British Pound Slips on Services PMI Release as it Finally Starts Taking Notice of Fundamentals Again

An interesting development has taken place over the course of the past few days - the Pound is finally starting to focus on data and other fundamental drivers once more.

Pound Sterling has long been influenced by the twists and turns of the Brexit story - while ignoring the news on the economy.

But, the reaction to the Bank of England Inflation Report on Thursday February 3 and the service PMI report on Friday February 4 confirms the Pound is trading on fundamentals.

The only problem for Sterling bulls is that markets have only decided to take notice at a point when the data comes in below expectation!

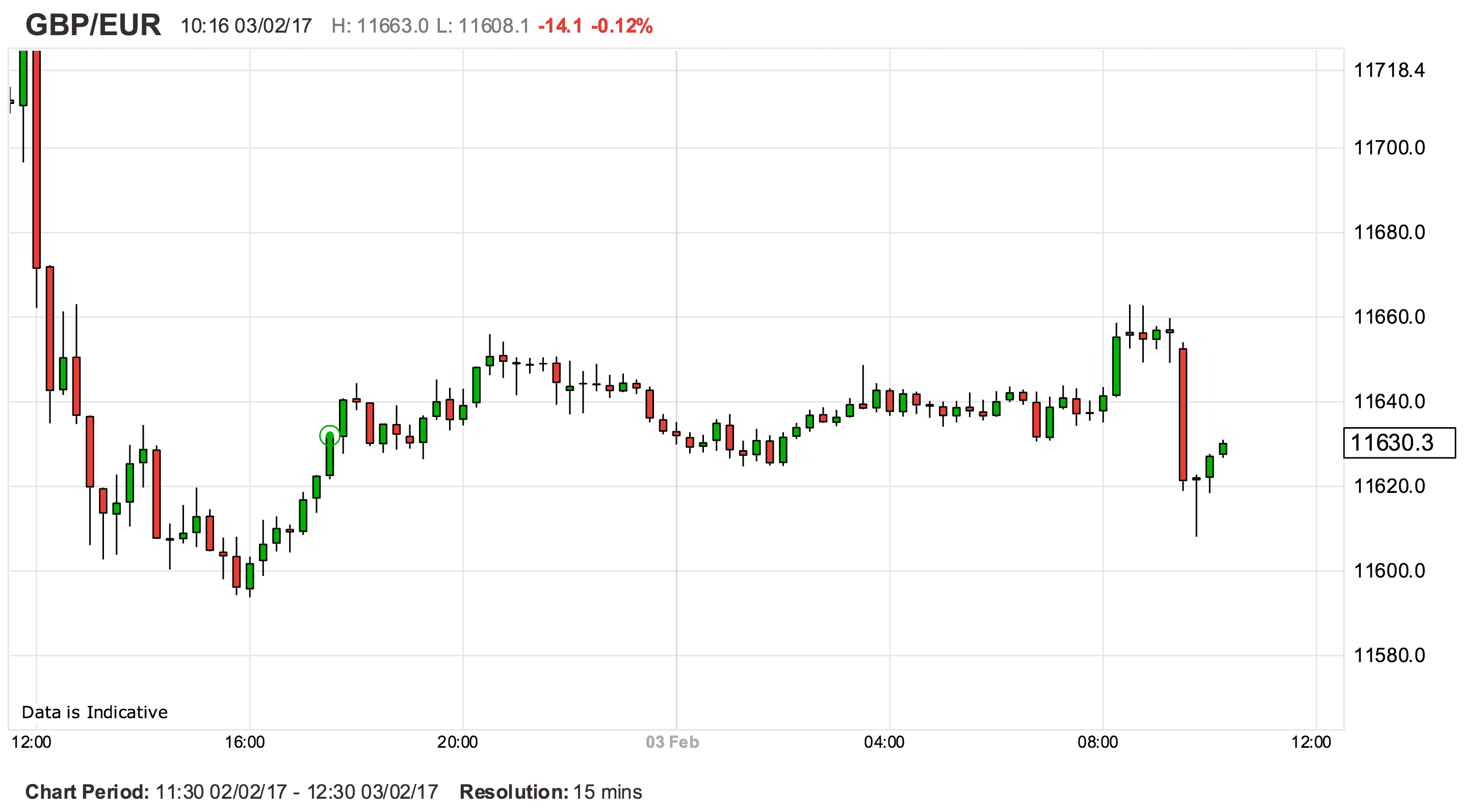

Above: The red bar at 09:30 confirms a negative reaction in GBP/EUR to the Services PMI release.

The dominant UK services sector slowed down in January with Markit and the CIPS reporting a figure of 54.5, below the previous month’s 56.2 and below consensus estimates for 55.8.

This is the first fall in four months BUT the same report indicates the strongest business expectations since May 2016 with part of the improvement coming from the added clarity surrounding Brexit.

The details:

- Inflationary pressures remained intense, with input price inflation accelerating to the highest since March 2011.

- New business increased for the sixth consecutive month in January.

- Overall degree of sentiment was the strongest since May 2016, and the equal-highest for a year-and-a-half.

- Positive sentiment was linked to new business pipelines, new product launches, low interest rates, diversification into new markets, marketing campaigns, a recovery in oil prices, greater political stability and clarity around Brexit

“With business optimism rising for the second month in a row, the sector has defied the Brexit doomsayers and is poised to maintain growth in 2017,” says David Noble, Group Chief Executive Officer at the CIPS. “With one eye firmly on the inflationary landscape, which is likely to become a permanent fixture in the coming months, the sector will be challenged to maintain its current trajectory.”

The data puts lends a touch of credibility to those who are forecasting a notable slowdown in UK activity in 2017.

While the Bank of England has upgraded forecasts to 2%, others maintain the view that circa 1% growth is more realistic.

Daniel Vernazza, economist with UniCredit in London, is one of those who believes UK economic growth to slow this year, although the exact timing and extent of a slowdown remains highly uncertain.

"The stronger than expected growth since the Brexit vote has been entirely due to much stronger than expected household consumption growth. It won’t last," says Vernazza.

Inevitably, consumption growth will slow as a result of higher imported inflation and the impending squeeze on real household income growth.

The BoE reckons the savings rate will continue to fall from an already very low level and for Vernazza this looks particularly risky given high uncertainty both domestically (surrounding Brexit) and globally.

Moreover, the BoE’s judgement on the savings rate seems to be supported by their projection that the unemployment rate will fall further, from the current 4.8%, which in Vernazza's view is unlikely as economic uncertainty is likely to hit hiring.

UniCredit forecast real GDP growth of 0.3% qoq in 1Q17 and annual growth of 1.4% in 2017.

The Pound Falls into a New Normal

The Pound to Euro exchange rate slid to 1.1630 on the news and the Pound to Dollar exchange rate to 1.2494.

“A sharp reversal from the top of the range leaves momentum biased to the downside today, coupled with bearish candle chart patterns. As such, the technical set-up is for a move back to pivot supports in the 1.2450/1.2350 region,” says Robin Wilkin at Lloyds Bank.

Regarding the Pound versus Euro rate, Wilkin says the pair is settling into a range.

Short-term the exchange rate has become trapped between 1.1834 and 1.1547 support and resistance levels, while the broader medium-term range is still 1.2121 – 1.1236.

“Intra-day studies are mixed and offer little bias at this stage. We therefore have a more neutral stance from a technical perspective today,” says Wilkin.