GBP/USD: Sterling on Back Foot after Public Spending Rises in November;

The pound pared gains on Tuesday after Public Sector spending beat estimates; the longer-term technical picture, however, remains biased to the upside.

The pound dipped to 1.4890 on Tuesday after the release of Public Sector Net Borrowing figures showed an above expected rise in the amount the British Government had to borrow in November:

“In November 2015, the public sector spent more money than it received in taxes and other income. This meant it had to borrow £14.2 billion to balance the books.” Said the summary findings from the Office of National Statistics (ONS).

The figure was higher than forecasts of 11.8bn; the previous month’s figure was revised down from 7.5bn to 6.7bn, but this was not positive enough to offset the higher figure in November.

Market watchers have been quick to point out that overall debt has been rising steadily to 1.536tr, which is 80.5% of GDP, and increase of 75.9bn from November 2014.

Nevertheless, the ONS findings, indicate that although overall debt is rising the pace at which it is rising has slowed down:

“Annual borrowing has generally been falling since the peak in the financial year ending March 2010.

“So far this financial year (April to November 2015), the public sector has borrowed £66.9 billion.

“This was £6.6 billion lower than at the same point in the previous financial year.

The figures had a minor discounting effect on Cable.

Weale's U-turn

Earlier in the week the pound appeared to shrug of comments from Martin Weale, who is a rate-setter on the Bank of England’s MPC, and has in the past voted for a rise in interest rates along with the other hawkish member Ian McCafferty.

He gave his main reason for revising his opinion as the “pause in wage growth,” and the continued fall in commodity prices, which had made the need to tighten policy, “slightly less immediate.”

Weale went on to say that there was evidence that the traditionally accepted 18-24 month lag between first raising interest rates to seeing their impact on the economy, was actually inaccurate and the impact was in reality normally felt sooner – another reason for postponing.

Nevertheless, the usually hawkish Weale still saw a rate hike as necessary eventually:

"My sense is that to keep inflation on target, rates need to be at some point higher than markets imply."

He also added that he was reassured by relatively muted market reaction to the Fed raising its interest rates:

“It's early days, but I what I think it has demonstrated is that a change in the Federal Funds target is possible without immediate disruption in financial markets, that was something that people had worried about."

Strong CBI Reported Sales provide antidote to Weale

Despite Weale’s dovish comments the pound soon recovered to make small gains against its main counterparts, and this probably to do with the survey results published by the Consortium of British Industry (CBI) which released data showing that December had been a fairly positive month for its members, although nevertheless not quite as strong as expected.

The data showed a +19% balance between those retailers who had thought sales had risen against those who thought they had fallen; a marked improvement on the previous months +7% but not a strong as the +31% forecast.

Nevertheless the CBI was overall positive in its report on the survey findings:

“The survey of 118 firms showed the volume of retails sales picked up in December, and was slightly above the average for the time of year, albeit below retailers’ expectations.”

Internet Sales had grown particularly impressively following Black Friday:

“Following Black Friday, internet sales volumes rose at their quickest pace since April, with the pace of growth expected to hold broadly steady in January.”

Barry Williams, CBI Distributive Trades Chairman and Chief Customer Officer at ASDA said:

“It would be ideal if the industry could keep that momentum into the New Year but retailers know 2015 was tough, and they’re expecting 2016 to start in much the same vein.”

Cable bullish due to technical support and 'bonds'

GBP/USD has reached a possible turning point at a substantial support level, leading to a possible recovery short-term.

Signs U.S bond markets don’t expect the Fed to raise rates as aggressively as previously are also putting pressure on the dollar.

The bottom edge of the wedge

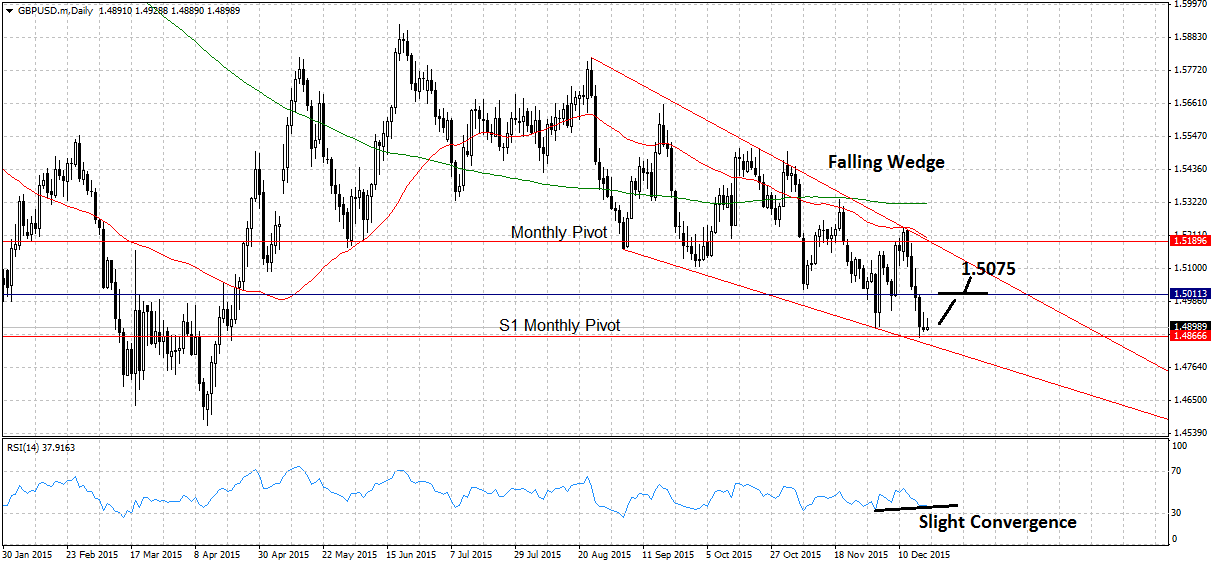

GBP/USD has fallen to tough support at the base of a falling wedge pattern, clearly visible on the daily chart (see below).

The support is made up of a cluster of the S1 Monthly Pivot and the lower border-line of the wedge.

It looks like the pair will now start to move higher off this support, moving up to the upper border of the descending wedge, to a zone in between 1.5075 and 1.5100.

A break above the 1.5011 highs would provide stronger confirmation.

Whilst the RSI indicator is not showing the pair looking particularly oversold, it is showing mild bullish convergence.

A rise for sterling against the dollar would also fall in line with seasonal expectations of stocks rallying in the week immediately prior to Christmas – and therefore likely weakness in the dollar which is inversely correlated.

Falling wedges warn of more upside eventually, and it is likely that the pair will eventually break out of the pattern and move higher – probably in a powerful surge.

Choppy New Year!

A fall in the 10-year Treasury Yield is making analysts concerned that debt markets are not pricing in a very aggressive Fed tightening trajectory, which is already starting to impact on U.S dollar upside.

Richard Perry of Hantec Markets sees the Fed having to “massage down dot-plots in coming meetings” on the basis of worsening global demand.

This is likely to weigh on the outlook for the dollar, which Perry sees as “choppy” over the coming “weeks and months.”