How is the Pound Likely to React to Hammond's Planned Stimulus Drive?

Theresa May's new Chancellor has scraped the previous administration’s goal of generating a budget surplus by 2020, allowing himself more room for manoeuvre in addressing the potential economic fall-out from Brexit.

In a speech immediately after the referendum, Bank of England (BOE) Governor Mark Carney made it clear that he could only do so much for the economy given how low borrowing costs already were.

By implication he was suggesting that an increase in fiscal stimulus - otherwise known as government spending / tax cuts - would have to play a role alongside the monetary stimulus he controls.

It now appears the Treasury has headed his call after the new chancellor of exchequer, Philip Hammond, announced he is going to “reset” the government’s economic policy, a euphemism for increasing government spending.

To gauge how this might effect sterling we might look to the case of Canada, where the recently elected liberal government also promised a great fiscal stimulus push to fight the recent economic slowdown (caused in their case by the dramatic slump in commodities).

In the end the effect was to take the pressure off the central bank which had previously been the main stimulus provider.

This led to a rise in the Canadian Dollar, as it was seen as reducing the likelihood the Bank of Canada would cut interest rates; which in modern global capitalism is positive for a currency as international investors prefer placing their money in countries which offer higher returns.

Cutting interest rates diminishes those returns and therefore aids a weaker currency.

Will a similar programme of government spending in the UK have the same effect on the Pound?

Much probably depends on what form the stimulus programme takes, and this we are unlikely to know until the Autumn budget statement.

Nevertheless, one of the more talked about measures considered, is a cut in Value Added Tax (VAT) on goods and services.

"Uncertainty will weigh on UK growth for a long time, but a targeted fiscal stimulus could help deal with the short term shock. Focus should be on offsetting the negative effect of currency depreciation on consumers' purchasing power. A temporary return of the normal VAT rate to 17.5% could absorb all the shock in year 1," says Gilles Moec at Bank of America Merrill Lynch Global Research.

This was the method used in 2008 when the then chancellor Alistair Darling launched a 20bn stimulus package to offset the negative consequences of the financial crisis.

A chart of the pound’s Trade Weighted Index (TWI) shows the currency fell sharply in 2007-8 and then stabilised and went roughly sideways for the next few years.

The lower 15% VAT rate was introduced on December 1st 2008 at which point the pound was in the final stages of its decline (see chart below).

The Pound then bottomed and went sideways for the next three years, indicating that the VAT measure did not seem to have a discernible impact.

“Shops cut prices, but the evidence of the cut in VAT was mixed. A study by the taxman in 2010 showed that 55pc of businesses felt it had no impact on their customers,” notes The Telegraph.

Given markets often react on the rumour rather than the fact, it’s possible to argue that part of the reason for Sterling’s sharp depreciation during 2008 may have been traders reacting to the news that the lower VAT was going to be introduced.

However, it could be argued that the lower VAT rate boosted consumer confidence and spending, thereby steadying the economy, ensuring the Bank of England did not need to enact any further GBP-negative rate cuts.

But, Higher Spending = a Higher Reliance on Imports

Lowering VAT would be expected to stimulate consumer spending, and given most products are foreign imports this would reduce the price of these imports making them more attractive to British consumers and thus increasing demand.

The greater levels needed to meet that demand would increase the selling of pounds to buy more foreign imports, leading to a weakening of Sterling.

Indeed, this is at the root of concerns about the UK’s Current Account deficit, which currency watchers think places a cap on Sterling strength.

Infrastructure

Another method the government could use to stimulate the economy would be to invest in infrastructure spending.

This is an area where some economists believe the money would be well spent, perhaps better spent than if it were used to cut VAT, which only had a very minor if any impact on growth.

Capital Economics’ Scott Bowman has suggested using the extra money to boost business investment and infrastructure spending.

Business investment is expected to be one area severely hit by Brexit, so a boost from government would be useful there.

Infrastructure spending on projects such as roads, hospitals, schools, social housing, electrifying key railway lines etc is similar to the Canadian model which saw CAD rise as it took the emphasis of cutting interest rates, so this sort of spending could well support the pound.

One criticism of infrastructure, however, is that it can be slow – or if too quick can lead to poorly focused spending.

This is because there are unlikely to be a sufficiently high number of viable projects which currently need funding to spend enough money quickly enough to counter the slow-down caused by Brexit.

In addition, these projects can take a long-time to get off the ground.

Bowman, agrees with the second point about timing but says there are a sufficient number of projects in the pipeline:

“Generally, infrastructure investment isn’t considered appropriate for short-term stimulus due to the time it takes to get projects started. But the UK currently has a significant amount of infrastructure projects in the pipeline. The government’s National Infrastructure Delivery Plans from March included £100bn of government spending on infrastructure over the next five years. Some of these projects could conceivably be brought forward – only about £17bn spending is planned for 2016/17. While it would be difficult to bring forward major projects (e.g. HS2) – smaller projects (e.g. improving roads) could be used for stimulus.”

However, there would be many advantages to increasing infrastructure spending now.

Firstly, borrowing costs are at record lows, meaning the government could borrow the money at a fraction of the average cost.

Secondly, most major think-tanks and world economic organisations are urging countries to invest more infrastructure, not less, this includes the OECD and the World Bank.

Finally, the UK is losing ground when compared to other developed countries in terms of quality of infrastructure. A recent study placed them 27th in the world in terms of quality and effectiveness of infrastructure.

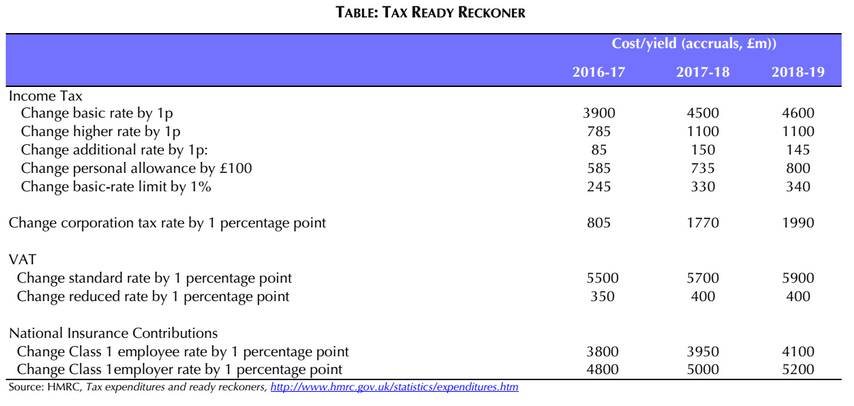

Other more direct methods of stimulating investment and the economy come under the umbrella of tax cuts.

Capital Economics’ Bowman says that investment could be increased by making the UK a more attractive destination for businesses by lowering corporation tax yet further (George Osborne already decreased corporation tax to 15%).

Clearly, increasing inbound investment by making the UK a more attractive place to be based would help sterling, as it would bring more capital into the country from abroad, increasing demand for sterling in the process, as well as confronting some of the fears underpinning the recent sell-off in the currency.

Another method to increase business investment mentioned by Bowman would be to raise the annual allowance companies can set against tax for capital expenditures.

As far as consumers go, the government could increase the personal tax free allowance - which is already planned to be raised to 11,500 in march 2017 and 12,500 by 2020 – however, they could speed up the process.

Such a policy, which would be more consumer-orientated, might, like cutting VAT, increase consumer spending on foreign imports and possibly lead to a weakening in the pound as a result.

However, regardless of which stimulus option - or options - the government eventually choses, the likelihood is the new measures will not be announced until the autumn budget statement.

Before then the likelihood is that all the responsibility for stimulating the economy will fall on the shoulders of the BoE, through the likes of cutting interest rates and increasing QE, and whilst the onus is on monetary policy and not fiscal policy, the pound is likely to weaken yet further.