Pound to Indian Rupee Forecast: GBP/INR Remains Vulnerable Despite Recent Rally

The GBP/INR exchange rate has enjoyed strength this week, but charts suggest the longer-term grind lower is likely to ultimately re-establish.

The Pound to Rupee exchange rate has edged higher over the course of the week gone by with a low of 86.137 recorded on the 15th giving way to rally to 87.6997 on Friday.

The Indian Rupee suffered over continued uncertainty as to who may take over leadership at the RBI; whilst Pound Sterling gained due to better-than-forecast retail sales data from the UK.

In fact Sterling saw three positive data releases - inflation, employment and retail sales - all of which have cast doubt on the negative forecasts made on the UK economy since the Brexit vote.

Although the GBP/INR looks poised to rally further after posting a bullish ‘Three Outside Up’ Japanese candlestick pattern on the daily chart, the longer-term monthly chart (see below) tells a different story altogether.

The break below the neckline of a large double top reversal pattern seen above, a drop to a minimum downside target of 83.195, (the current exchange rate is 88.014), is signalled.

A break below the 86.037 lows would provide confirmation of a continaution lower to the 83.195 target.

Furthermore, the MACD indicator has moved below zero also signalling a change of trend from up to down.

Sterling still vulnerable

It is, however, possible that sterling has got a little ahead of itself in response to this week’s data, which was considered very positive by analysts, but which is still potentially too recent to gauge the longer-term full implications of the decision to leave the EU on the UK economy.

For example, whilst Tuesday’s headline inflation data was only marginally higher, the recent dramatic fall in sterling, would have been expected to increase prices more.

Neverthelss, Producer Prices in July, ie Factory Gate prices, did show a substantial rise, reflecting the more instantaneous response to the weaker pound felt by industry and those who import foreign components in high volumes.

The better-than-expected unemployment data was for June and so mostly covered a period before Brexit.

The stellar Retail Sales data was boosted by the July heatwave and was for a period prior to most households feeling the impact of Brexit “materially”, according to the head of the British Retail Consortium (BRC) whose data out earlier was similarly positive.

It’s therefore possible the pound’s rally may be short-lived as analysts start to critique the data, and find it limited as a longer-term gauge of Brexit.

Hawkish or Dovish Orientation of Rajan’s Replacements

Of major interest to rupee traders, however, will be the person anointed as successor to the throne of the RBI now that the present incumbent Raghuram Rajan is set to step down on September 4.

Rajan has been widely praised as a steadying hand at the RBI after he tackled high inflation, sandbagged the country’s FX reserves and underpinned the sagging rupee.

Prime Minister Modi and Finance Minister Jaitley now have the unenviable task of seeking asuccessor who can inspire as much confidence as Rajan, who will be a hard act to follow.

The two were reported as meeting on Thursday to decide who to appoint but there is still no news of his successor.

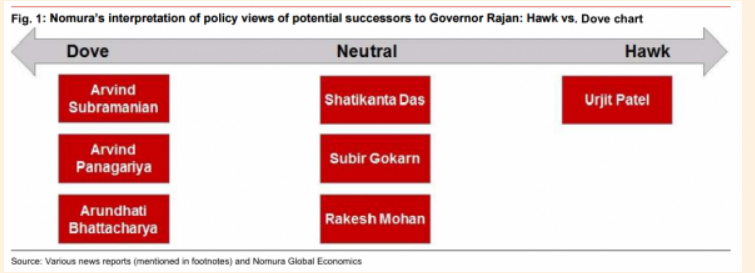

The seven most likely nominees, according to Times of India, are, “Former RBI deputy governor Subir Gokarn, deputy governor Urijit Patel, chief economic advisor Arvind Subramanian, Niti Aayog deputy chairman Arvind Panagariya, SBI chairman Arundhati Bhattacharya, and economic affairs secretary Shaktikanta Das.” Bloomberg names eight by also including K V Kamath.

Aravind Subramania, Arvind Panagariy and Arundhati Bhattacharya are monetary doves (more likely to cut interest rates) so if any of them are appointed the rupee will probably weaken as a result (GBP/INR will go up).

Patel is seen as hawkish (more likely to raise interest rates) like Rajan was, so if he is appointed it would probably lead to a rise in the rupee (GBP/INR will go down).