No Mr. Soros, Brexit Will Not be a Black Friday for the British Pound

George Soros says the British pound is at risk of another 'Black Wednesday' event should the UK vote to Leave the European Union on June the 22nd. We disagree.

George Soros, the man who once ‘broke the pound’ is back in the headlines with warnings that the British pound would suffer a cataclysmic decline, similar to Black Wednesday of 1992, should the UK vote to exit the EU.

Soros has told The Guardian that:

“I would expect this devaluation to be bigger and also more disruptive than the 15% devaluation that occurred in September 1992, when I was fortunate enough to make a substantial profit for my hedge fund investors at the expense of the Bank of England and the British government.”

George Soros's Quantum Fund, and other speculators, borrowed UK gilts only to sell them and buy them back later at cheaper prices.

They repeated this 'short' trade every few minutes, making a profit each time.

Soros apparently made £1bn for him and his clients from selling gilts he didn't own.

By mid-morning the selling was so intense that Bank of England officials were buying £2bn of sterling an hour.

Why This Time is Different

There are a couple of points to note that suggest GBP is unlikely to suffer another Black Wednesday event.

Firstly, we must understand the environment that Sterling traded within back then.

The UK had joined the European Union’s Exchange Rate Mechanism (ERM) which stipulated member currencies must trade within a certain band.

The ERM was part of the European Monetary System (EMS), the aim of which was to reduce exchange rate variability and achieve monetary stability in Europe.

The end goal was to prepare Europe for the introduction of the euro, which was introduced on 1 January 1999.

Therefore, the pound was not priced according to economic fundamentals.

Rather it was set to artificial levels, propped up by the Bank of England.

For a central bank to keep the value of Serling artificially high for a prolonged period was always a hard ask.

In fact, The Treasury conceded in a 1993 review of the costs associated with Black Wednesday that, “returns to intervention have been negative in most years; sterling interest rates have been higher than foreign interest rates, and this has not been offset by correspondingly large depreciation of sterling.”

Jim Trott, chief dealer at the Bank of England at the time, described the day as "stunningly expensive".

He said that behind the scenes he bought more sterling in four hours that day than anybody had before or since.

This was a nasty arrangement that gives a clear insight as to the inherent flaws of a unified monetary system for economies of differing character.

Following the exit from the ERM, Sterling dropped 15% against the US Dollar and the German Mark in the space of just a week, ending the year 25% lower against the Greenback.

In short, it slipped to where it should have been.

Soros arguably did us a favour by showing us the futility of maintaining an exchange rate not in keeping with fundamentals.

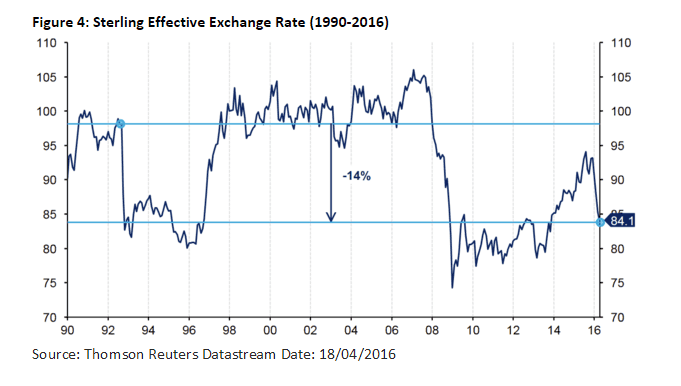

In trade weighted terms, the pound is currently trading around 14% lower than it did prior to the removal of the ERM in early September 1992.

“This would suggest that the Pound has less to fall in the event of a Brexit than it did following the withdrawal from the ERM,” says Enrique Diaz-Alvarez, analyst with Ebury Partners.

The pound is a free-floating currency, the volatility witnessed in 2016 have been notable but declines serve a purpose - they cushion us against any shocks.

We are therefore arguably close to the bottom implied by Brexit.

The other point about Black Wednesday in 1992 is the market is structurally different.

No one really knew what Soros and his crew were up to, but we do no now how the event unfolded.

The big loser was the Bank of England, which prior to Gordon Brown taking over the Treasury, was an arm of government.

We may not see short selling on the scale we did back then because the Bank of England’s desperate defence of the pound directly fuelled the kind of profit’s reaped by Soros.

In a rational market there would not be a counterpart as willing to take hit after hit that would allow the damage to be exacerbated.

Treasury papers would be released showing the cost to be an estimated £3.3bn

“We do not anticipate a decline in Sterling to the magnitude witnessed in the early 1990’s, let alone the 20% depreciation suggested by Goldman Sachs,” says Diaz-Alvarez. “We would instead expect a depreciation in Sterling of roughly 10% against the US Dollar and 5% against the Euro in the immediate aftermath of a Brexit vote.”