Pound to Yen Rises to 145.15 After BOJ Slashes Deposit Rate

The pound to yen spiked higher on Friday after the Bank of Japan decided to cut its deposit rate to -0.1%, effectively charging institutions to deposit money with them.

The Bank of Japan have made their move, and now markets are flying.

They cut the deposit rate from 0.1% to -0.1% in order to discourage banks from depositing money with them (central banks are essentially 'banks for banks') , so as to hopefully stimulate investment and lending.

The move came after the yen flirted precariously with the key 115 to the dollar level, which represents a Rubicon under which the currency could not fall for fear of impacting negatively on corporate earnings, delicate wage negotiations and the waning competitiveness of Japanese exporters.

Well, they brought out the bazooka and dealt with the immediate threat, pushing the dollar-yen back above 120, and the pound-yen above 145, nevertheless markets were surprised.

After all, only a few canny investors saw the possibility the BOJ would increase their easing whilst the majority like those at Barclays expect there to be no change in policy:

“We expect the BoJ to keep its policy settings unchanged on Friday."

They said in a recent note, continuing:

“After fine-tweaking the parameters of the QQE program last December, we believe BoJ will wait until April to evaluate its current monetary policy stance, when updated inflation forecasts and more clarity about the evolution of wages will be at hand.”

Amongst the minority expecting the BOJ to make a move, was BMO Capital Markets, who thought the BOJ would increase easing to avoid the possibility of a rapid appreciation of the currency in the event of a global shock.

BMO pointed out that in 2008, during the crisis, “The USDJPY exchange rate fell 20%,” which, they add, “is something that Japan wants to avoid repeating.”

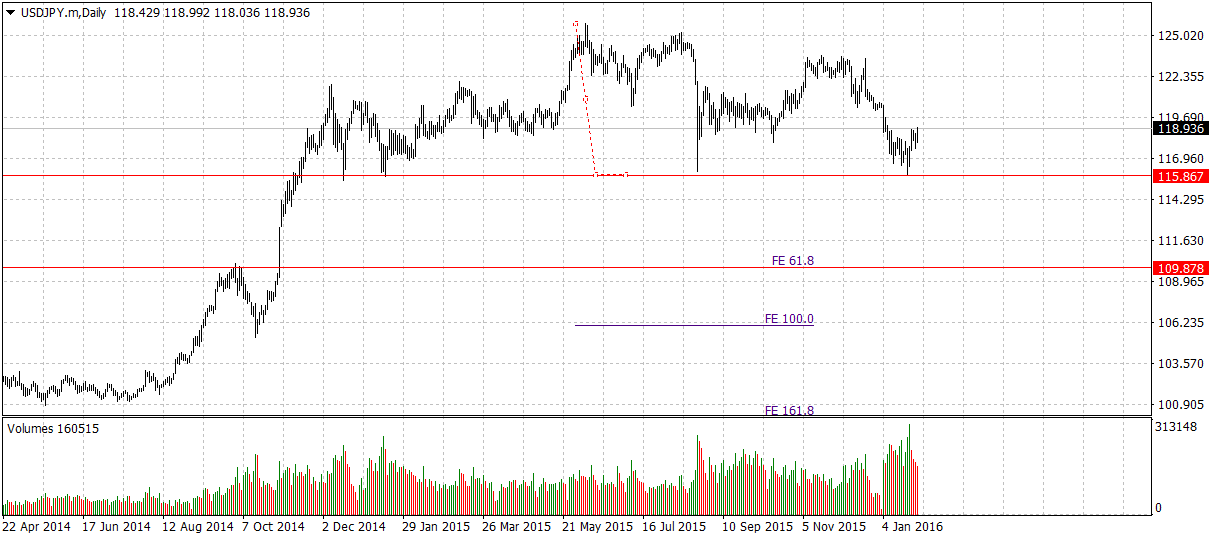

Below is a chart of USD/JPY before lats night's meeting, which shows why they might have been worried:

No-one could miss the ugly, large, bearish head and shoulders pattern dominating the view, indicating the possibility that prices would break sharply lower.

Indeed, the high buying volume at the recent test of the critical 115.87 level –the neckline of the H&S - may well have been partly due to the BOJ intervening to defend neckline against penetration, as a clear break below would have set off a currency rout, potentially right down to the 109s.

115 yen to the dollar is significant in other ways too. If the yen rises above this level major Japanese exporting corporates like Toyota have to revise down their earnings forecasts in order to factor in a decline in both competitiveness and profitability.

It’s also significant from a wage perspective, because if the yen appreciates below 115 to the dollar, large corporates expect to have less money to finance wage increases, which have become a critical element in Abenomics, as well as reaching the BOJ’s 2.0% inflation target.

The annual shunto wage negotiations start soon (in February) and the government will want to see a substantial increase in take home pay, in order to help support their efforts to improve the outlook for inflation and the economy.

Given the exchange rate was flirting closely with the critical 115 level, which is also the neckline of the bearish H&S, and the fact that volume has been quite unconvincing during the small rally since the 115 low, It was in some ways no suprise that policymakers at the BOJ wanted to increase easing and thereby ‘make a clearance well out of the box’ pushing the exchange rate back up towards the 120s well away from 115.

Below is the same chart post-BOJ:

Pound-yen hits out 145.15 target

In the case of pound-yen we are pleased to say that the exchange rate hit Pound Sterling Live's prefered target at 145.15, following the annoucnment by the BOJ.

The pair made a clear break above the S2 Monthly Pivot at 171.05 and the Jan 11 highs at 172.30 which we said would probably confirm the pound appreciating to 174.15 yen.

Below was our original chart:

And this is our updated chart post-BOJ: