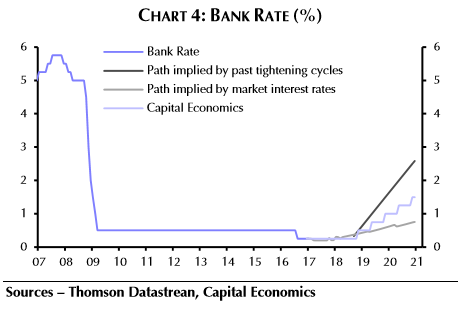

“Accordingly, the onus will remain on monetary policy to support the economy. Admittedly, we think that the Bank of England could start raising interest rates sooner and faster than market pricing currently implies, if the economy holds up as well as we expect. But any tightening should be much more gradual than in past cycles and interest rates will probably remain well below those seen prior to the financial crisis. (See Chart 4.),” commented Capital Economics.

Article 50 to be Triggered

The House of Commons has voted to resend the Brexit Bill back to the House of Lords unammended.

The Lords will now likely pass the Brexit bill, paving the way for the government to trigger Article 50 so the UK can leave the European Union.

Peers backed down over the issues of EU residency rights and a meaningful vote on the final Brexit deal after their objections were overturned by MPs.

The bill is expected to receive Royal Assent and become law on Tuesday.

Downing Street sources have told the BBC this will not happen this week and the PM is expected to wait until the end of the month to officially notify the EU of the UK's intention to leave, thus beginning what is expected to be a two-year process.

“We doubt the announcement of Article 50 (possibly 16 or 25 March) has an immediate impact on GBP. Instead, it should usher in a period of tough bargaining, weighing on GBP over coming quarters,” says Chris Turner, Head of Foreign Exchange Strategy at ING in London.