Swedish Krona Forecast to Strengthen in 2017 by SEB

Excess is somewhat frowned upon in Sweden, so when it comes to their currency, the Krona, it is no surprise that whilst they see it rising, they don’t see it rising excessively in 2017.

The driver for the Krona’s modest appreciation, according to analysis from SEB’s Charlotte Asgymr, is likely to be a change in the Swedish Central Bank, the Riksbank's monetary policy.

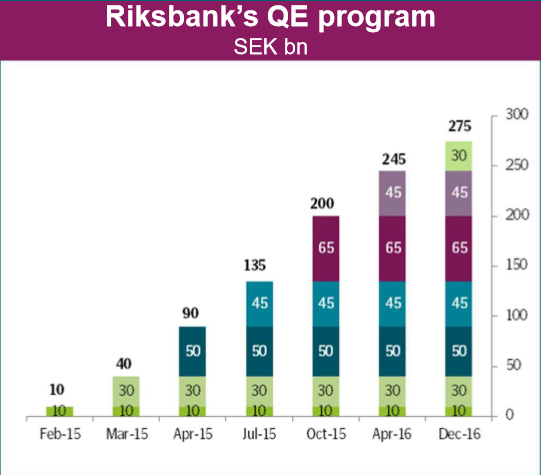

Up until now, the Riksbank had adopted an unconventional approach, combining negative interest rates and quantitative easing or bond purchases, also known as QE, to help support growth and prevent deflation.

Most recently at their December meeting, the Riksbank's monetary policy committee voted to increase QE by 30bn to 275bn in total, which had the effect of weakening the Krona.

But SEB’s Asgymr now sees the currency as extremely undervalued.

That, combined with the probable end to QE (the December meeting vote was only narrowly won by the governor’s casting vote) are the twin drivers she sees for the Krona’s modest appreciation in 2017.

In the absence of QE, the Krona is likely to rise, but its appreciation is also likely to be capped, says Asgymr.

Whilst the bank is expected to unwind QE it is not expected to increase its interest rates (repo rates) which stand at -0.5%, one of the lowest in the world, and this will probably be a drag on the currency.

The -0.5% rate is relatively speaking very low compared to other currencies, so interest rate spreads with other currencies will continue to be SEK negative in many cases, particularly with US rates rising due to the effect of Trumponomics.

Investors tend to gravitate to higher interest bearing currencies where they are assured a return from the interst rate differential if nother else.

“Riksbank is unlikely to continue QE program H2 2017 but excess liquidity/negative repo rate prevent meaningful turnaround in rate spreads,” said SEB.

Yet, nevertheless, despite this SEB still see the SEK rising versus USD and EUR, although their favoured short-sell option is versus the EUR.

The Bank advises selling the Euro versus the Krona at 9.95 with a target at 9.40/50.

“Upside in SEK remains limited H1 2017 (eg9.40/50 in EUR/SEK), implied vols are expected to head lower still," states Asgymr.

They also recommend selling USD/SEK at 9.25/35.

SEB is not the only bank who see SEK strengthening.

DNB's Magne Ostnor also expects the currency to recover due to lessening Riksbank involvement.

"We expect the SEK TWI (Trade Weighted Index) to strengthen 10% in 2 years, but think Riksbanken has come to the end of the easing cycle," said Ostnor in a recent note.

Other Macro Economic Projections

Part of the reason why SEB are so sure of an end to QE is the strong above trend growth enjoyed by the Swedish economy, which they expect to show GDP rise by 2.8% in 2017 (Riksbank forecasts only 2.4%).

If so the economy will have shown above-trend growth for four years in a row.

Inflation is also on the rise due to higher fuel costs and the effect of the weaker Krona.

Unemployment remains moderately low at 6.2% and although wage growth is still weak it is expected rise when the labour market tightens.

Overall, the signs are the Riksbank has probably reached a trough in its easing cycle, from where it is likely to start moving up.

GBP/SEK – Potentially Weakening to 11.0000

What goes for Euro and USD also probably goes for the Pound.

If anything, Sterling is arguably more at risk of weakness than either of the other two, especially the Dollar.

SEB’s forecast that SEK will rise but not excessively in 2017probably also applies to GBP/SEK.

The chart below shows SEK has already started rising versus the Pound, breaking below a key trendline and moving down to the 50-day MA at the 11.30 level.

The trend is still unclear at this point despite the recent bout of SEK strength and GBP weakness.

A clean break below the December 23 lows at 11.2450, however, would confirm a step continuation lower, to an eventual final target at 11.0000.

The MACD indicator, which has moved below the zero-line is also indictaing more downside.

Alternatively, a break above the 11.77 highs would signal a continuation of the bullish trend to a target at 12.0000.

Save

Save