GBP/EUR: Downside Continuing - 1.3500 Now in Sight

The euro continues strengthening versus the pound as data from the euro-zone outstrips expectations, but how long will it last?

German Gfk Consumer Confidence beat estimates, coming out at 9.4 versus the 9.3 expectation from 9.3 previously.

German Import Prices also recovered to -3.5% year-on-year from -4.1% previously and beating expectations of -3.6%; mom, however, there was no marked improvement as analysts had expected.

In the U.K, however, data showing the public sector borrowed more-than-expected in November stung the pound, although Gfk Consumer Confidence in December, had ticked higher, rising to 2 from 1, 1 expected.

Consumer's Confident

On Monday Euro-zone Consumer Confidence came out slightly better-than-expected in December, setting the tone for a potential continuation of euro strength versus the pound, as GBP/EUR unambiguously broke below a key technical support level on its way down towards a key neck-line level at 1.3350.

The Flash Estimate for Consumer Confidence showed a +0.2% recovery in Euro-zone sentiment to -5.7% - above expectations of -5.9% - whilst sentiment in the EU recovered even more strongly, increasing by +0.7% to -3.7%.

The recent news flow from the U.K has been mixed, with dovish comments from the normally hawkish Martin Weale of the MPC pushing the pound lower, but then positive findings from the CBI Retail Sales report in December, leading to a recovery as it renewed hopes the economy was still on track.

Overall the CBI result was still lower-than-expected, coming out at 19 vs 31 expected, but higher than 0.7 previous.

Technical Break

The technical outlook remains bearish short-term and neutral mid-term.

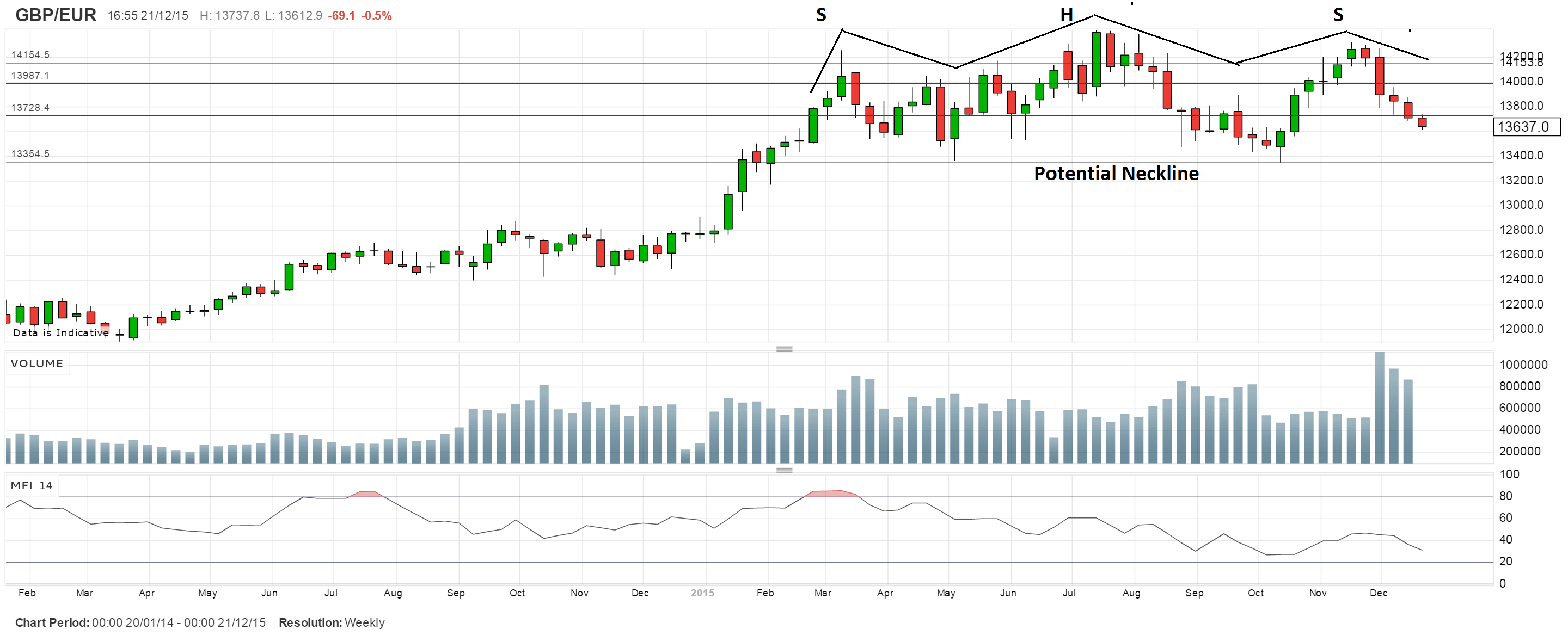

The GBP/EUR pair has extended its down-side trajectory, clearing the S2 Monthly Pivot which had been supporting price for 9 days in a row at 1.3730; (at the time of writing the pair is trading at 1.3657).(See chart below).

This comes on the back of a growing number of signs the pair may have changed its short-term trend.

Firstly, peak and trough progression is bearish and expected to continue lower.

The pair has successfully broken below the 50 and 200-day MA’s.

It has breached the 1.3675 level and will probably fall towards its first expected target at round-number support at 1.3500, followed possibly by the key 1.3350 lows.

AFEX’s LIllicrap: recovery rally possible

In contrast to above bearish technical interpretation, AFEX’s Lucy Lillicrap sees the possibility of a near-term low leading to a recovery to 1.4000:

“potential is apparent for at least an interim low and subsequent recovery back up into this ongoing range and once above 1.3800/10 a re-test of 1.3900 if not 1.4000 is implied next.”

However, she sees no way back up to the 1.43 highs:

“No obvious or direct path exists back to 1.4300+ levels without an obvious base (which will need to be constructed before re-emergent GBP strength is considered sustainable either).”

DNB bullish longer-term

DNB Bank ASA is more bullish seeing new highs above 1.4300 as quite possible eventually.

Their central case is that the markets are under-pricing the likelihood of the BOE hiking rates early.

They argue that overall the U.K has strong fundamentals:

“A solid economic development and an improving labour market has favoured the GBP.

“We think the market is under-pricing the timing and pace of Bank of England rate hikes. We expect the central bank to start hiking in May.

Leading up to this we expect to see interest rate expectations pick up and a stronger GBP leading up to this.”

DNB sees mixed U.K employment data as another reason for current sterling weakness:

“Mixed British labour market data. Claimant count rose in November, while ILO unemployment edged down 0.1pp to 5.2% in October. Retail sales were better than expected in November.”

Overall DNB expects the pound to strengthen in the new year as rate hike expectations start to solidify, and for the pair to make new highs (lows in EUR/GBP).

Longer-term technicals show that 1.3350 line is key

Longer-term technical analysis shows a consolidation range at the highs of the weekly chart, which has been forming after the previous bullish rally ran out of momentum in March of this year.

This range could either be a continuation or reversal pattern.

However, it looks a like a potential head and shoulders pattern given the lower highs either side of the highest high at 1.4413 in July.

The only problem is that volume is too heavy on the right shoulder for the pattern to conform to the classic H&S criteria exactly.

Nevertheless, there is a range of sorts – or a pattern- and in that sense the 1.3350 range lows are key as they will both provide support if reached – or if breached will provide a significant breakout level, from where the pair would be expected to move lower, quite rapidly; changing the whole outlook to very bearish.

Ultimately I’d be looking for confirmation of a long-term change of trend coming from a breach of the 1.3200 level, for certainty, and if so this opening the door to a move down to the psychologically significant round number level of 1.3000, as a conservative estimate, followed by a deeper penetration to 1.2500 (the target for the H&S).